CRE Pushes Toward Recovery

Capital and tenant demand point to a clear flight to quality, according to Integra Realty Resources’ latest report.

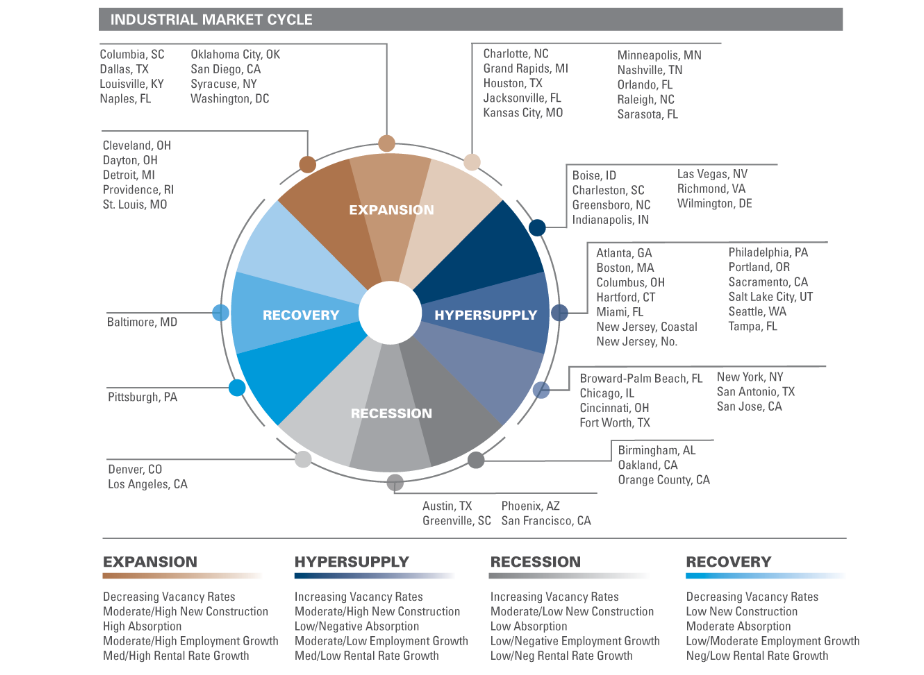

Commercial real estate, hit hard by the pandemic and subsequent interest-rate shocks, now seems to have reached a turning point. More markets are in recovery mode as opposed to recession, according to Integra Realty Resources’ 2025 midyear report.

The research study also noted a continued bifurcation in asset performance, as capital and tenant demand illustrate a clear flight to quality, with investors and occupiers prioritizing high-performing assets. Capital is becoming more selective, with underwriting driven less by market momentum and more by long-term staying power and resilience, IRR explained.

There are two dominant trends across all asset classes in almost every market that will play out—especially in the weakest (office) and strongest (industrial) sectors in the coming 24 to 36 months, IRR CEO Anthony Graziano told Commercial Property Executive.

“The first is that new construction is extremely difficult to execute,” Graziano says. “Higher interest rates, slower rent growth, macroeconomic uncertainty and escalating construction costs are all conspiring to slow new construction.”

READ ALSO: CRE’s Mixed Bag of Uncertainty and Opportunity

This construction slowdown benefits the supply-side equation in most markets, he said, which is having a stabilizing effect on occupancy and rental rates.

“The second trend is a widening of value spread between the highest-quality assets in the market and everything else,” Graziano said. “Top-tier properties in prime locations will deliver outsized returns, while older assets will trade at much steeper discounts to replacement cost.”

Office, industrial: still on different paths

In the office market, according to the report, vacancy remains elevated nationally, particularly in urban cores like San Francisco and Chicago. In those cases, hybrid work schedules and downsizing continue to impact demand. By contrast, metros in the Sun Belt and other places, such as Miami, Charleston, S.C., and Boise, Idaho, are showing signs of stabilization.

Demand tilts toward high-quality assets, reinforcing the ongoing flight-to-quality trend. The widening performance gap between Class A and commodity space is shaping both leasing and investment strategies, the report noted. New construction has slowed significantly, with activity mostly limited to build-to-suit, life science and medical office projects.

The office market is starting to stabilize, Graziano noted. As the labor market slackens, more employers will demand a return to the office for their workforce—so the office market is far from dead—and in fact in most markets, it’s in the early stages of recovery.

READ ALSO: Delivering an Office Experience That’s Worth the Commute

The industrial sector has been red hot from a demand perspective, but speculative construction is now pencils down, Graziano said. This will provide price support for existing assets, but shifts in logistics patterns and the impact of consumer spending could negatively affect industrial values everywhere except the most land-constrained markets.

Industrial remains healthy overall, but speculative development deliveries are pushing vacancy higher in some major markets, such as DFW, Indianapolis and Philadelphia, where new product is outpacing absorption, according to the report.

Rent growth is flattening in oversupplied areas, but remains positive in tight infill markets such as San Jose, Calif., and Richmond, Va. New starts are focusing on build-to-suit and adaptive reuse, as investors prioritize tenant durability and location quality.

“We are entering that point in the market cycle where industrial asset values will revert to the mean,” Graziano says. “This will bring greater stability and renewed investment demand back into the market after nearly two solid years of tepid activity.”

You must be logged in to post a comment.