Austin’s Office Sector Remains Resilient

The Texas capital keeps its development pace and sale prices, according to the latest Yardi Research Data.

Construction activity in Austin’s office sector continued its strong progress, with the market standing out as the leader in square footage under construction, according to Yardi Research Data.

Developers added large projects, while deliveries slowed down in the Texas capital. At the other end of the spectrum, Austin’s office sales volume placed it among the lowest-performing metros, while two of its peers outpaced gateway markets.

The metro’s vacancy rate remained as the most elevated in the nation and is expected to rise some more, as the metro is adapting to stock that has been completed over the past five years.

Austin’s office pipeline still growing

As of July, Austin’s pipeline included nearly 4 million square feet of space under construction across 30 projects. This represented 3.6 percent of existing stock, well above the national figure of 0.9 percent and positioning Austin as the leader of its peers, with Nashville, at 1.8 percent, following.

Austin’s pipeline topped the charts too, the metro that followed being Dallas, with nearly 4 million square feet underway. The Bay Area ranked third, with 3.3 million square feet, followed by Houston’s approximately 3 million square feet.

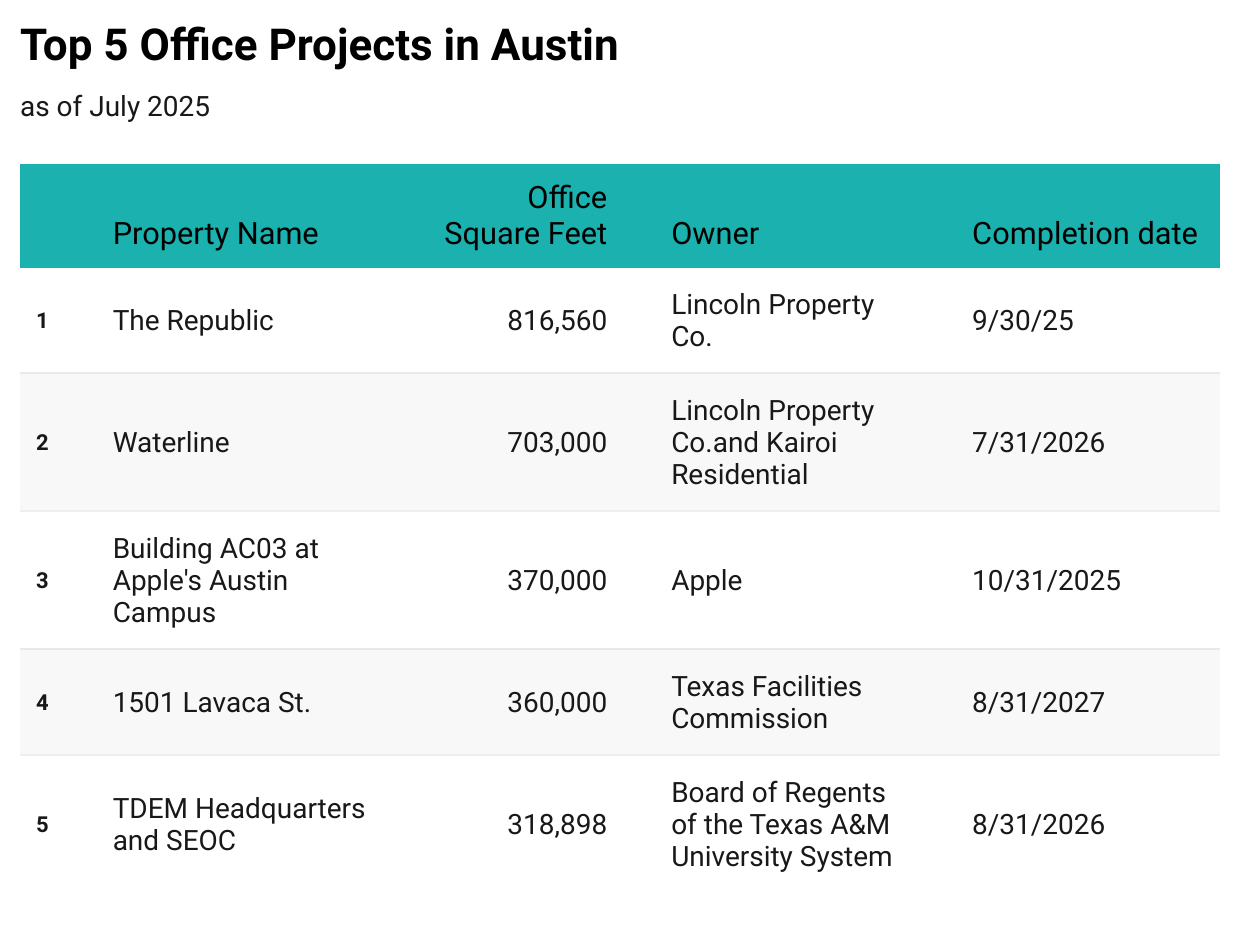

The largest office project in the metro remains The Republic, Lincoln Property Co.’s 816,560-square-foot tower in downtown Austin. The company is developing the project alongside Phoenix Property Co. and DivcoWest. Construction started in 2022 and completion is estimated for this September.

The second-largest office project in the metro is Waterline, a 703,000-square-foot high-rise. Another project of Lincoln Property Co., with co-developing partner Kairoi Residential and $742.5 million in construction funds, Waterline topped out earlier this month at 74 stories and 1,025 feet, making it the tallest building in Texas.

Deliveries in Austin comprised 16 properties totaling 399,578 square feet, representing only 0.4 percent of its existing stock and marking a notable 50.7 percent year-over-year decrease in office completions. Meanwhile, only 156,124 square feet across two properties broke ground since the start of the year.

Elevated vacancy likely to escalate

As of July, Austin remained the market with the most elevated office vacancy rate, clocking in at 27.2 percent—well above the 19.4 percent national rate and marking a 430-basis-point increase over the past 12 months. Despite the metro recording string office utilization and employment growth over the past few years, Austin’s vacancy will likely continue to grow as the metro is impacted by a considerable amount of completed office stock.

Meanwhile, the metro’s listing rates averaged $45.61 per square foot, above the $32.72 per square foot national value. When compared to similar markets, Austin’s rents were higher than San Diego ($45.23 per square foot) and Atlanta ($35.66 per square foot), while the Bay Area led with $51.55 per square foot.

Slow investment pace, prices still high

As of July, Austin recorded $343 million in office transaction volume, with properties trading at an average of $223 per square foot—above the national average of $182 per square foot. The metro’s sales price outperformed Atlanta ($139 per square foot), Phoenix ($197 per square foot) and Houston ($96 per square foot), while the Bay Area emerged as the priciest similar market, with properties swapping at $377 per square foot.

Austin’s investor activity was among the lowest ones in comparison with most of its peers. For context, the Bay Area led the rankings with $3.1 billion, followed by Dallas, with $1.2 billion, while Austin outperformed Twin Cities, with $321 million. The Inland Empire had the slowest investment activity, with only $59 million in sales at the end of July.

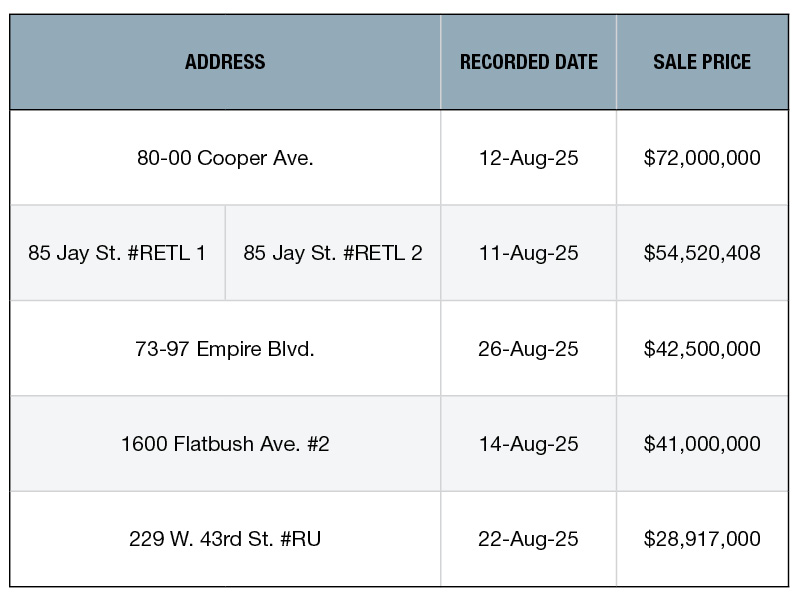

One of the largest sales in the Texas capital was the $57.1 million portfolio sale of two assets within the Creative Office at MetCenter. Preylock Real Estate Holdings purchased Buildings C and D, encompassing 135,250 square feet, from Zydeco Development, in a deal that closed in February.

Coworking share on par with hotspots

Texas’ capital coworking market included approximately 1.8 million square feet of space across 92 locations as of July, representing 1.8 percent of its total office inventory. The metro’s flex office footprint outperformed inventories in Tampa (1.7 million square feet), Charlotte (1.5 million square feet) and Orlando (1.4 million square feet), while its share of total leasable office space was on par with Dallas, Houston and Charlotte.

As of July, the flex office provider with the largest footprint in Austin remained WeWork, with 298,149 square feet. Companies that followed include Industrious (210,446 square feet), Expansive (160,245 square feet), Regus (157,735 square feet) and Spaces (121,938 square feet).

You must be logged in to post a comment.