Baltimore Reclaims Its Charm

Employment growth, coupled with the metro’s relatively affordable rental rates, should generate a solid absorption of the new apartment units coming online this year.

By Evelina Croitoru

Baltimore rent evolution, click to enlarge

Baltimore’s multifamily market remains tepid, despite the continuing revival of downtown and surrounding areas. The metro is steadily overcoming decades of decline in blue-collar industries and population loss. It does, however, benefit from the proximity of Washington, D.C.’s less affordable market, where both renters and investors are slowly being priced out.

Demand has accelerated, due to employment rebounding in sectors such as education, health care, professional services and government. The largest increase in college-educated young professionals fueled substantial job migration, resulting in a shift from Washington, D.C., and other Mid-Atlantic employment hubs. In order to encourage growth, local authorities have committed to upgrading the infrastructure with new urban renewal projects. One is the $700 million Creating Opportunities for Renewal and Enterprise (CORE) initiative, which demolishes vacant city properties and replaces them with new developments.

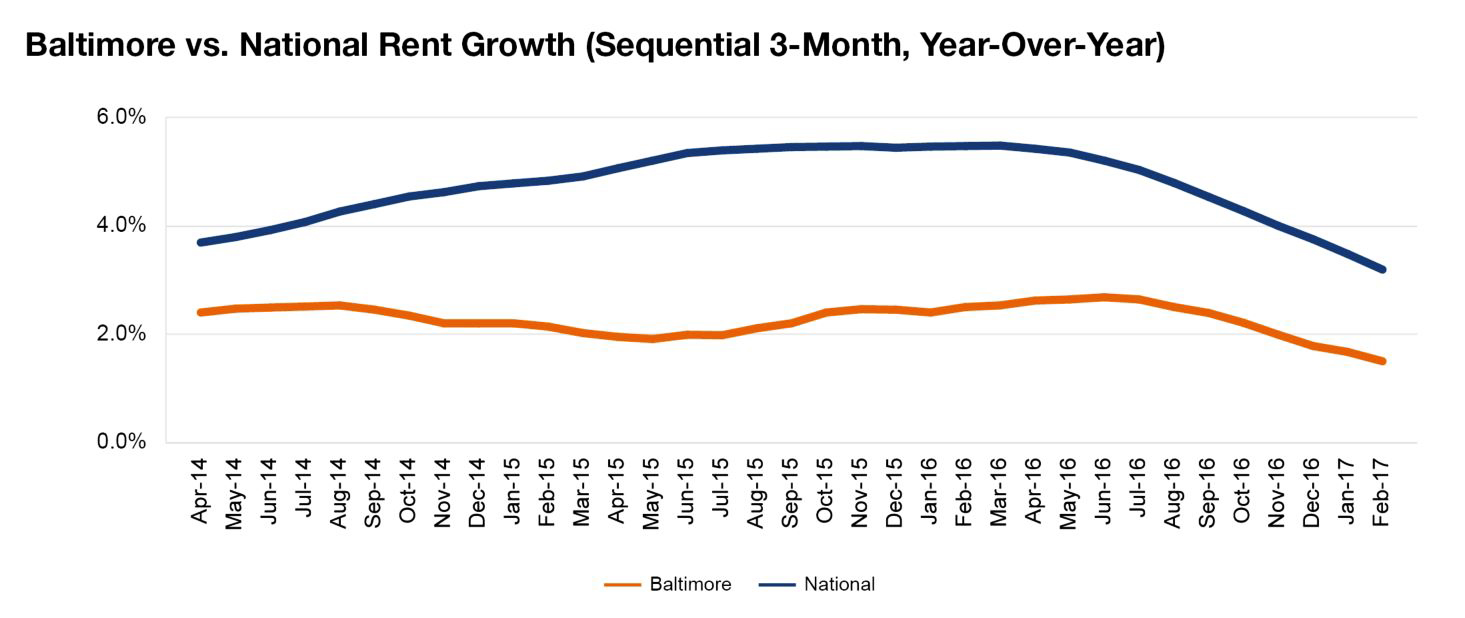

Baltimore’s recent job gains, along with its relatively affordable rental rates, should provide solid absorption in the coming months. As a result, development activity continues to be strong, as reflected by the 29,000 units in various phases of construction. The metro exceeded last year’s transaction volume of $1.4 billion, marking a new cycle high. We expect continued moderate rent appreciation of 1.7 percent in 2017.

Read the full Yardi Matrix report.

You must be logged in to post a comment.