Albuquerque: On the Mend

Despite being the hub of New Mexico’s technology corridor, the metro has only experienced modest population and employment growth throughout the recent economic expansion, Yardi Matrix data shows.

By Laura Calugar

Albuquerque’s multifamily market is held back by the city’s persistent struggle with a sluggish labor market. Despite being the hub of New Mexico’s technology corridor, the metro has only experienced modest population and employment growth throughout the recent economic expansion.

Employment gains have been limited largely because the manufacturing sector has been hit by—among other things—job cuts at Intel, one of the metro’s largest employer. However, prominent construction projects are expected to boost several sectors in the Los Lunas submarket, where Facebook is spending $1.8 billion on a new data center. To meet Facebook’s need for renewable energy, locally based Affordable Solar plans to build three solar farms. Also in the works are the $30 million expansion of Albuquerque’s International Sunport Airport and a $135 million medical center in Santa Fe developed by Presbyterian Health Services. Moreover, Xcel Energy broke ground on the southeastern New Mexico portion of a $400 million transmission line that will connect the state to Texas.

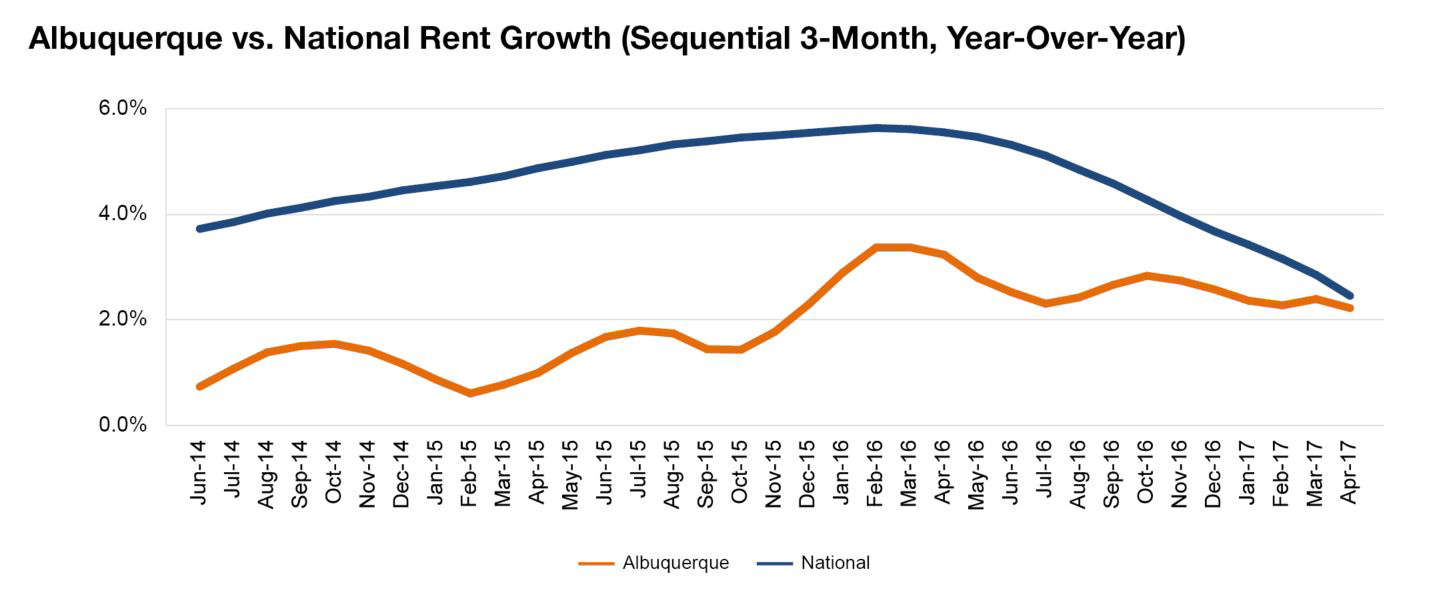

Property transaction and development volumes have been modest. Multifamily investment totals slowed in 2016 and transaction volume dropped 45 percent from 2015’s cycle high. Furthermore, only 85 new units are projected to be delivered this year. Yardi Matrix expects rents to grow by 3.1 percent in 2017. Demand in Albuquerque may not be strong, but unlike most of the country, there is little new supply.

You must be logged in to post a comment.