Top HQ Relocation Trends

What’s behind these corporate strategies, according to recent research.

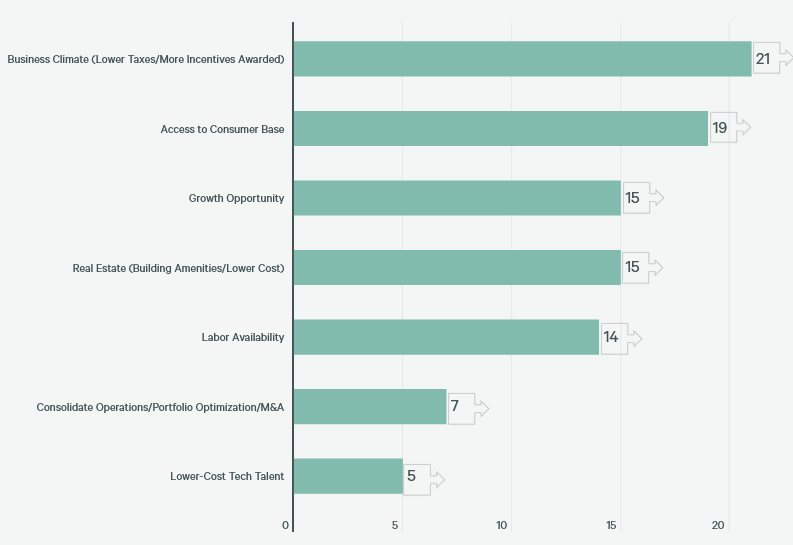

Business climate and access to the consumer base were the top reasons for U.S. companies across many industries to relocate their headquarters in 2024, according to CBRE Americas Consulting’s latest research.

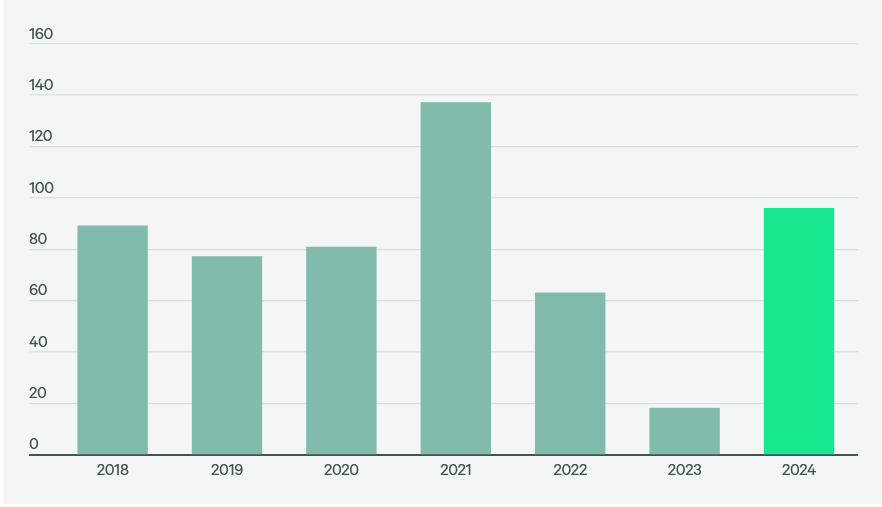

The group based its findings on approximately 561 publicly announced headquarters relocations between 2018 and 2024, ranging from start-up enterprises to Fortune 500 companies. The pandemic triggered a wave of corporate relocations, with an annual peak of 137 announcements in 2021, followed by a decline in 2022 and 2023.

Last year however saw a significant increase in corporate headquarters relocations, with a total of 96 moves. Business climate/lower taxes led to 21 relocations, while the access to the consumer base was the next top reason, accounting for 19 of the moves.

Among industries, the technology and manufacturing sectors saw the most relocations in 2024, each accounting for 28 moves. Texas was once again the most popular destination, with a total of 26 moves. Of those, 13 went to Dallas, 6 to Houston and 4 to Austin, Texas.

From a global perspective, another notable trend emerged in 2024 as 25 of the 96 corporate relocations were driven by international firms setting up or moving their global headquarters to the U.S. This reflects a growing confidence in the U.S. market as the preferred destination for worldwide companies seeking to grow and expand.

Between 2018 and 2024, the top markets that gained corporate headquarters moves included Dallas (100 relocations), Austin (81) and Nashville, Tenn. (35). San Francisco/San Jose, Calif., lost 156 corporate headquarters, followed by Los Angeles/ Irvine, Calif., (106) and New York City (27).

These headquarters relocations from California to states like Texas, Tennessee, Arizona and Colorado highlight deeper economic and strategic factors reshaping business decisions, according to the report.

Driving innovation and growth

Seizing the opportunity to move offices to refresh workplace technology and enhance productivity has been a big driver among RealFoundations’ clients, according to Todd Fehr, its lead managing consultant.

“Clients continue to move toward enhanced Wi-Fi experiences, allowing more mobility in and around the office spaces,” Fehr told Commercial Property Executive. “Demand and continued expansion of upgraded video conferencing experiences are also a factor.”

Fortune Brands Innovations recently opted to consolidate its regional offices to a new campus headquarters in Deerfield, Ill., while maintaining its digitally focused office in San Francisco.

READ ALSO: CRE’s New Money Movers

FBIN’s new headquarters will open later this summer and will accommodate more than 1,000 workers by the end of 2027.

“Our headquarters relocation to a state-of-the-art campus is all about driving innovation and growth,” Kristin Papesh, executive vice president & chief human resource officer for the company, told CPE.

“Fortune Brands Innovations is increasingly developing digital solutions for our consumers and customers. By bringing our professional associates together from across our leading brands and functional areas, we are creating an environment where we can create and implement better solutions, faster.”

Papesh said the timing was right because it was part of a multi-year transformation for the company into one that is more efficient, agile and innovative.

“We chose Chicagoland after a comprehensive national search due to the world-class office space and a deep pool of talent from across industries,” she said.

Illinois also offered a significant incentive through the EDGE tax credit program.

“Our teams have felt the uplifting energy we have when we are together in the office, and our new headquarters will be a vibrant environment that enables us to network and collaborate more fully, and to capture that excitement and energy on a regular basis,” Papesh said.

“We’re also retaining our hybrid schedule where people are in the office Tuesday, Wednesday and Thursday so that we all benefit from being together while keeping remote workdays that are also productive.”

From California to Texas

Chevron recently moved its headquarters from Bishop Ranch in San Ramon, Calif., to Starbase, Texas, reflecting the unfavorable California and San Francisco Bay Area environment for oil companies, according to Ed Del Beccaro, executive vice president & San Francisco Bay Area manager of TRI Commercial/CORFAC International.

Bishop Ranch/Sunset Development and the Mehran family purchased more than 1.3 million square feet within the 92-acre Chevron Park campus for $174.5 million in the first quarter of 2025. Chevron, in turn, leased 400,000 square feet elsewhere in the park.

“California has an unfriendly business environment characterized by many regulations that make it difficult to do business here, along with high taxes,” Del Beccaro told CPE.

“It takes a long time in most of the Bay Area to approve major projects vs. other parts of the country. Also, the high cost of housing has made it challenging to find an affordable workforce. The cost of energy is also the highest in the country.”

He said that other companies continue to stay in the San Francisco Bay Area because of the critical mass of intellectual capital represented by Stanford, UCSF, Cal Berkeley, the University of Davis, the military labs, including Lawrence Livermore Lab, and the Genome Center in Berkeley, Calif. Also, the San Francisco Bay Area and Silicon Valley still provide most startup venture capital.

South Florida, a hot relocation market

In Delray Beach, Fla., Pebb Capital’s project, Sundy Village, has become a magnet for corporate relocations looking to align real estate strategy with workforce trends, according to Todd Rosenberg, managing principal of Pebb Capital.

DigitalBridge—one of the world’s largest digital infrastructure investment firms—and Vertical Bridge—the largest private owner/operator of communications infrastructure in the U.S.—have signed to lease headquarters space within the 7-acre mixed-use campus.

This relocation and Pebb Capital’s decision to move its headquarters to the site account for nearly 140,000 square feet of leased space.

“The most competitive locations offer more than favorable economics—they align with how and where people want to work,” Rosenberg told CPE.

“South Florida has emerged as a standout, especially among tech and digital infrastructure firms drawn to its pro-business environment, lifestyle appeal and market resilience.”

While Miami and Fort Lauderdale, Fla., remain a focal point, nearby submarkets like Delray Beach are gaining traction for their walkability, influx of high-net-worth residents and curated tenant mixes that reflect modern workplace values, he said.

“These shifts reflect a broader trend: tertiary and suburban markets are emerging as bright spots, offering affordability, space and lifestyle advantages in today’s talent-driven landscape,” Rosenberg said.

You must be logged in to post a comment.