Foxfield JV Locks In $132M Industrial Refi

Affinius Capital originated the loan for a recently completed property in a major Northeast market.

The owners of Lower Bucks Logistics Hub, a newly constructed, two-building, Class A industrial warehouse portfolio with 815,000 square feet of space in Langhorne, Pa., have refinanced the assets with a $132.4 million loan provided by Affinius Capital.

Affinius made the loan to a joint venture between an affiliate of Foxfield, a Boston-based real estate investment and development firm, and an unidentified New York real estate private equity firm.

The financing was arranged by Chad Orcutt and Michael Pagniucci of JLL.

The refinancing replaces the $114 million construction loan originated in July 2023 by Mesa West Capital to develop the buildings in the Philadelphia industrial market.

Perry Katz, an Affinius Capital senior vice president, described Lower Bucks Logistics Hub in prepared remarks as a premier industrial warehouse portfolio designed to meet the evolving needs of modern logistics and distribution tenants.

Highlights of the buildings

The larger of the two assets, the 453,110-square-foot Building 2 at 1620 E. Old Lincoln Highway, was completed in late 2024. Building 1, which has 316,457 square feet, delivered earlier this year at 1600 E. Old Lincoln Highway. Both have 40-foot clear heights and columns that are spaced 50 feet by 50 feet.

READ ALSO: Top 5 Metros for Industrial Deliveries

Building 1, also known as the north building, is a rear-loading facility with 36 dock-high doors and two grade-level doors. Located on 34.3 acres, the property has 312 parking spaces.

Building 2, or the south building, has cross-dock loading and is located on 39.56 acres. The property has 44 dock-high doors, four grade-level doors and a 185-foot truck court.

North-South access

The portfolio is located along I-295, which provides immediate access to other major transportation routes, including 1-95, I-276, US 1 and PA 73. The buildings are located 4 miles from I-95, which serves as the main north-south interstate on the East Coast. The hub provides direct connectivity to New York, Philadelphia and Washington, D.C. Situated 5 miles from I-276, the Lower Bucks Logistics Hub also offers tenants quick access via Route 1, with routes to New Jersey to the East and the Lehigh Valley to the West.

The site is 13.4 miles from Northeast Philadelphia Airport, 35.6 miles from Philadelphia International Airport and 22.4 miles from the Tioga Marine Terminal at the Port of Philadelphia.

Strong leasing in market

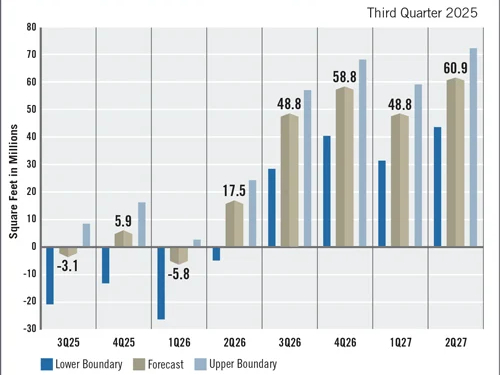

Industrial leasing activity in the Philadelphia market saw significant growth during the second quarter of 2025 with nearly 3.7 million square feet of quarterly leasing, according to Cushman & Wakefield’s industrial report for the second quarter of2025. The Lower Bucks County submarket had 2.6 million square feet in leasing activity during the second quarter and overall net absorption year-to-date of 2 million square feet. The submarket’s overall vacancy rate for the second quarter was 11.3 percent, just slightly lower than the overall market’s vacancy rate of 11.4 percent.

Cushman & Wakefield states the region’s construction pipeline continued to level out and future development is expected to wind down. In Lower Bucks County, there was no new industrial construction occurring during the second quarter that saw about 2.1 million square feet of space delivered.

More Foxfield deals

Foxfield invests in and develops primarily industrial and residential real estate across the East Coast. The firm has a $1 billion pipeline and about 7 million square feet in assets under management or development.

In December, Foxfield acquired a 169,252-square-foot industrial building in Duluth, Ga., within Atlanta’s Northeast submarket, for $19 million from Barco, according to Yardi Research Data. The deal was a sale-leaseback agreement, with Barco continuing to occupy the building under a six-year, triple-net lease. The transaction was the 14th acquisition made through the firm’s Foxfield Open-End Fund that targets fully leased Class A and B industrial and flex/R&D assets.

Two months earlier, also within metro Atlanta, Foxfield and AEW Capital Management signed a full-building, 200,000-square-foot lease at Sugarloaf Logistics Hub, a 2.2 million-square-foot master-planned industrial development in Lawrenceville, Ga. Souto Foods, a subsidiary of Alex Lee, is leasing the space that includes a cold storage component. The developers broke ground on the first phase in early 2024 with plans to build 1.1 million square feet of space across three buildings.

You must be logged in to post a comment.