KBS REIT Sells Kansas City Mixed-Use Asset

The investment trust is now a pure office play.

KBS Real Estate Investment Trust III, a nontraded REIT affiliated with KBS, has sold its only mixed-use asset to DFW Land. The 484,980 square-foot Park Place Village comprises office and retail space across 10 buildings in Leawood, Kan., an affluent Kansas City, Mo., suburb. Newmark represented the seller, while Greenberg Traurig served as legal counsel for KBS.

KBS REIT III is now a straight office landlord, since Park Place was the only one of its mixed-use assets as of the end of the second quarter. The company had held the property for about 10 years.

The REIT now owns office properties nationwide in major U.S. metros, including Chicago, Dallas-Fort Worth, Atlanta and Washington, D.C., among others. The company has owned all of them for 10 years or more, and their leases have an average remaining term of 5.4 years.

WATCH VIDEO: Why REITs Have an Edge Amid Uncertainty

The buyer, DFW Land, is a North Texas-based investor, with most of its properties located in Dallas-Fort Worth. Metro Kansas City represents a geographical expansion for the company.

In fact, the firm has been on the prowl for more assets lately. CEO Vijay Borra said in a prepared statement DFW Land has acquired several million square feet of office and retail space in the last three months.

A mixed-use property near Kansas City

Carrying the address 11500 Ash St., Park Place Village came online in phases between 2007 and 2013. Its amenities include boutique shops, upscale restaurants and cafes, a fitness center and bike storage. The campus also has EV charging stations, on-site parking and a rooftop terrace. The property was fully leased at the time of sale.

Park Place is south of Highway 50, some 20 miles from downtown Kansas City. The surrounding neighborhood features various shopping and entertainment venues, parking garages, a hotel and more than 250 residential units.

Newmark’s Derek Fohl and Gary Carr were leads for the Chicago- and Dallas-based Capital Markets teams that represented KBS. Jim Postweiler, Peter Harwood, Jack Trager, Jake Paschen, Robert Hill, Chris Murphy and Austin Sheehan were also involved in the transaction. Attorneys Bruce Fischer and Howard Chu, together with Paralegal Amanda Kennedy, were part of the Greenberg Traurig team.

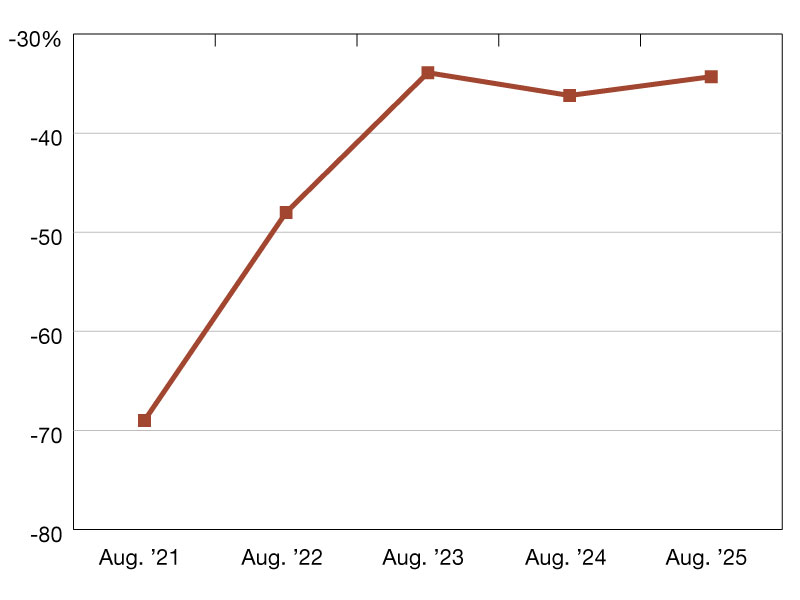

Kansas City office on the recovery path

The Kansas City office market is making a measured recovery, according to Newmark data. During the second quarter of this year, the metro had more than 116,000 square feet of net positive absorption, representing the fourth quarter in a row that tenants wanted more space than not: 1.1 million square feet combined during the last 12 months.

Still, uncertainty persists—especially about the economy—prompting occupiers and investors to approach deals with greater caution, Newmark noted. Tenants will retain considerable leverage in lease negotiations, given the elevated volume of available space.

Not only is virtually no non-BTS office space being developed in Greater Kansas City, the conversion of office properties to alternative uses will help reduce obsolete inventory, tempering further vacancy increases, Newmark reports.

You must be logged in to post a comment.