Dragos Capital Buys CVS-Leased Retail Portfolio

The collection encompasses 18 properties.

Dragos Capital has acquired an 18-asset triple-net lease retail portfolio occupied by CVS.

All properties are under long-term leases with the pharmaceutical company, which has been looking to sell off its surplus assets. As of August, CVS was looking to sell roughly 3.4 million square feet of space, mostly closed stores.

The pharma firm set out to close 271 stores this year as part of an ongoing restructuring effort aiming to streamline operations amid shifting consumer needs. Yet, the company also expects to set up shop at 30 new locations.

READ ALSO: Top Retail Trends: Uncertainty Shifts Demand Dynamics in 2025

CVS isn’t the sole company looking to adjust its footprint, as Walgreens aims to downsize its real estate portfolio as well. In 2024, it laid out plans for some 1,200 retail store closures over the next three years, with 500 of them set to close this year.

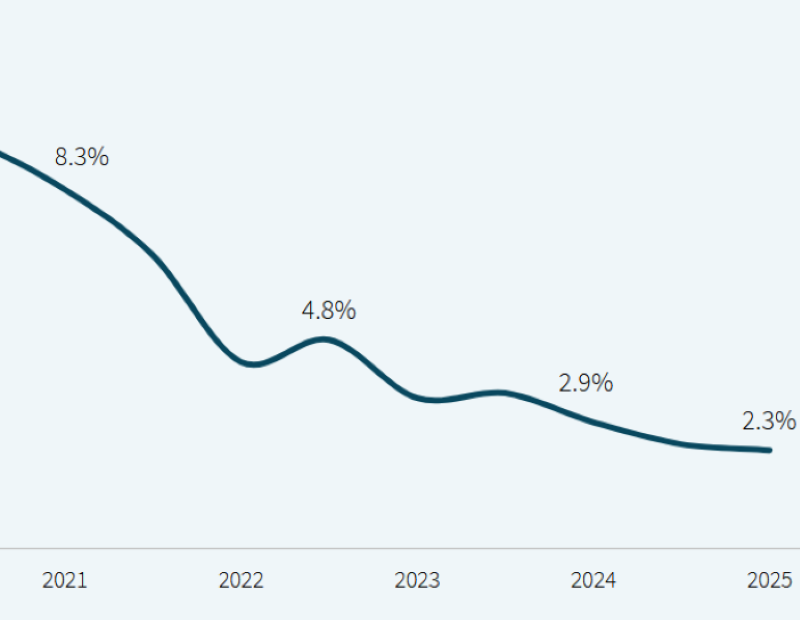

Retail single-tenant, net-lease sales plummet as cap rates rise

As retailers continue to fine-tune their operations, investors have been wary about stepping in and purchasing single-tenant, net-leased assets. Such sales totaled $2.2 billion nationally during the second quarter, representing a 31 percent decline compared to the first three months of 2025, according to a Northmarq report.

Cap rates stood at 6.97 percent in June, up 104 basis points compared to their 2021 reading, the report shows. Yet, the index increased by only 9 basis points since 2024, suggesting that rates are on a slow but steady path toward stabilization.

Despite market uncertainty and a sluggish investment scene, some companies bet on a market revival. FrontRange Capital and O’Connor Capital Partners created a $150 million joint venture to develop triple-net leased retail properties. The duo aims to complete 12 to 15 such projects across the East Coast.

You must be logged in to post a comment.