Nuveen Creates 1031 Exchange Platform

The move is responding to an expected generational wealth transfer over the coming years.

Nuveen has launched a 1031 real estate exchange platform that will offer property sellers the opportunity to convert proceeds from a sale into an ownership interest in an UPREIT. The maneuver thereby realizes the tax advantages of a 1031 exchange without the search for a compatible investment property.

The structure, called Nuveen Global Cities Real Estate Investment Trust, is a non-listed REIT that will focus on holding commercial real estate. Nuveen, which is the investment arm of pension fund TIAA, did not specify the geographic reach of the new entity, but did say in a statement that it would concentrate on the “world’s most dynamic cities,” pointing to an international scope.

The platform also represents a new capital raising source for GCREIT, which will target high-net-worth property investors who may not have previously considered such structures.

GCREIT will offer more than tax advantages, Nuveen noted. It is designed to help investors address key planning objectives, such as capital gains deferral, estate transition and portfolio diversification, while accessing Nuveen’s global real estate expertise.

READ ALSO: Wealth Surge Drives Family Office Growth, Evolution

The time is right, according to Nuveen, since a massive wealth transfer is in the offing between generations in the U.S. Through 2048 that transfer will total $124 trillion, with $105 trillion expected to flow to heirs and $18 trillion will go to charity, financial services consultancy Cerulli Associates forecasts.

The number of high-net-worth individuals has also been growing recently, despite the tumults of the post-pandemic era. In 2023, millionaires already accounted for 1.5 percent of the adult population worldwide, according to UBS. The U.S. had the highest number of such individuals, at nearly 22 million.

Uncertainty Haunts 1031 Exchanges

During the earlier part of the 2020s, the volume of 1031 buyers—especially in the net lease property sector—has been a major factor keeping cap rates low, according to Northmarq. 1031 investors, who face tight transaction deadlines and have a strong incentive to seek tax deferment, have often been willing to pay a premium for properties.

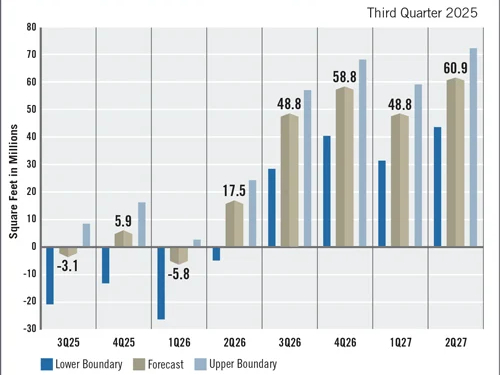

In 2024, interest rate shifts and other economic uncertainty slowed the 1031 market, along with the rest of commercial real estate, Northmarq noted. Commercial real estate may be picking up in deal volume this year, but there are still questions about where cap rates, and 1031 buyers, are going to go from here.

Historically, 1031 investors provided liquidity to the net lease market and buoyed demand for such assets as pharmacies, fast food locations and essential retail. In 2024, their influence waned, but now 1031 investors are returning to the market, Northmarq reported.

You must be logged in to post a comment.