Denver Office Sector Still Sluggish

The market’s development pipeline and sale prices lag national figures, according to Yardi Research Data.

The Denver office market activity remained on a downward trajectory, according to Yardi Research Data.

The development pipeline continued to decelerate in the first six months of this year, while vacancy rates climbed steadily since January. The slowdown reflects broader uncertainty and shifting tenant demand, particularly in the downtown area. Moreover, the metro registered one of the lowest sale prices per square foot in the U.S. at the end of June.

However, the market could see a boost in infrastructure investment through the Vibrant Denver Bond Package initiative expected to go before voters in November. The program would allocate funds toward roads, bridges and pedestrian infrastructure improvements without raising taxes, supporting long-term real estate growth across the metro.

Denver’s construction activity below U.S. average

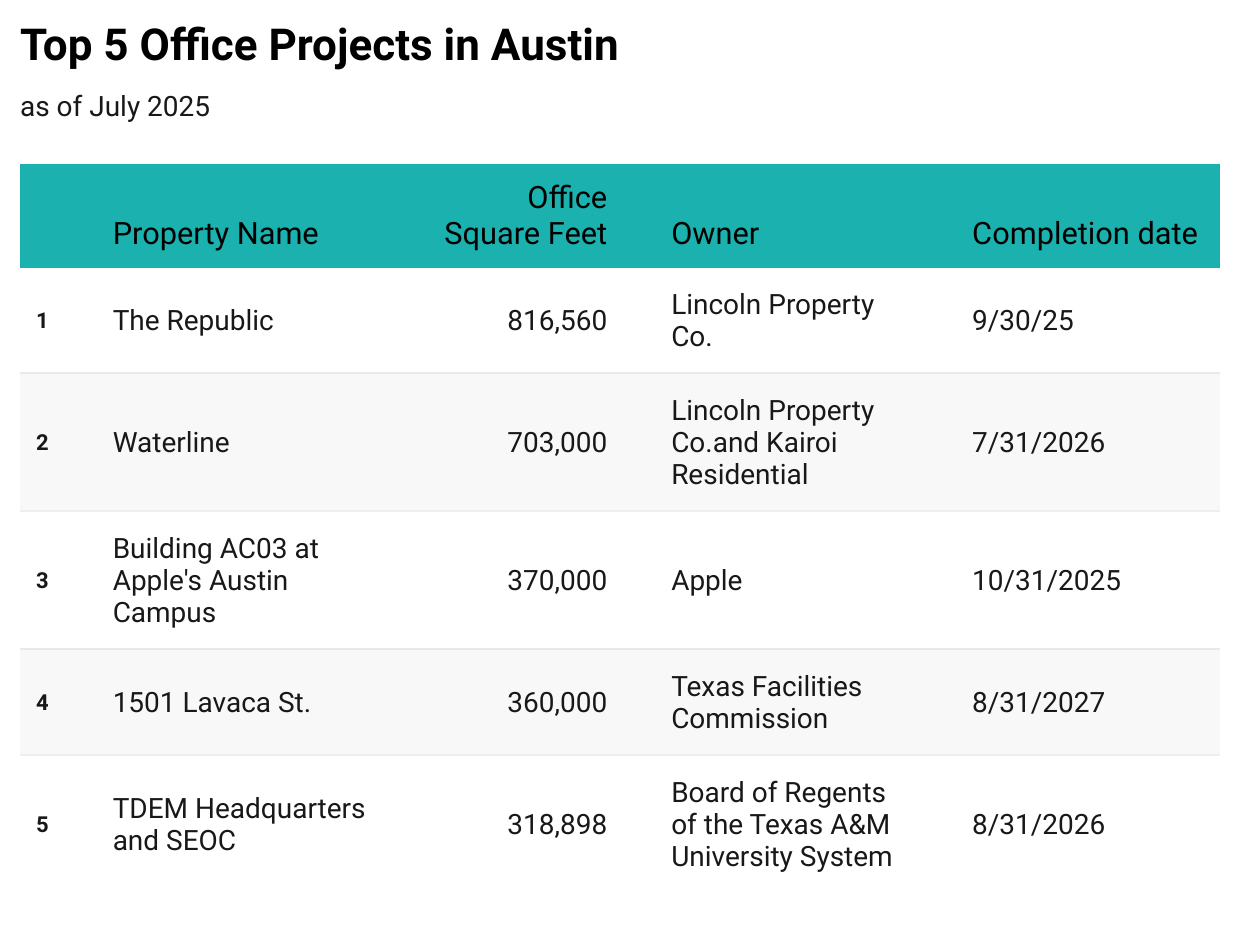

The Denver office development pipeline encompassed 818,179 square feet in the first half of the year. This accounted for 0.5 percent of its total stock, slightly below the 0.6 percent U.S. threshold. Peer markets with smaller pipelines included Atlanta (707,500 square feet), while Austin (2.7 million square feet), Houston (1.8 million square feet) and Philadelphia (1.2 million square feet) fared better.

Adding planned projects brought the metro’s share out of total stock to 1.7 percent, 50 basis points below the national average. Denver also lagged Atlanta (2.6 percent) and Houston (2.1 percent). Nationally, Austin took the lead with 6.7 percent.

In March, Sterling Bay and Piper Sandler Special District Group obtained $88 million in bonds to start work on a 2.6 million-square-foot mixed-use campus. Dubbed Redtail Ridge, the Boulder County, Colo., project is to include biomanufacturing, R&D, industrial, office and retail space, as well as more than 20 miles of trails across 389 acres. The first buildings are set to come online next year.

CoorsTek is also working on Building B3, a 181,503-square-foot office development within Clayworks, a mixed-use campus in Golden, Colo. The company took out an $80.2 million construction loan from UMB Bank for the project set to come online next year, according to Yardi Research Data.

As for office completions, only three properties totaling less than 65,000 square feet have come online during the first six months of the year. This marks a 77.1 percent year-over-year decline.

Denver office assets trade for half the U.S. price

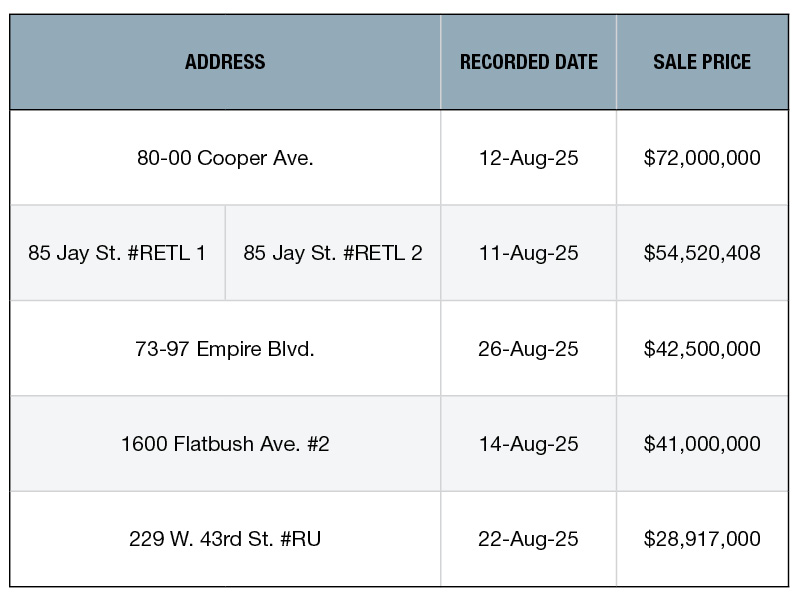

Denver’s office investment volume year-to-date as of June clocked in at $425 million, Yardi Research Data shows. Among peer markets, Houston ($1.2 billion) and Atlanta ($884 million) topped the ranking, while Austin ($278 million) and Philadelphia ($202 million) were at the opposite pole.

Assets in the metro sold for $95 per square foot on average, almost half the $189 national value. Philadelphia sales averaged $89 per square foot, but higher prices were recorded in Houston ($109 per square foot) and Austin ($221 per square foot).

One of the deals that closed so far this year involved Rampart Medical Campus, a two-building, 71,000-square-foot property in Denver. Echo Real Estate Capital Inc. purchased the medical outpatient complex from Healthcare Realty Trust for $8.6 million—more than $121 per square foot.

In February, Lone Star Funds acquired 17th Street Plaza, a 695,221-square-foot high-rise, for $132.5 million. Equity Commonwealth sold the 32-story asset.

Office vacancy rate climbs year-over-year

Denver’s office vacancy rate was 23.5 percent at the end of H1, well above the 19.4 percent national average. Year-over-year, the market saw a 140-basis-point increase in availability.

When compared to similar metros, Denver fared worse than Phoenix (17.1 percent), Dallas (23.2 percent) and Houston (20.6 percent). Austin (28 percent) registered the highest vacancy rate nationally, followed by San Francisco (27.7 percent).

Meanwhile, the listing rate was $30.7, below the $32.9 national figure and on par with peer metros such as Dallas ($31.4) and Philadelphia ($31). New Jersey ($33.8) and Austin ($45.3) posted higher rates.

Hoping to help the housing market and reduce the office vacancies, some investors turn to office-to-residential conversions. In April, the Luzzatto Co. purchased Colorado Tower I and II, two downtown buildings totaling 973,000 square feet, and announced plans to redevelop them into 700 apartments. The high-rises have Conversion Feasibility Index scores of 84 and 88, respectively.

Coworking inventory remains steady

Denver’s coworking footprint at the end of June amounted to 3.7 million square feet across 232 locations, according to CoworkingCafe. This accounted for 2.2 percent of its total leasable office space, just above the 2 percent national threshold. Peer markets such as Dallas-Fort Worth (1.7 percent), Houston (1.7 percent) and Philadelphia (1.5 percent) had less shared space available, while Atlanta (2.3 percent) surpassed the metro.

Regus remained the largest flex office provider in Denver, with 39 coworking locations totaling 728,232 square feet. WeWork (307,846 square feet), Spaces (179,696 square feet) and Office Evolution (155,916 square feet) followed.

You must be logged in to post a comment.