Inside RXR’s $3.5B Office Investment Platform

The venture is seeded with three Manhattan trophy towers.

For the past 18 months, RXR has been capitalizing on the post-COVID dislocation in the Manhattan office market, acquiring interests in more than 7.5 million square feet of premier office space at discounted prices. Seeking more opportunities from what it calls one of the largest structural realignments of the office market in decades, RXR has launched Gemini Office Venture, a new multibillion-dollar investment platform targeting high-quality New York City office assets.

Gemini has made commitments totaling more than $3.5 billion in transaction value to date. The new investment venture is seeded with RXR’s interests in three Class A office towers—the recently acquired 590 Madison Avenue, 1211 Ave. of the Americas, in which RXR acquired a 49 percent stake in January, and The Starrett Lehigh Building at 601 W. 26th St., which RXR purchased in 2011 and recently completed a $1.1 billion recapitalization.

READ ALSO: Where Office Visits Are Spiking Now

Led by Scott Rechler, RXR’s chairman & CEO, Gemini comprises a consortium of investors that have provided equity to the platform—The Baupost Group, Criterion Real Estate Capital, Liberty Mutual Investments, Abrams Capital and King Street Capital Management.

Rechler said in prepared remarks Gemini represents the culmination of the firm’s post-COVID office strategy and reflects their deep conviction in the New York City office market. He noted that the nation-leading strength of the NYC office leasing and financing markets continues to validate RXR’s strategy. According to Rechler, RXR’s Office Recovery Strategy separated what he called “digital” buildings to invest and operate for long-term success versus “film” assets to be exited.

Growth vehicle for premier assets

By launching Gemini, Rechler said they will be able to execute strategic office acquisitions while providing diversification and liquidity to existing owners of Manhattan office buildings. He added it will serve as a growth vehicle for the highest-quality Class A office portfolio to be curated, providing investors the ability to benefit from attractive valuations, institutional management and enhanced portfolio exits.

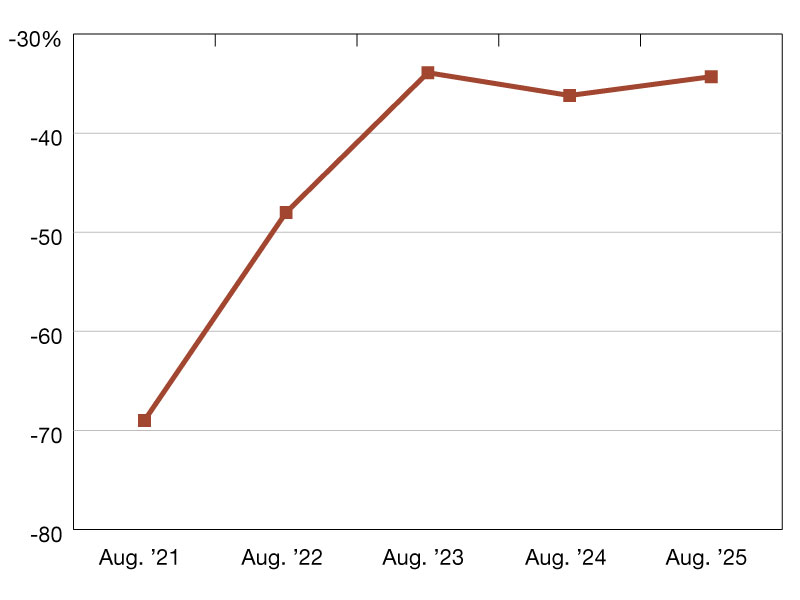

Rechler told Bloomberg that for the past 18 to 24 months market values have been close to a 50 percent discount compared to the previous cycle.

Gemini will have competition for the best properties, as the commercial real estate industry has seen in recent months with New York deals. Some of the city’s top landlords and industry leaders like Blackstone, Vornado, SL Green, Empire State Realty and DivcoWest were among the bidders to purchase Paramount Group and its Manhattan and San Francisco office portfolio before Rithm Capital agreed to buy it for $1.6 billion in a deal announced last week.

Before RXR and Elliott Investment Management acquired 590 Madison Avenue for nearly $1.1 billion from the STRS Ohio pension fund, interested buyers reportedly included Blackstone, RFR, SL Green and Tishman Speyer.

“The flight to quality continues unabated as there is a healthy appetite for high-quality office assets in New York City as evidenced by recent new fund formations and M&A activity,” Jahn Brodwin, a senior managing director & co-lead of the Real Estate Solutions practice at FTI Consulting, Inc. in New York City, told Commercial Property Executive. “In particular, there is significant capital available to assist owners of Class A properties re-tenant existing properties, provide upgrades to remain competitive in the marketplace and resolve inefficiencies in the capital stack.”

Gemini’s initial portfolio

Here’s a look at the three New York City premier office properties in Gemini’s initial portfolio:

- 590 Madison Avenue

RXR and Elliott Investment’s purchase of the trophy tower was the largest full-asset office buy in New York City since 2018. Affiliates of Apollo Global Management also provided a $785 million financing package as part of the acquisition, which closed in August.

The 42-story, 1 million-square-foot mixed-use tower in the Plaza District was completed in 1981. In addition to Class A office space, the building has 42,193 square feet of Class A retail on the first and second floors, according to Yardi Research Data. Office tenants include Apollo Global Management, which leases 99,418 square feet. It is also the North American headquarters for luxury brand conglomerate LVMH, which leases 250,000 square feet across four floors.

- 1211 Avenue of the Americas

RXR completed a senior loan financing totaling more than $1 billion concurrent with the Gemini closing in August after RXR acquired a 49 percent interest in the 44-story, 1.9 million-square-foot trophy tower in January. Anchor tenants FOX and News Corp. will occupy 55 percent of the tower through 2024. Located in the Rockefeller Center neighborhood, the building is undergoing a full transformation of the lobby, ground floor and exterior plaza experience. Ivanhoé Cambridge, the global real estate group of CDPQ, remains the majority owner. The co-owners are investing $300 million in the repositioning that will also include a new amenity center, conference room and wellness center.

- The Starrett Lehigh Building

The 19-story, 2.3 million-square-foot building was acquired by RXR from Shorenstein in 2011. Located in the Cheslea section on Manhattan’s West Side, the former industrial building dates to 1931 and was redeveloped into office space in 2000. The property also has about 6,200 square feet of first-floor retail. RXR and its partners executed a $1.1 billion recapitalization of the property in January. Ralph Lauren, which leases 222,220 square feet, is one of the leading tenants along with Witel Communications and Fashionphile Group. RXR notes the property benefits from $165 million in capital improvements, including more than 100,000 square feet of amenities and a 10th floor amenity center. The building is also home to the Olly Olly food hall, Hav and Mar, a restaurant operated by celebrity chef Marcus Samuelsson, and The Yacht Club, a newly opened indoor and outdoor restaurant.

You must be logged in to post a comment.