Sentiment, Market Optimism Surge: CREFC

This index saw one of the strongest quarterly improvements in its history.

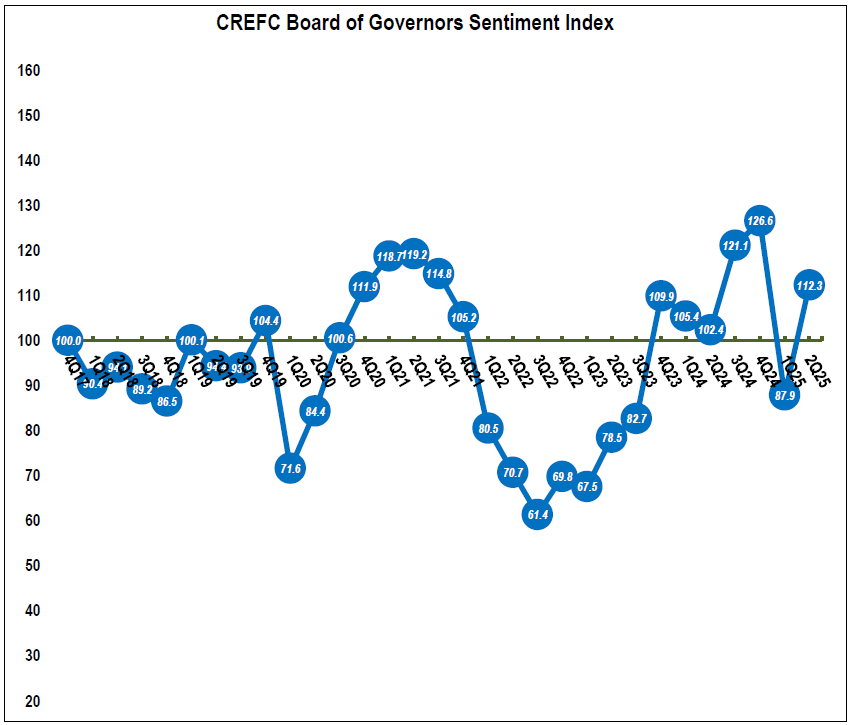

After a sharp decline in the first quarter, the CRE Finance Council’s Board of Governors Sentiment Index surged from 87.9 to 112.3 in Q2, climbing back above the neutral 100 baseline. The 27.8 percent increase marks one of the strongest quarterly improvements in the index’s history.

The rebound in the overall Q2 index followed a 30.5 percent decrease in the first three months of the year. That was the second-largest drop on record, exceeded only by the beginning of the pandemic in early 2020. The first-quarter survey, which was conducted from March 31 to April 7, coincided with White House’s ‘Liberation Day’ tariff announcements on April 2 and reflected the uncertainty and economic pessimism surrounding tariffs.

A dramatic shift in sentiment

The second quarter survey, conducted from July 8 to July 22, showed a “dramatic shift in sentiment as market participants adapted to the evolving economic landscape and found renewed optimism in stabilizing interest-rate expectations and improving capital market conditions.”

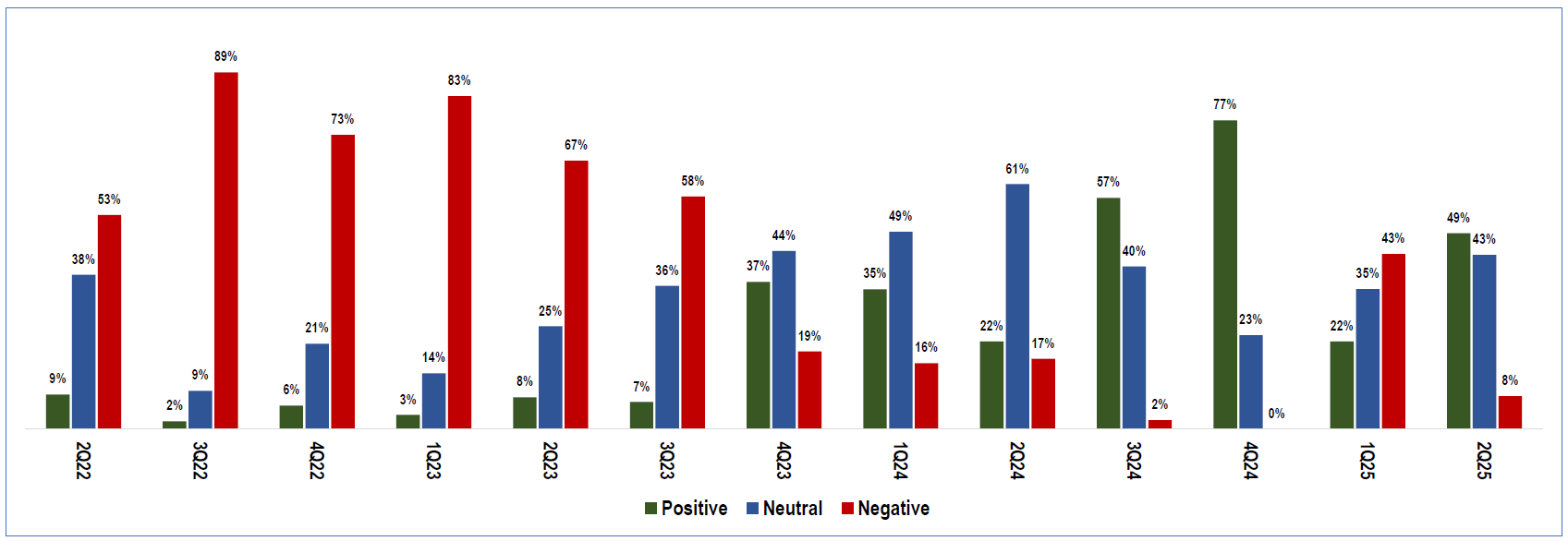

The industry’s overall outlook showed a robust recovery from the first-quarter survey, with 49 percent expressing a favorable view for CRE finance businesses over the next 12 months, up from 22 percent in 1Q. Only 8 percent remained negative, down from 43 percent in the previous quarter.

Lisa Pendergast, president & CEO of CREFC, said in prepared remarks the turnaround in the index highlights the CRE finance industry’s resilience and adaptability. While challenges remain, the market is regaining its footing, she noted.

The BOG index aims to gauge quarter-to-quarter shifts in market conditions and outlooks. In one of the most telling responses, 71 percent of the governors reported their firm’s appetite for new CRE lending or investment is increasing moderately or significantly for the second half of 2025.

Key index highlights

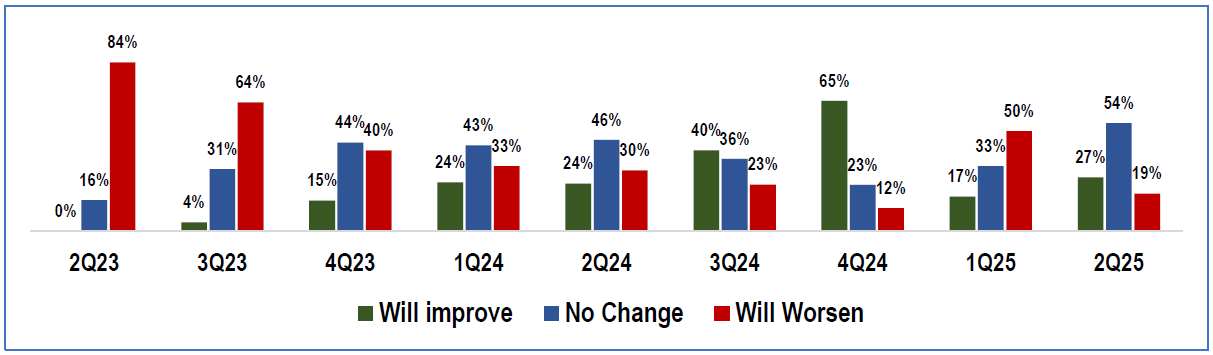

In one of the key core questions, sentiment turned positive, with only 27 percent of respondents expecting economic conditions to worsen over the next 12 months. That’s a dramatic improvement over the first quarter, when 80 percent of respondents expected the U.S. economy to see worsening conditions compared to the preceding 12 months. This time, the majority (54 percent) expect it to stay the same and 19 percent anticipate improvement.

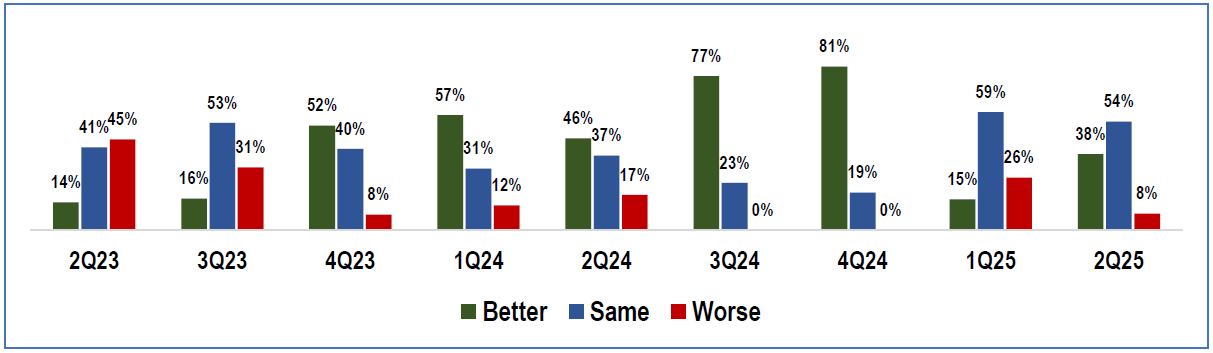

The outlook for CRE fundamentals stabilized in the second-quarter survey with 81 percent foreseeing fundamentals to improve or remain the same and only 19 percent of respondents expecting worsening conditions, down from 50 percent in Q1.

The board was described as exceptionally bullish on financing demand with 86 percent of respondents expecting increased borrower demand, up from 48 percent in 1Q, and none of the respondents expecting less demand.

The survey also indicates a sharp rebound in buyer activity for CRE and multifamily assets in the next 12 months after a soft first quarter. Expectations nearly doubled, with 65 percent of respondents predicting more demand, up from 35 percent in the first quarter, and only 3 percent expecting less demand, down from 20 percent in the previous survey.

With transactions expected to increase and borrowers returning, the survey respondents also had more confidence in market liquidity. Over the next 12 months, 92 percent expect better or the same liquidity, up from 74 percent last quarter, with only 8 percent expecting worse conditions. That’s down from 26 percent in 1Q.

Although the Federal Open Market Committee declined to cut the benchmark federal funds rate, keeping it at a range between 4.25 percent and 4.5 percent, the survey respondents reflected a growing belief that the rate environment will become more stable and conducive to business over the next 12 months. The next FOMC meeting is in September but Chairman Jerome Powell said Wednesday the committee has not decided if it will cut rates then. Still, 38 percent of the CREFC’s BOG survey respondents see more favorable rate movement, up from 30 percent in the previous quarter. Negative sentiment dropped slightly from 30 percent in 1Q to 27 percent.

Asked where they expect the target range to be by Dec. 31, 78 percent of respondents said they expect at least one 25 basis point rate cut by the end of the year. The majority, 53 percent, are anticipating the target range to be 4.00 to 4.25 percent.

In general, the governors see a much more favorable federal policy landscape for the next 12 months, with 49 percent expecting a positive impact from government actions, up from 11 percent in 1Q. The survey found only 16 percent are anticipating a negative impact, down from 59 percent in the previous quarter.

You must be logged in to post a comment.