Investcorp Sells Industrial Portfolio for $365M

The assets total 3.5 million square feet.

Investcorp has sold a portfolio of U.S. industrial properties to an undisclosed buyer or buyers for $365 million, generating a return that the company said exceeded “original underwritten expectations.”

The assets total about 3.5 million square feet and are all in the Midwest. They include 23 light industrial properties totaling more than 2 million square feet in Columbus, Cincinnati and Cleveland; an eight-building industrial park near Chicago’s O’Hare International Airport totaling roughly 1 million square feet; and a 434,000-square-foot distribution facility in the Cleveland MSA.

READ ALSO: CRE’s Mixed Bag of Uncertainty and Opportunity

The move doesn’t represent an exit from either industrial or U.S. properties for the Bahrain-based investor. Investcorp still sees strong opportunity to invest in U.S. submarkets near well-populated consumption centers, Global Head of Real Assets Herb Myers said in a statement. He also noted that the firm was able to acquire the assets during “peak pandemic dislocation in 2020.”

Early this year, Investcorp acquired portfolios in Minneapolis and Baltimore, ponying up more than $335 million for 27 properties totaling 2.7 million square feet. The company has been one of the top five largest cross-border buyers of U.S. real estate since 2020, according to Real Capital Analytics.

The investor had $16 billion of real estate and infrastructure assets under management as of the second quarter of this year, with the largest component being U.S. real estate. Its current U.S. portfolio consists of $9.4 billion of assets under management, of which 98 percent are industrial and residential properties.

Industrial sales edge down nationwide

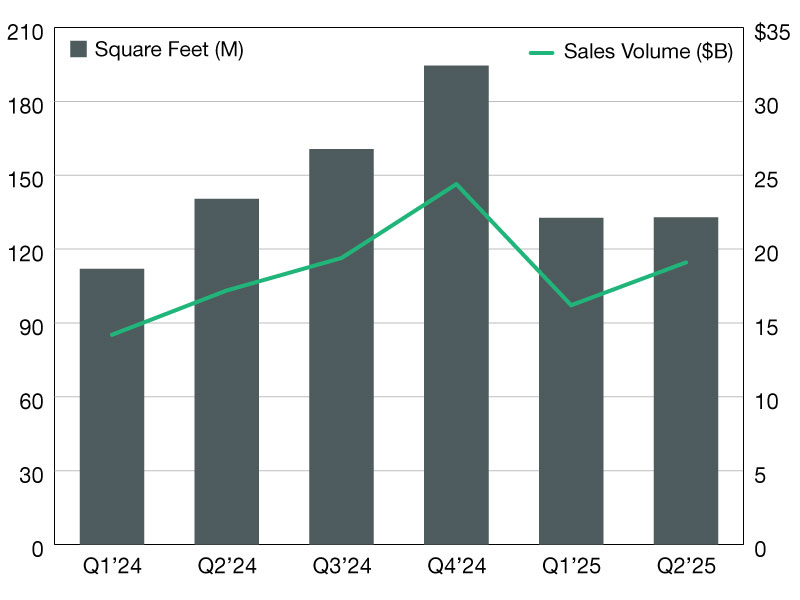

The Investcorp sale comes at a time when industrial assets are less interesting to buyers than previously. Transactions have been sliding since a recent quarterly high of well over $80 billion in the fourth quarter of 2024, according to Yardi Research Data.

By Q2 2025, investment sales in industrial were down to roughly $40 billion, the research shows. Some markets are still relatively strong, however, with New Jersey leading the pack, with $1.7 billion in volume, followed by Dallas and Chicago.

Demand for industrial product among tenants has also been slipping recently. The national vacancy rate was 9 percent in June, an increase of 290 basis points over the past 12 months.

You must be logged in to post a comment.