Who’s Buying Distressed Office Buildings?

There's both pain and relief in the market. Here's who's seizing the moment.

Distressed office assets are distressed for a reason. Those acquiring them face inherent risk.

Yet, many such properties are continuing to find buyers, and broad categories of investors are displaying steadily rising appetite for the class. They’re willing to take on the challenge for what they see as sizable opportunity.

“Today’s office market is being reshaped by private capital investors taking advantage of historic discounts,” said Lukas Krause, CEO of SVN International Corp.

“With a focus on distressed and value-add opportunities in resilient urban cores and fast-growing metros, the trend signals a belief in the long-term recovery and relevance of office space, albeit repositioned to meet the evolving needs of the future workforce,” Krause continued.

Value-add opportunity in distressed office

The top areas for distressed office acquisitions are major CBDs in primary markets with robust fundamentals and historical resilience, Krause said. Sun Belt metros are also garnering strong interest based on their continuing population and employment growth.

Decidedly distinct from Class A assets that are high quality, well situated and require little repositioning, the distressed assets being sought are high-vacancy or deferred-maintenance buildings that offer value-add opportunities for those investors inclined to deploy capital in upgrading and re-leasing strategies. They view the huge discounts as cushions allowing for repositioning or value-enhancement strategies. Sellers, Krause added, tend to be “institutional investors, including pension funds and investment managers, divesting underperforming or non-core assets to rebalance their portfolios”

Buyers and sellers of distressed office buildings vary building by building, micro-market by micro-market, reported Benjamin Adams, CEO of Ten Capital Management, which played a key role in last year’s acquisition of The Townsend Group from Aon.

“One of the more confusing things about the after-effect of the pandemic is that there has been a complete fractionalization in the asset class,” Adams said.

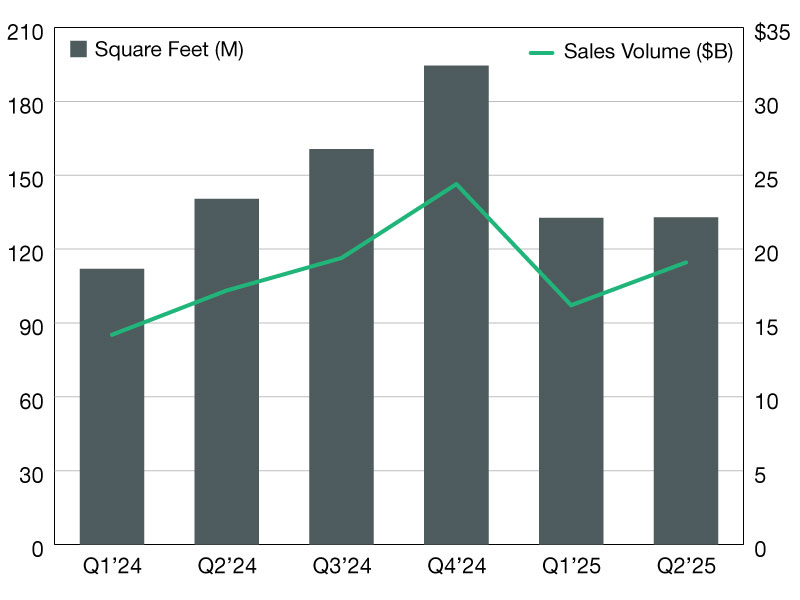

While there have been some core-plus trades, they tended to be few and far between, with lease roll stickier and longer-term, and the post-Covid downsizing trend fully realized. Transaction volumes remain, in general, very low.

READ ALSO: Office Prices Slide as Discounts Surge

“We are seeing a lot of family offices participate in the middle markets, particularly in note sales,” Adams said. “They have the benefit of being able to take a longer-term view. A conventional closed-end fund with constraints on an investment period often can’t do that. Family offices also can be very quick to act and are probably more comfortable with the risk of limited to no contingencies or due diligence in a note sale environment.”

Private capital buying distressed office

Private capital entities, such as private equity firms, family offices and high-net-worth individuals, are one type of buyer Krause sees. Such investors are taking advantage of price reductions from prior valuations, and particularly so in primary markets accustomed to resilience and recovery after downturns. Private equity firms are actively investing in discounted office assets, aiming for turnaround and value creation. Family offices and high-net-worth individuals are pursuing undervalued assets with an eye toward long-term appreciation and consistent income streams, he said.

Another buyer type is the owner-occupier or owner-user, represented by firms seeking greater control over their workspaces and increasingly acquiring offices rather than leasing, especially when acquisition costs decline below new construction expenses.

In each case, “These investors are motivated by the potential to reposition assets through leasing strategies, property improvements and riding the eventual wave of market recovery,” Krause mentioned.

Among prospective owner-operators or owner-users are health-care industry professionals, including physicians and dentists, said Sandip Sachar of DDS, a New York City dentist with a 20-year-plus general dental practice, Sachar Dental, in Manhattan. The high-interest rate era following the pandemic unleashed opportunities for doctors and dentists to acquire their buildings and medical condos, she said.

“Interestingly, young doctors still cannot afford Manhattan real estate, and older doctors, close to retirement, do not have the desire to purchase at this point,” she added. “There is a sweet spot of doctors in practice for 10 to 20 years with enough capital and enough foresight to invest in real estate, and still having the years left to benefit from the ownership and appreciation of their asset.”

In Miami, two types of distressed office buyers are dominating, said Holly MacDonald-Korth, CEO of KDM Financial. One category includes owner-users locking in opportunistic pricing. The other comprises developers seeking to convert distressed office buildings into multifamily or mixed-use.

“What’s interesting is that with housing demand on the rise, underutilized offices, especially in the urban core and outer suburbs, are becoming attractive to the smart money,” she added. “These areas are typically housing constrained, and offer a great opportunity for creative developers to turn an underutilized property into housing or a mixed-use project.”

Out West

On the West Coast, Robin Santiago, managing director of the SVN Capital West Partners office in San Jose, Calif., reported most distressed office building buyers have been owner-operators seeking long-term control over their real estate, frequently at discounted pricing.

The largest Bay Area transactions of the past year by dollar volume were the recent acquisition by Microsoft of its 643,000-square-foot campus in Mountain View in a $330 million all-cash transaction and the recent expenditure of $374 million by NVIDIA for a seven-building, 626,000-square-foot property. LinkedIn recently paid $75 million for a Sunnyvale building it had previously leased. On the investment side, San Francisco-based PSAI Realty Partners purchased a three-building trophy office campus in Campbell, Calif. for $54 million, a more than 60 percent discount from its previous sale price.

Meanwhile, Silicon Valley-based South Bay Development purchased a seven-building, 406,000-square- foot development named The Quad. Its approximately $51 million price tag was discounted by 66 percent compared to its previous sales price, Santiago said.

Caveat emptor

Though in many cases offering acquisitions at deeply slashed sale prices, distressed deals are not without serious risk. That’s the earnest reminder of Steven “Sonny” Ginsberg, partner at CRE law firm Ginsberg Jacobs LLC.

“Usually, the discounted property is being sold at the direction of a lender, whether through a short sale, by a receiver or post-foreclosure or deed in lieu,” Ginsberg said.

“If a lender is the seller, they’ll have very limited representations. If the lender is not the seller, their reps may not be worth anything, as the selling entity will be receiving little or no equity from the sale. And a lender is unlikely to allow a holdback to secure any reps regardless of who the actual seller is. … That puts more focus on buyer due diligence, which may also need to be performed timely and at the buyer’s sole cost.”

You must be logged in to post a comment.