Single-Tenant Retail Is Back in Favor

Cap rates are reflecting sunnier skies, a new Colliers paper shows.

The single-tenant net-lease retail market has started making inroads with investors.

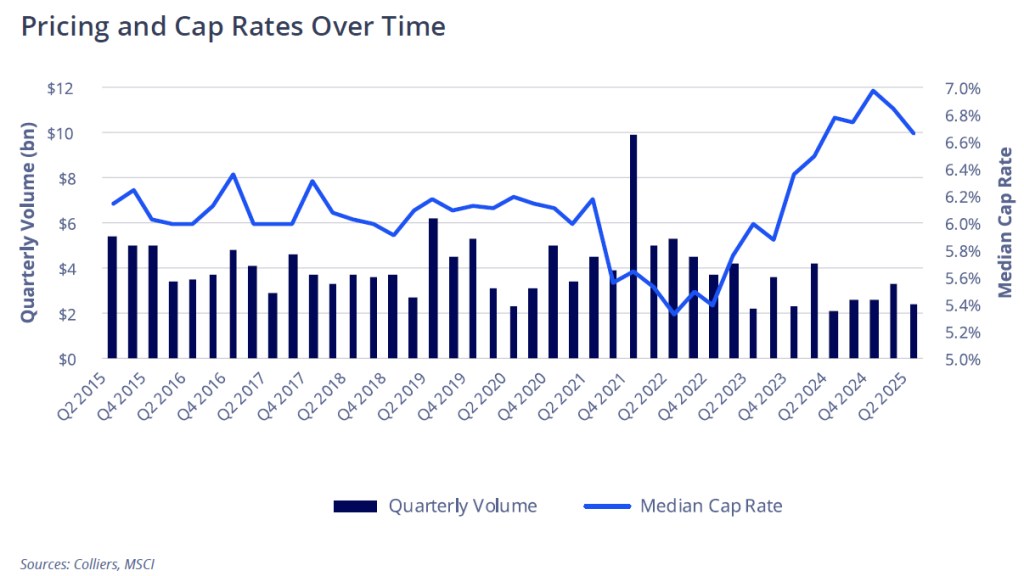

While facing stores closures and uneven performance across subsectors, the market saw an increase in sales during the first half of 2025 when compared to the previous six months, according to a Colliers review of the single-tenant net-lease retail space.

Deal volume ticked up 9.6 percent compared to the second half of 2024, clocking in at $5.7 billion year-to-date through June. The median price likewise rose, up 8 percent, landing at $309 per square foot.

Meanwhile, the STNL median cap rate stabilized at 6.8 percent, down 10 basis points and continuing to compress, now for the past three quarters straight. This shift mirrors a broader trend across commercial real estate, with capitalization rates sliding slightly, and yields appearing to be near or already over the cycle peak.

How are single-tenant net-lease retail deals evolving?

Notably, as transaction volumes climbed, the square footage of traded assets shrank. To a level, this is denoting outsized interest in smaller properties that align with omnichannel strategies and disciplined investment flow, the paper states.

Big-box retail stores ought not to be glossed over, however, as such properties reposition to derive value through more specialized means, Anjee Solanki, national director within Colliers’ U.S. retail services and practice groups, told Commercial Property Executive.

WATCH: Let’s Talk About Retail Trends

While it’s true that small-to-medium store retailers such as Goodwill, HomeGoods and Citi Trends are slated to overperform by offering price advantages or unique value propositions, big-box retail players the likes of Costco can benefit from a loyal customer base and their ability to deliver value at scale.

“This shows that the future of big-box retail lies in differentiation: stores that lean into value, loyalty and efficiency will remain highly relevant, while undifferentiated players will face more challenges”, Solanki added.

Convenience stores command high prices, restaurants lead by volume

Although foot traffic eased for both convenience and drug stores, the Colliers paper states, convenience retail is a clear frontrunner, commanding the highest median price per square foot, at $925 across all subsectors. The total transaction volume for convenience stores increased by 16 percent in the first half of 2025, while also scoring the lowest cap rates (5.4 percent).

“Convenience stores have proven more resilient than drug stores, and I expect that gap to widen. Their role in quick fill-in trips, fuel and everyday essentials, paired with modernization efforts like fresh food, digital ordering and loyalty programs, positions them to hold traffic more effectively”, Solanki told CPE.

Drug store market headwinds did not deter all investors. Just last month, Dragos Capital purchased an 18-asset single-tenant net-lease retail portfolio occupied by CVS.

Yet, the only subsectors recording more than $1 billion each in deals during the first half of 2025 were quick-service and full-service restaurants, despite both also seeing their dips in retail foot traffic.

Investor interest remained strong for restaurants, as cap rates slid and prices rose. One strong selling point was demand, as the two property types accounted for nearly one-fifth of all new retail leasing.

“With digital adoption, loyalty programs and the enduring appeal of value and convenience, restaurants remain a cornerstone of consumer spending and a bright spot for investors despite cost pressures,” Solanki reasoned.

You must be logged in to post a comment.