Industrial Absorption to Stay Positive, but for How Long?

We're in for a dip in the third quarter, according to NAIOP.

Amid the current slowdown, occupiers are adjusting their operational strategies, resulting in a measured deceleration of industrial absorption at a national level.

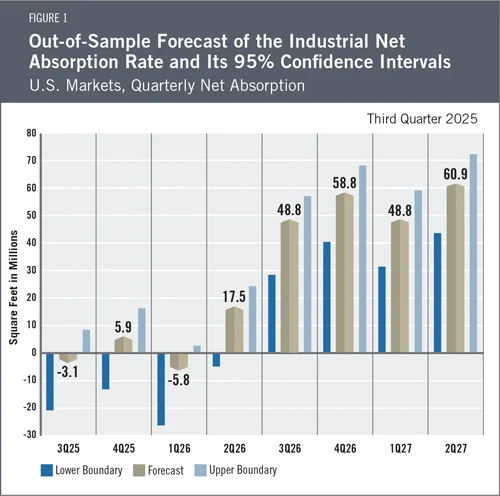

However, this cautious moderation won’t drag absorption in the red, though admittedly it’s not slated to be far off. Absorption is on track to reach 2.8 million square feet nationally during the second half of 2025, according to the latest NAIOP Industrial Space Demand Forecast, albeit the last quarter is set to compensate for the sluggishness of summer and early fall.

The NAIOP forecast model bakes in variables such as lagged net absorption, real GDP growth, inflation and output gaps, monetary policy, as well as seasonal and structural effects.

The constant back-and-forth in trade policies made it difficult for importers and exporters of raw, intermediate and finished goods to settle on any long-term leasing decisions, the report states. Such tenants will need to adapt to the new environment when accounting for their current and future occupancy needs.

It is expected that these industrial users will delay or postpone major decisions whenever applicable, Joshua Harris, managing partner at Lakemont Group & executive director at Fordham Real Estate Institute, as well as co-author of the NAIOP forecast, told Commercial Property Executive.

READ ALSO: Top 5 Metros for Industrial Deliveries in H1 2025

Yet, industrial competitiveness could offset economic headwinds as tenants seek to expand their businesses, Harris added, the caveat being that they’re unlikely to become as expansionist as they would have otherwise been in a less strenuous economy.

Zooming in, international port markets such as Southern California or Northern New Jersey might experience elevated uncertainty, while hubs for regional and national distribution could fare better.

Manufacturing centers such as Detroit tend to be more difficult to predict due to the complexity of supply chains, Harris reasoned. Meanwhile, metros reliant on energy, including those in Texas and the Gulf South, would reap the rewards of The One Big Beautiful Bill, which supports capital expenditures.

Absorption to steady out

Looking farther, a noticeable positive shift is slated for the second quarter of 2026, when absorption is forecasted to rebound. The full annual volume for next year is expected to reach 119.3 million square feet, while the figure for 2027’s first half is estimated at 109.7 million. For reference, the first half of 2025 witnessed the absorption of just 27 million square feet.

As further rate cuts are more or less universally expected, the market should regain its footing, rebalancing tariff pressures with cheaper debt, according to Harris. “The prospects of lower rates tomorrow vs today can make some wait/delay longer as borrowing to expand could be cheaper in the near future.”

How would U.S. industrial absorption react to a recession?

The forecast looks at two diverging scenarios, accounting for either a recession or its absence. The negative outcome is seen as having a 21 percent probability of playing out this year, while the soft landing has a likelihood of 79 percent.

The out-of-sample baseline for a recession paints only a slightly darker picture, with a negative 7.1 million square feet of absorption during 2025’s second half, followed by a rather swift rebound. The scenario unfolds with a volume of 86.8 million square feet in 2026 and an additional 101.4 million square feet of positive absorption in the first half of 2027.

However, it should be noted that previous NAIOP forecasts have overestimated market performance before, as earlier models placed expected absorption for 2025’s first half more than 25 million square feet above the real number. Similarly, the expected volume for the second half of 2024 was 17.1 million square feet above the actual figure.

You must be logged in to post a comment.