RXR to Pay $1B+ for Manhattan Tower

The asset also attracted interest from Blackstone, Tishman Speyer, SL Green and RFR, according to reports.

RXR will acquire 590 Madison Ave. for almost $1.1 billion, The Real Deal reported.

State Teachers Retirement System of Ohio owns the 1 million-square-foot property in Manhattan and paid $202 million for the asset almost 30 years ago, CommercialEdge shows. The property is encumbered by a $650 million loan issued by Wilmington Trust, set to mature this October, according to the same source.

Among interested buyers were also Blackstone, RFR, SL Green and Tishman Speyer, according to The Real Deal. Last month, reports placed Blackstone as the frontrunner.

However, just weeks ago, the dynamics shifted to a race between RXR and Tishman Speyer, Commercial Observer reported. Simultaneously, one bidder was pushing for an installment sale structure.

The asking price of more than $1 billion hasn’t been surpassed in the New York City office market since Google’s parent company—Alphabet—acquired 550 Washington St. for almost $2 billion in 2022.

READ ALSO: 2025 Office Investment Update

The 42-story building is located near Central Park on Manhattan’s Upper East Side. Built in 1981, the tower is slated to receive a new amenity center including an outdoor roof terrace and meeting areas, as well as a multi-purpose conference hall, among other features. It last received a facelift in 2014.

Last month, Apollo Global Management committed to 100,000 square feet at the building. Other tenants include Berkshire Hathaway, Morgan Stanley and Taurus Asset Management.

Eastdil Secured Managing Directors Will Silverman and Gary Phillips negotiated the sale of 590 Madison Ave., according to The Real Deal.

Manhattan’s cutting-edge office investment scene

RXR kicked off 2025 by purchasing a 49 percent interest in 1211 Avenue of the Americas, a nearly 2 million-square-foot office asset. The company became a co-owner alongside Ivanhoé Cambridge.

Its competition for 590 Madison Ave. hasn’t sat by idly this year. RFR recapitalized 475 Fifth Ave., securing new debt and equity for the 275,738-square-foot office building. Citibank and JPMorganChase issued a $160 million loan.

Tishman Speyer is expected to pay $108 million for 148 Lafayette St., a 150,000-square-foot asset in Manhattan’s SoHo neighborhood. The company entered into a contract to purchase the building earlier this month.

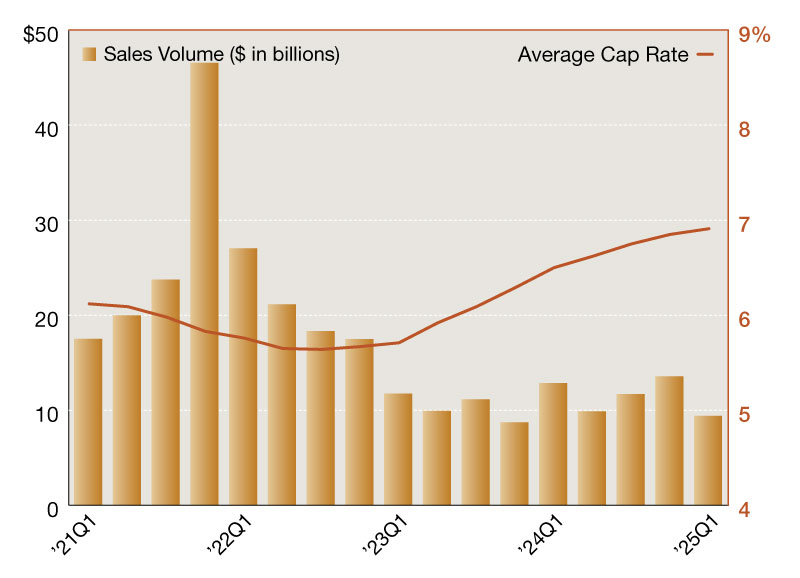

All in all, Manhattan’s office investment volume clocked in at almost $2.6 billion during the first four months of the year, according to a CommercialEdge report. Assets traded on average for $439 per square foot, significantly above the $191 national figure.

You must be logged in to post a comment.