CRE Executives Less Optimistic

Tariffs, inflation and geopolitical tensions remain key concerns, according to a DLA Piper survey.

Bearishness gripped the respondents of the late DLA Piper 2025 Global Real Estate Review, with a sudden spike this spring in those feeling pessimistic about the industry’s prospects. The spike coincided with the White House’s new trade policy announced in April, and markets’ and investors’ reaction to it.

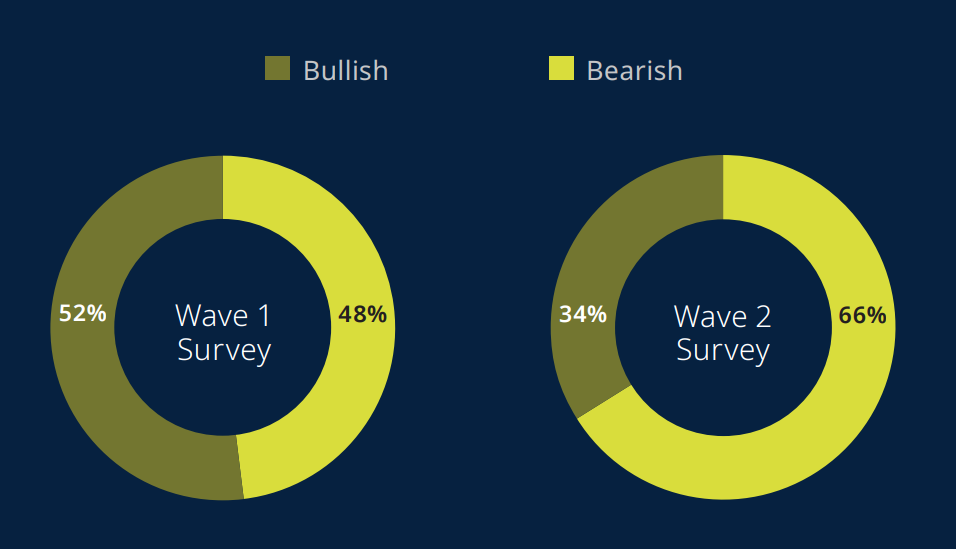

DLA did a survey, facilitated by Wakefield Research, of 126 CRE executives and other experts in February and March, which found that those expressing bullish sentiments about the market and those expressing bearishness were roughly tied, with 52 percent for bearishness and 48 percent for bullishness.

In light of the April events, the company did a second round of surveys in May, involving 116 respondents. Those later respondents feeling bearish now came in at 68 percent, compared with 34 percent expressing bullishness. More than half of them felt that tariffs were going to have a negative impact on the commercial real estate market, including 16 percent who felt that the impact was going to be very negative.

On the other hand, 41 percent expected no impact from tariffs. As it happens, according to the report, industry respondents are still the most worried about interest rates than anything else. Rates have been in neutral since December, and will be at least a little longer, following the Fed’s recent inaction on changing them.

That was another difference between the first and the second round of surveys. Back in February and March, 55 percent of respondents expected interest rate cuts in the near future, but by April and May only 30 percent thought that. An increasing number (41 percent) thought that rates might actually go up.

READ ALSO: CRE Faces Challenges Near and Far

At the time of the first survey round, respondents were more-or-less evenly split on whether non-U.S. investment in U.S. real estate will be strong, with 31 percent saying it would, and near-equal numbers disagreeing or remaining neutral on the question. Fast forward a few months, and only 12 percent say overseas investment will be strong.

The prospect of high tariffs also rekindled concern about inflation. In the earlier part of the survey, only 16 percent of respondents felt that inflation was still poised to have a negative impact on CRE. The Fed’s rate adjustments might have been bitter medicine, but inflation seemed to be tamed.

By April and May, the percentage concerned about a negative inflationary impact on CRE had ballooned to 65 percent. Tariffs would mean domestic price hikes, and thus a possible reheating of inflation. Such a scenario could prevent interest rate cuts in the near term, and if bad enough, even inspire hikes.

The optimistic side

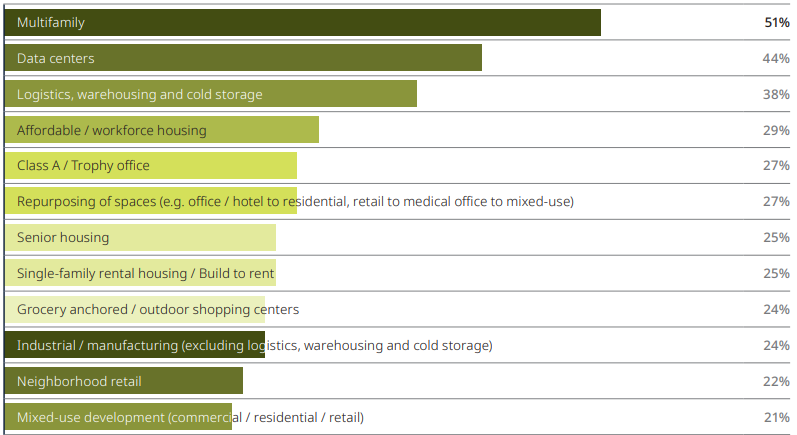

Still, the survey found that CRE pros weren’t pessimistic about everything. In both the first and second surveys, respondents said that multifamily and data centers were strong spots in CRE, and thus particularly strong asset classes. A shortage of housing drives the former, while the nation’s sizable appetite for data drives the latter.

The suffering office sector got a little love as well, with 32 percent of respondents predicting that office occupancy rates would return to pre-pandemic levels over the next three years. A year ago, only 16 percent felt that way. Most (75 percent) expect office workers to be in the office three times per week over the next year, up from 35 percent who said that in 2024.

Investors are also relatively cheerful about CRE pricing. The recent tough times in CRE have pushed prices down for some assets in some places, offering investors with ready liquidity the opportunity to snag some deals. The report notes that a broad spectrum of investors are interested, including private equity firms, sovereign wealth funds and insurance companies, who are largely looking for office and hospitality assets.

Geographically, investor interest is evenly distributed across U.S. markets, with 42 percent of respondents identifying opportunity in top-ranked Dallas-Fort Worth, up from just 29 percent last year. New York (30 percent), Miami (29 percent), and Chicago (28 percent) grew more attractive, rounding out the list of top investment cities.

You must be logged in to post a comment.