How Construction Headwinds Are Shaping Development

JLL's update on the factors that will be affecting projects in the second half.

The construction industry is facing uncertainty for the remainder of this year and throughout 2026 due to policy changes, particularly on the tariff and immigration fronts, which are impacting everything from material costs to labor availability for commercial real estate stakeholders.

JLL’s mid-year update analyzes construction spending, material costs and construction labor force changes and how they have changed the outlook for the second half of the year and beyond. It also outlines the challenges facing commercial real estate investors and decision-makers, as well as the opportunities available in select sectors like data centers and advanced manufacturing and in certain regions like California and Florida, where rebuilding efforts are underway following disasters.

“Uncertainty is the biggest issue right now and transparency through the process is the best approach,” Louis Molinini, Project and Development Services lead, Americas, at JLL, told Commercial Property Executive.

“Economic conditions can change quickly too. Factors like interest rates, material costs and overall economic growth will play a role in determining the overall health of the construction sector,” Molinini added.

READ ALSO: Data Centers’ Power Crunch

To navigate these challenges, JLL stated commercial real estate stakeholders need to have focused responses and adapt strategically to changes.

Tariff impacts on material costs

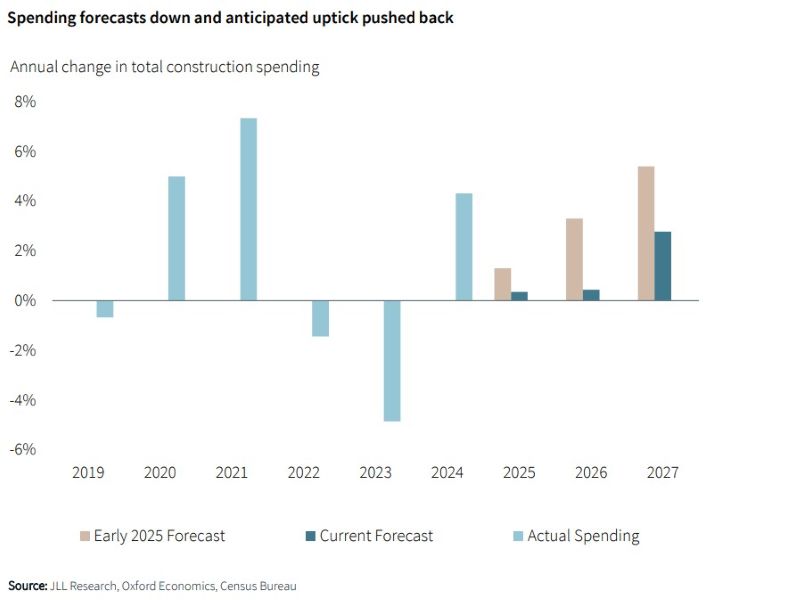

The report noted construction industry projects are increasingly on hold, spending forecasts are being adjusted downward, and contractors are facing reductions in secured work. A previously estimated late-2025 surge of starts is not expected to happen leading to a forecast of a slim 0.3 percent change in total real construction spending through 2026. That’s the lowest spending growth since the pandemic.

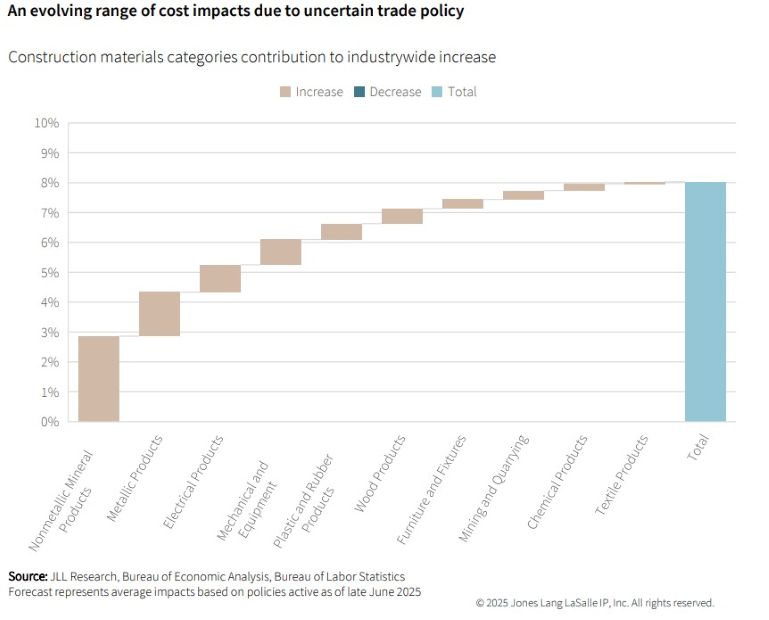

Material costs are now estimated to rise 7 to 12 percent for the second half of the year versus 5 to 7 percent estimated in JLL’s 2025 construction outlook released in November. JLL stated the cost environment has shifted dramatically in the last six months going from modest contraction to potentially one of the largest increases in recent history. The picture remains unclear however because of the delays and renegotiations that have pushed back the full impact of tariffs.

“The extensive rush to purchase following initial announcements pushed prices up slightly but that inventory has stabilized prices so far this year. As it disappears, we’ll see costs more accurately reflecting the tariff prices. Additionally, with limited pipeline, there’s been less demand side pressure on prices,” Molinini told CPE. “It’s been a delicate balancing of forces that has worked out for relatively stable prices but will give way to accelerating increases quickly, especially as we see starts pick up again.”

The report also noted costs of materials vary by category, with mechanical and electrical components facing greater exposure to tariffs and higher demand from sectors like data centers. Molinini said planning for tariff cost impacts early in design and incorporating other areas of cost savings early at each stage of design is key to controlling costs. He suggests making direct purchases of long-lead mechanical and electrical equipment, especially in data center projects.

Labor market disruptions

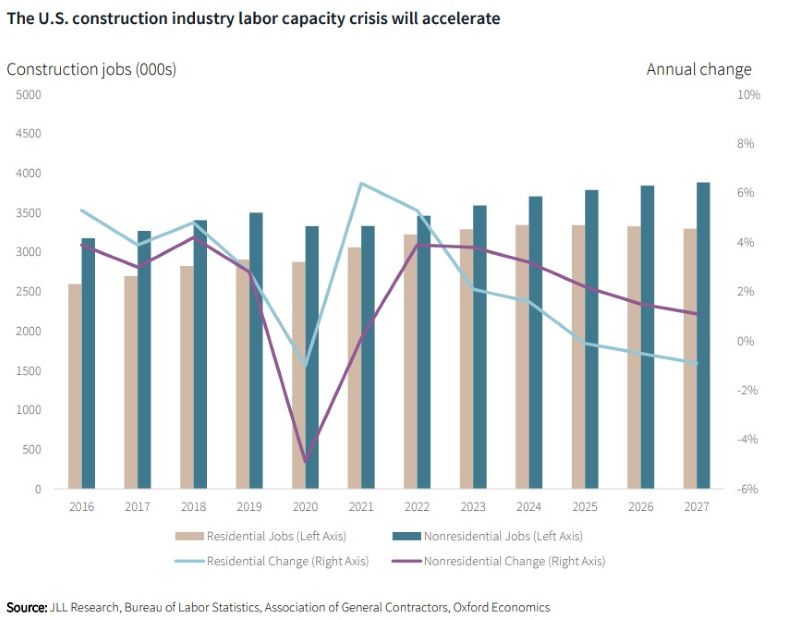

The JLL report states the construction industry labor market is facing disruption from the administration’s immigration policy, with the anticipated growth rate down to 1 percent, well below the 3 percent average of recent years. Targeted federal deportation, including enforcement actions at jobsites, have created a chilling effect. JLL notes contractors are reporting increased absenteeism and project delay concerns. The disruptions are affecting current projects and future capacity, compounding existing labor shortages.

Molinini said California, Florida and Texas are the most reliant on foreign-born construction labor due to the proximity to the border but there are labor shortages across the nation and every state has immigrants in the work force.

“Labor retention has been the priority for a while as contractors were looking to bridge to the next cycle,” he said. “The timing is difficult as backlogs are more uncertain, with starts down and cost increases on the horizon.”

Molinini said wages and benefits are likely to rise above the national average.

“But that’s not a sustainable solution without confidence in backlog growth,” he said. “The bigger concern is a lack of hands when that does happen.”

The effects will vary geographically and impact regions in different ways that will shift project viability, timelines and wages. Labor retention and development will continue to be the primary concern of forward-looking contractors.

Development bright spots

JLL states data center and advanced manufacturing development is driving growth despite broader hesitancy. The report notes real spending on data center construction is expected to more than double from 2023 to 2026.

“AI is definitely a major factor in the current data center construction boom,” Molinini told CPE. “The huge computational demands of AI applications, machine learning and large language models require massive data processing and storage capabilities, which translate directly into the need for more and larger data centers.”

Molinini said there has also been a noticeable push to bringing advanced manufacturing back to the U.S., driven by supply chain vulnerabilities highlighted during the pandemic and federal incentives for more domestic production.

While these are good signs, Molinini said it’s unclear whether these two sectors can sustain the construction industry for the next several years.

“Data centers are quickly growing, but they’re a small part of the overall spend picture and require significant infrastructure investments in power and water to support. The latter sectors are huge opportunities for the industry but also require public support,” he said.

“It’s safe to say these areas will remain strong, but relying solely on them is risky,” Molinini added.

Asked what other sectors and regions are seeing the most activity now and are expected to continue into 2026, Molinini said, “Broadly speaking, we’re seeing more multifamily activity than expected enter the pipeline across the nation and rebuilding efforts in California and Florida are making for extremely active locales.”

You must be logged in to post a comment.