EJF Capital JV Obtains $115M Refi for Industrial Assets

The portfolio totals 1.3 million square feet.

North Signal Capital and EJF Capital secured a $115 million refinancing note for a 1.3 million-square-foot industrial collection spanning three facilities in Hardeeville, S.C. Synovus and City National Bank issued the funds in a deal arranged by JLL Capital Markets.

This debt retires a previous $75.1 million senior construction loan originated by Bank OZK in 2023. The buildings came online that same year and are now 87 percent leased.

The trio rises in RiverPort Commerce, a master-planned industrial development that could encompass nearly 4.4 million square feet upon completion. The property is within about 10 miles from the Port of Savannah, Ga., 4 miles from Interstate 95 and about 13 miles from Interstate 16.

READ ALSO: The Case for Life Company Loans in a Shifting Climate

The largest building spans 791,259 square feet, featuring a cross-dock configuration with 154 dock-high doors and a clear height of 36 feet. The other two facilities include a 130,436-square-foot rear-load building and a front-load warehousing measuring 402,491 square feet.

JLL Capital Markets Managing Director Bobby Norwood, together with Senior Managing Director Mark Sixour, Vice President Kelsey Bawcombe and Associate Austin Smith represented North Signal and EJF in the debt negotiations.

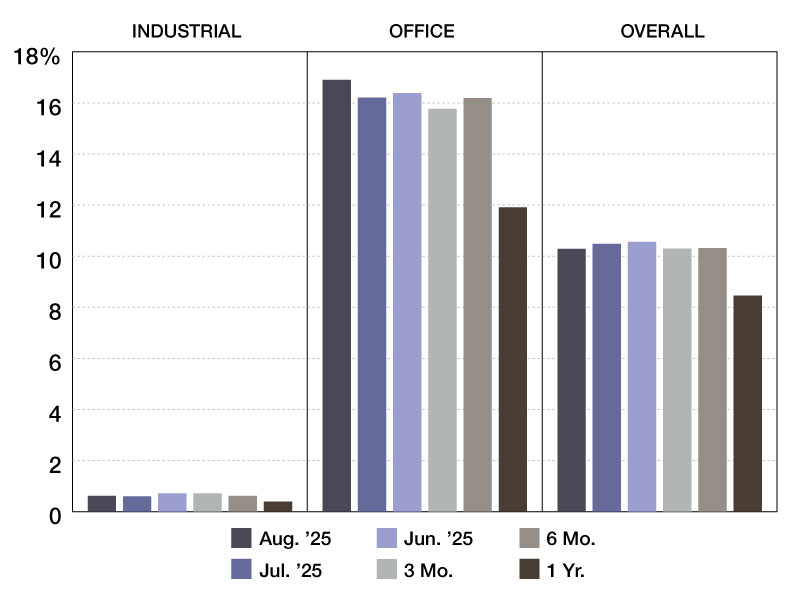

Savannah’s industrial market performance

Metro Savannah led the nation for industrial absorption as a percentage of stock during the first half of 2025, according to a JLL report. Year-to-date through June, the market saw the absorption of more than 4.2 million square feet.

Meanwhile, the industrial vacancy rate across the metro jumped 160 basis points quarter-over-quarter, landing at 11.4 percent in June, the report showed. This increase stems from new speculative industrial deliveries, which clocked in at 4.4 million during the second quarter.

Despite a heavy supply environment, the market continues to show stable tenant demand. The metro’s construction pipeline is balanced, with future completions spread evenly across the coming year, the report notes.

Another industrial financing closed in the market in June, when Capital Development Partners obtained a $77.3 million construction note for a three-building speculative project. A life company issued the funds.

You must be logged in to post a comment.