Data Center Industry Sets New Records

As demand far outpaces supply, power remains a brake on overbuilding, according to JLL's research.

The North American data center market is experiencing a period of unprecedented demand and a supply pipeline that isn’t keeping up, according to JLL’s latest North America data center report.

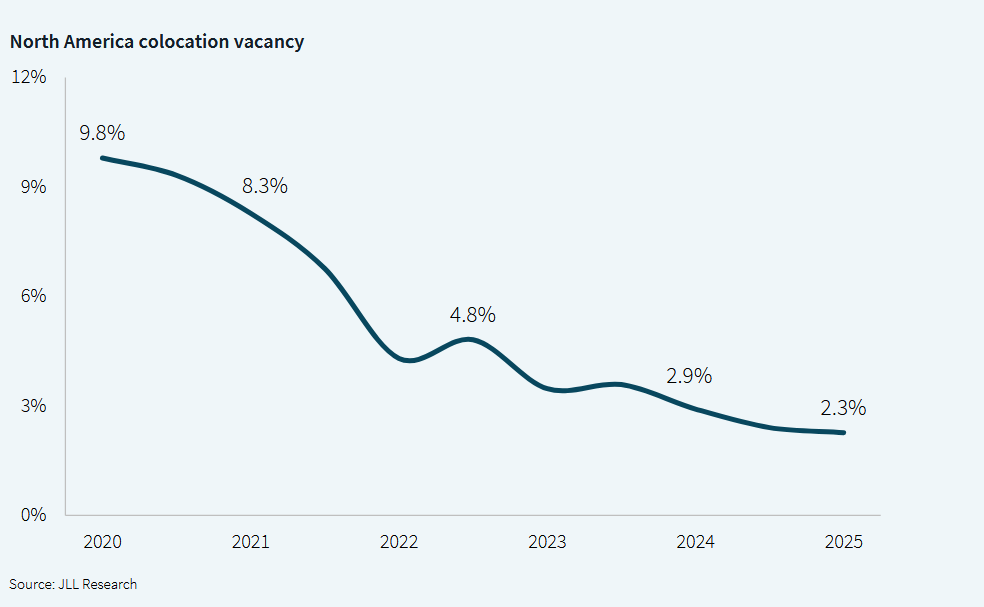

Marketwide in North America, data center vacancy rates came in at an anemic 2.3 percent at the end of the first half of 2025, even as inventory shot up to a record 15.5 GW. So the demand is there, but going forward, new development is hitting a number of jarring bumps, including severe capacity constraints and energy sourcing challenges.

The colocation market is experiencing unprecedented demand pressure under an increasingly stressful environment, JLL’s Andy Cvengros, executive managing director & co-lead of U.S. Data Center Markets, said in a company statement.

AI is a demand factor, but the report also noted that cloud providers and technology companies continue to dominate data center demand, accounting for 65 percent of all leasing activity.

The pace of absorption vs. development

The market absorbed a whopping 2.2 GW in the first half of 2025, with half of this activity concentrated in Northern Virginia (647 MW) and Dallas-Fort Worth (575 MW). Chicago (368 MW) and Austin, Texas/San Antonio (291 MW) also showed energetic leasing activity, JLL reported. Altogether, the sector is on pace to break the record for absorption levels, which was only set in 2024.

Northern Virginia maintains its position as North America’s largest data center market by far. The market enjoys 5.6 GW of capacity, making it more than triple the size of the next-largest market, Dallas-Fort Worth, which totals 1.5 GW. But DFW is seeing monster growth.

In DFW, there’s unparalleled competition for limited capacity, according to Curt Holcomb, managing director with JLL’s global data center solutions practice team. Major cloud providers are securing power reservations years in advance, and the development pipeline has expanded to over 1 GW under construction.

READ ALSO: Investor Interest in Data Centers Ramps Up

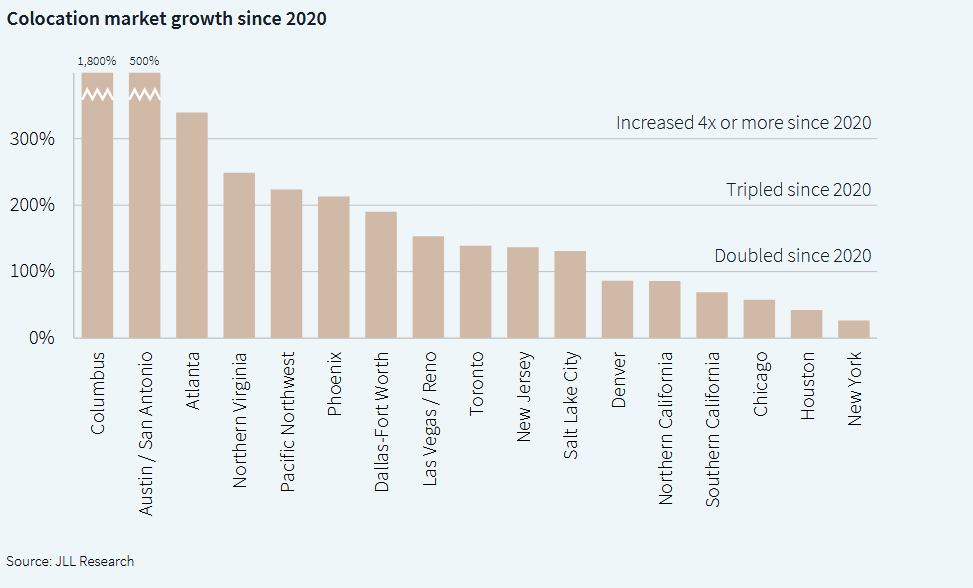

The DFW Metroplex isn’t alone in its ballooning data center market. Austin has emerged as a genuine Tier 1 market, Holcomb pointed out, with nearly 921 MW of inventory and another 341 MW under construction, representing a 500 percent growth since 2020.

The North American data center construction pipeline now stands at 7.8 GW, roughly 10 times the volume from five years ago. Phoenix (1.3 GW) leads development activity, followed by Chicago (1.18 GW) and Atlanta (1.11 GW), leading development activity outside Northern Virginia.

For those seeking space, this high level of development is almost academic, since 73 percent of all capacity under construction is already preleased. Preleasing at elevated levels has remained consistent for the past two years, signaling meaningful market relief remains years away, JLL predicts. North America could see $1 trillion in data center development between 2025 and 2030.

Power Issues

While established data centers markets are still dominating when it comes to development and absorption, emerging markets are growing fast, and they have an ace in the hole: cheaper and more available power.

Columbus has seen an astounding 1,800 percent growth in capacity since 2020, while Austin/San Antonio has grown 500 percent from a smaller base during the same period, JLL reported. As power constraints in primary markets push development elsewhere, these emerging markets are benefiting.

Commercial electricity rates have risen nearly 30 percent since 2020, reaching an average of 9.7 cents/kWh in the first half of 2025. Lower power cost markets include Salt Lake City (5.7 cents/kWh) and Denver (6.4 cents/kWh).

Lower electric costs are an important factor in data center site selection, but not the only one. Incentives figure in the mix as well.

“Certain up-and-coming markets have incentives in place that abate or partially abate sales tax on the purchase of infrastructure such as servers and software,” Holcomb told Commercial Property Executive. “Markets with these types of incentives have a definite competitive advantage.”

The average wait time for a grid connection across the U.S. is now four years, the report explained. Thus, power delays are a significant hurdle in alleviating data center supply constraints. On the other hand, power acts as a check on overbuilding, preventing a bubble from forming in the sector, JLL posited.

You must be logged in to post a comment.