Net Lease Market Shows Stability

Transaction activity will gain momentum, The Boulder Group predicts.

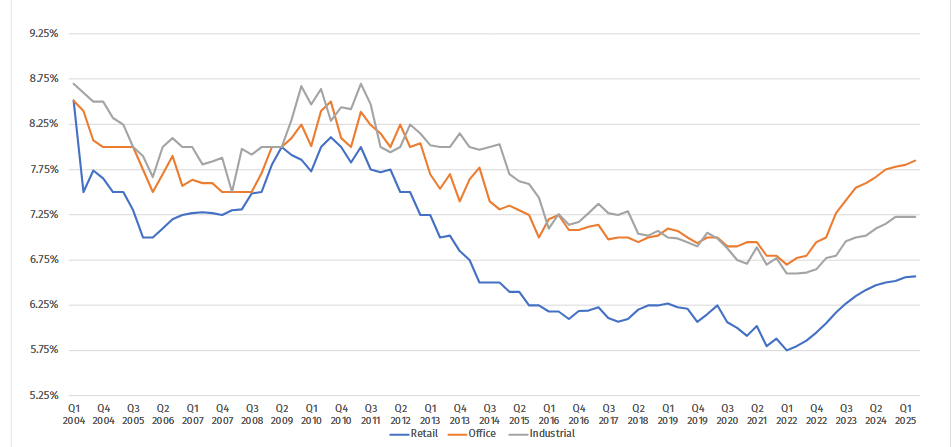

The U.S. net lease market is showing signs of stability after three years when cap rates were on an upward trajectory, according to the latest Boulder Group report, covering the second quarter of 2025.

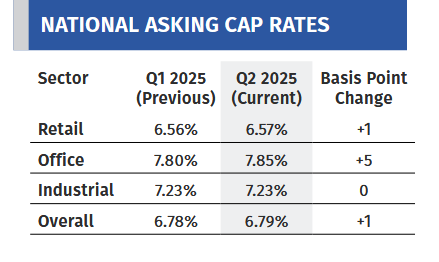

Quarter-over-quarter, overall asking cap rates were up a minuscule single basis point, from 6.78 percent to 6.79 percent.

Compared with the first quarter, retail cap rates edged up slightly to 6.57 percent (up 1 basis point), while office cap rates increased to 7.85 percent (up 5 basis points). Industrial cap rates remained unchanged at 7.23 percent for the second quarter in a row.

READ ALSO: Global Trade Rebalancing

The market is demonstrating a flight to credit quality among investors, the report noted, with premium tenants commanding cap rates lower than the market averages. High-credit retailers like 7-Eleven, Chase Bank and Wawa commanded sub-6 percent cap rates, while tenants with ongoing corporate challenges, such as Walgreens, traded at cap rates in excess of 7 percent, as relative risk is baked into pricing.

Corporate QSR brands also continued to attract aggressive pricing, with Chick-fil-A and McDonald’s maintaining their position as the most aggressively priced assets in net lease space, at 4.45 percent and 4.38 percent cap rates, respectively.

While transaction volume remains below historical peaks, especially in the 1031 exchange space, the narrowing bid-ask spreads and continued institutional participation suggest improved market liquidity, the report noted.

With cap rate movements moderating and supply-demand dynamics showing greater balance, net lease activity is expected to gain momentum through the remainder of 2025. Pricing and transaction volumes will, however, likely remain well below the peak market conditions experienced in prior years, the report forecasts.

Big investors go big in net lease

Investors aren’t shying away from the sector. With interest rates stable and participants feeling that they have a good grasp of this administration’s economic policies, net lease investors have growing confidence in putting money to work in this environment, Boulder Group President Randy Blankstein told Commercial Property Executive.

“Private Equity’s interest in the net lease market is gaining momentum, as evidenced by the recent news of BlackRock and Starwood marking multibillion-dollar acquisitions of large platforms in the net lease sector over the past two weeks,” Blankstein said. “The expectation is that additional similar transactions will occur in the next few months.”

In the Starwood deal, the company agreed to purchase Brookfield Asset Management’s Fundamental Income Properties for $2.2 billion, a net lease platform comprising 467 assets totaling 12 million square feet nationwide.

In the BlackRock deal, the investor acquired ElmTree Funds, a build-to-suit net lease specialist in the industrial sector. ElmTree currently has about $7.3 billion in assets under management.

Sectors that are outperforming in this market include retail properties occupied by discount retailers such as Aldi, as well as industrial properties with data centers and e-commerce logistics tenants, Blankstein said.

You must be logged in to post a comment.