Are Partial Conversions Right for You?

Learn how New York City is resolving the need for more housing and economical office space in the same building.

Recently, RXR Realty, Apollo Global Management and SL Green secured two separate notes for the partial conversion of 5 Times Square, the iconic 1.1 million-square-foot office tower in midtown Manhattan, N.Y., into a 1,250-unit multifamily community with 313 affordable units. The 37-story building was built in 2002 as Ernst & Young’s headquarters but has remained largely vacant since then.

New York City is leading the country in office-to-residential conversions with 17,400 units in the pipeline, according to Ariel Property Advisors. The lion’s share of activity is focused on total conversions, but several developers are taking a more nuanced approach by retaining some office floors while transforming the rest to multifamily.

Designed by Gensler, the 5 Times Square partial conversion project will transform approximately 918,000 square feet of office space into 1,050 studio apartments and 200 one-bedroom units. Roughly 37,000 square feet of retail space will be preserved, while streaming company Roku will occupy the remaining commercial office space.

Fueled by targeted changes

The project is made possible by recent zoning and policy updates. The owners of 5 Times Square will receive a tax abatement under New York state’s 467-m initiative, in exchange for building affordable units, which will be reserved for future residents earning up to 80 percent of area median income. The project will also benefit from a state budget bill that eliminated the residential floor area ratio cap of 15 and 18.

Additionally, the New York City Council approved the City of Yes for Housing Opportunity amendment in December 2024, the most significant update to the city’s zoning code since 1961, which aims to add 80,000 housing units over the next 15 years.

READ ALSO: Why the Office-to-Lab Conversion Trend Will Last

“It’s a whole new world now,” said Alkis Klimathianos, a design principal with Perkins Eastman. “Before City of Yes, the codes for partial conversions were very difficult. If there was one tenant above you in the building that wanted to remain commercial, the zoning codes and the multiple dwelling law didn’t allow for conversions. The codes and regulations have changed to make partial conversions easier.”

There has been more talk now about partial conversions than there was six or nine months ago, according to Klimathianos, with 5 Times Square set to be the “test drive.”

He believes the new regulations will help fill a niche of the conversion market and that the product will be even more important than full conversions because New York City is almost back in full swing with commercial activity and office attendance.

Fully converting a building is very expensive. It’s a financially herculean feat. … I think partial conversions will fill a particular niche, which will be more important than full conversions.

—Adam Greene, Senior Vice President of Development, RXR

“Not everybody can afford the Class A or Triple A office space that’s getting built right now,” he noted. “The smaller commercial vendors and companies will need an upgraded Class B product, which the partial conversion allows you to do.” This will also help committed commercial property owners maximize the value of their buildings.

Besides 5 Times Square, other prominent partial conversions are also entering the pipeline. In August, Bushburg Properties announced it had secured $320 million in financing for a partial residential conversion at 80 Pine St., a 1.2 million-square-foot office building in Manhattan. Levels two through 17 of the 38-story tower are set to be transformed into 713 multifamily units. Designed by CetraRuddy, the first apartments will be ready in January 2026, with the repositioning project benefiting from the 467-m tax incentive program that targets conversions of non-residential buildings to residential use.

In a city like New York, where about 80 percent of vacancies are in 30 percent of the buildings, promoting conversions is smart public policy and makes economic sense, noted Adam Greene, a senior vice president of development with RXR Realty.

“Our central business districts are hubs of activity that support a broader ecosystem beyond just office spaces,” he said. “They sustain small businesses, restaurants, retail stores and more. When these office buildings sit vacant, they harm this larger ecosystem.”

The codes and regulations have changed to make partial conversions easier.

—Alkis Klimathianos, Design Principal, Perkins Eastman

New York State and New York City are among the fastest in the country to implement game-changing programs that encourage commercial-to-multifamily conversions, whether full or partial.

“Incentive programs allow owners to repurpose buildings more efficiently and could enable the conversion of 25 to 40 million square feet of office space, much of which is located in prime areas across Manhattan,” observed Greene. “Building on the successful model of lower Manhattan, where post-9/11 conversions created the city’s only 15-minute live-work-play neighborhood, this new wave of conversions has the potential to develop vibrant, walkable communities throughout New York City.”

Since City of Yes was launched, 69 building owners have expressed interest in conversions, more than doubling the number of such projects completed from 2010 to 2020, according to Greene. Also, the program’s zoning reforms have expanded both the types of eligible buildings and allowable uses.

“Partial conversion has become a viable and allowable option for developers to consider,” noted Greene. It allows vacant office space to be converted into apartments while keeping existing commercial tenants in place, and it can also be beneficial to the owner if there are tenants with long-term leases who want to continue to stay in the space they occupy. “The option makes sense today as a cost-effective way to address housing shortages and revitalize underutilized urban areas,” he added.

A nationwide trend?

Although it seems to offer multiple benefits, this trend is still in its early stages in other parts of the country.

“At this stage, partial office-to-residential conversions are not a widespread (national) trend,” acknowledged Marissa Kasdan, director of research and development with KTGY. “The most prevalent activity we see involves full conversions of smaller office buildings to residential.”

This is often paired with additional ground-up residential development on adjacent parcels—frequently, underused parking lots—maximizing the residential potential of the site.

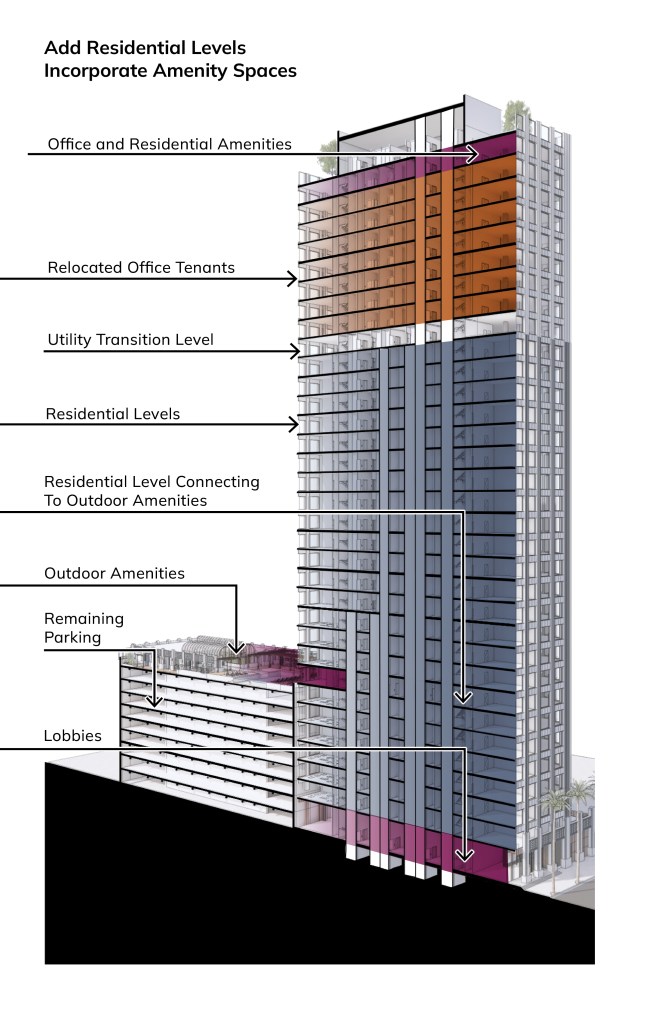

KTGY has been exploring the concept of partial or phased development through an original R&D design concept: Upcycle Tower. In this model, the occupied tenant office spaces are relocated and consolidated to the two floors of the building where they use the existing chiller system located on the roof, freeing the lower floors for conversion to residential. An upgraded mechanical system at the ground level serves the residential floors. While not yet built, this fully developed concept is ready for implementation when the right developer and project appear on the scene.

You must be logged in to post a comment.