Data Center Industry’s Remarkable Momentum

New market leaders are emerging, according to Avison Young’s latest report.

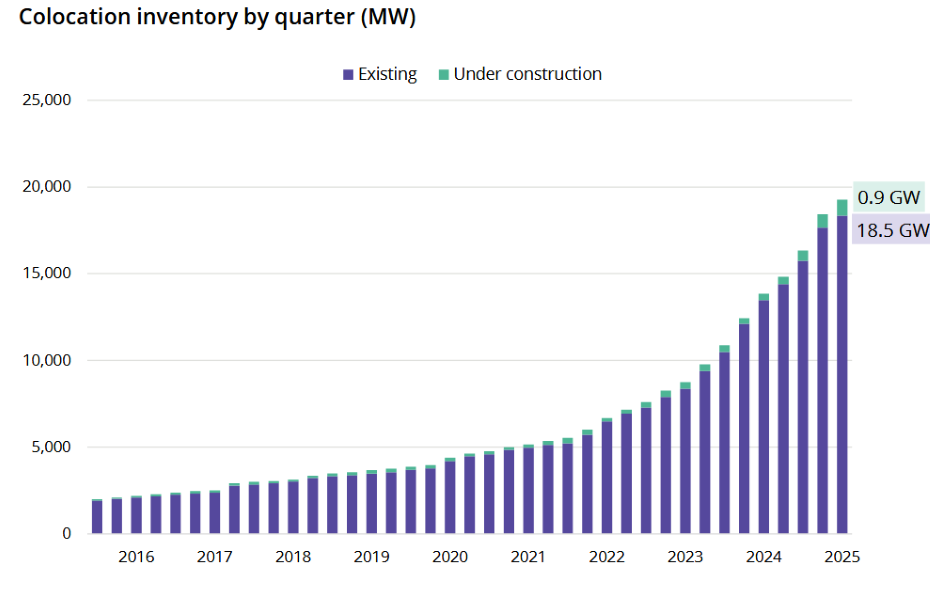

Colocation data center inventory growth slowed in the first quarter of 2025 as the market absorbed recent supply following a record-breaking fourth quarter last year, according to a new report from Avison Young.

Construction pipelines, however, continue to flow, signaling sustained long-term momentum.

Hyperscalers are among the world’s strongly capitalized companies, and the competition to control AI development and deployment is intense, according to Raj Joshi, senior vice president of Moody’s Ratings Corporate Finance Group.

Joshi told Commercial Property Executive that he expects them to maintain their global data center and IT infrastructure spending to support growth in AI and traditional cloud services, unless their core businesses are under meaningful pressure from a sharp deterioration in the U.S. economy.

READ ALSO: From Data Center YIMBY to NIMBY?

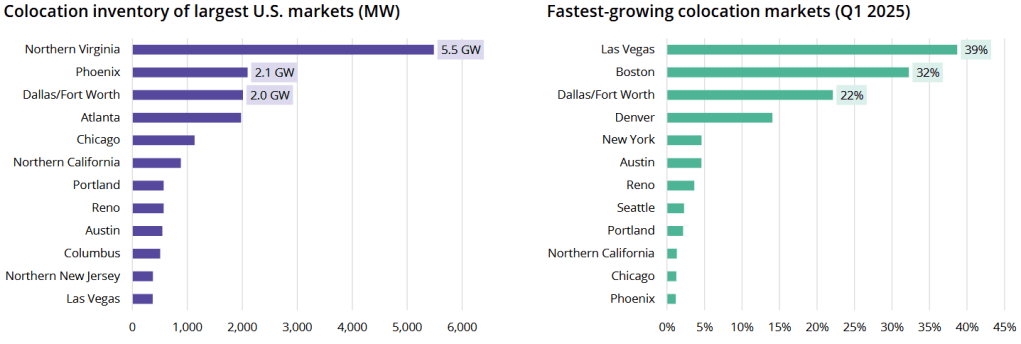

Las Vegas led percentage growth in colocation inventory in the first quarter. Boston also saw notable growth, driven by spillover demand from power-constrained Northern Virginia, which remains the largest data center market in the world.

Dallas/Fort Worth continued its rapid expansion, passing Atlanta to become the third-largest data center market in the U.S., according to Avison Young.

New liquid-cooled data centers are coming soon to Chicago; Austin, Texas; and Reno, Nev., among other markets.

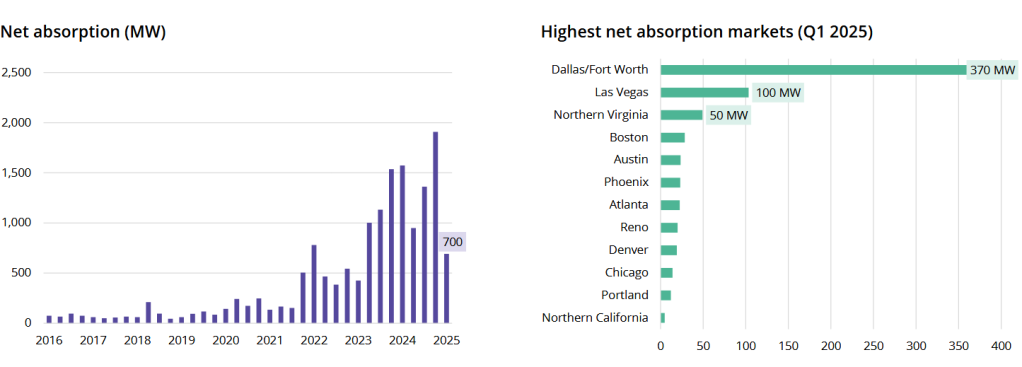

Absorption slows somewhat

National net absorption slowed in early 2025 amid a cyclical pause, but Texas gained momentum. Dallas/Fort Worth saw the highest absorption among all markets in the first quarter, achieving nearly 80 percent of its 2024 absorption in just one quarter. Hyperscale and AI users are actively targeting the region, making 2025 a promising transaction year.

Las Vegas surged into second place, doubling its previous quarterly absorption record, according to Avison Young. Meanwhile, Northern Virginia’s growth was hindered by power constraints.

“Recent project cancellations by Microsoft and AWS, while making headlines, reflect the hyperscale norm of over-allocating capacity for future needs. These decisions are strategic rather than indicative of market contraction,” Howard Berry, Avison Young principal & director of data center solutions, told CPE.

“Other operators or tenants typically absorb vacated sites, and the data center sector continues its robust growth trajectory.”

Demand remains exceptionally strong, with vacancy rates at historic lows. Major primary markets report colocation vacancy below 1 percent. Turnkey colocation rents are rising as market conditions tighten, with pricing for large-scale requirements increasing even more sharply.

Mergers and acquisitions are starting strong in 2025, driven by telecom activity and growing institutional investment. Institutional and REIT buyers dominate the market, while private buyers have decreased, signaling a more mature landscape.

Cap rates declined to the mid-6 percent range for turnkey facilities and around 5 percent for powered shell properties. Strong investor demand may continue pushing rates lower. The global datasphere is projected to double from 2025 to 2028, with emerging technologies driving increased data consumption.

Power demand spiking

With that consumption comes increasing power demand.

“Local power utility companies are starting to catch up from massive power requests by grouping their load studies, according to Todd Johnson, Ryan Cos. director of real estate development for the mission critical sector.

“This clustered approach clearly shows what upgrades are required to meet the requests and spreads the costs more fairly,” Johnson told CPE. “It also allows utilities to reset contract terms and the ‘rules of the road.’”

He added that serious end users are separated from speculative projects through firm contract steps and required deposits. “While it may be tough now, this will benefit end users in the long run.”

Some communities are actively discouraging further data center development as power utilities reach their capacities, according to Robert Martinek, director at EisnerAmper.

“Growth is now moving into new regions that were not considered in the past,” Martinek said. “Emerging markets include Pennsylvania, the Carolinas and West Texas as new choices for data center developments.”

As 2030 net-zero goals near, the largest hyperscale tenants have committed to reducing their carbon footprint in all facets of operations, according to Cushman & Wakefield’s global data center comparison report for 2025.

This is increasingly done through renewable energy infrastructure and sustainability initiatives, such as solar and wind farms accompanying those exceeding 100 MW.

Financing options widen

As owners perhaps increase capital expenditure to avoid obsolescence of their aging data centers, their cash flow might eventually narrow for commercial mortgage-backed securities and asset-backed securities (ABS), according to Darrell Wheeler, head of CMBS research at Moody’s Ratings.

“A major financing tool for data centers now is structured finance, with more than $9 billion of issuance through the end of April 2025 ($4.6 billion from CMBS and $4.7 billion from ABS transactions),” Wheeler told CPE.

With the surge in demand for data centers, which can be expensive to build, have high cooling requirements and require a significant amount of electricity, many owners and developers are considering C-PACE financing, according to Jonathan Kloos, senior director of lender partnerships and new products at Nuveen Green Capital.

“Because C-PACE can often provide financing at a lower rate than other available options, data center owners and developers are becoming increasingly aware of it as a cost-efficient option to finance new projects, or to refinance mid-stream,” Kloos said. “C-PACE is well-positioned to address the growing demand for data centers, and we anticipate capitalizing several more projects this year.”

You must be logged in to post a comment.