What’s Next for AI in Property Management

New ideas to keep CRE operations competitive.

CRE property managers, take note: If you’re not progressing from automation and predictive models to using generative artificial intelligence, prepare to be left behind.

Figuring out the most productive solutions and implementing them are not easy tasks. Property managers are just beginning to scratch the surface of AI’s potential as the technology continues to evolve in what is a very crowded field. In 2023, venture capital plowed $29.1 billion into 691 generative AI deals, up from about $8 billion in 485 deals the year before, according to capital markets data provider PitchBook.

Earlier learning and predictive forms of AI embedded through sensors in building management systems are already monitoring properties’ mechanical components, most notably HVAC units, and making decisions based on energy consumption, tenant comfort and indoor air quality. AI can also do things like alert the maintenance team when a pump room leak occurs.

But the latest advances should provide landlords with further savings by driving efficiencies among property management providers and within buildings. It’s also anticipated that more machine learning and automation will help fuel industry expansion. The global property management market is projected to grow at an annual rate of 8 percent, to $36.4 billion in 2028 from $24.7 billion in 2023, according to MarketsandMarkets, a management consulting firm.

“We’re leveraging AI and emerging technologies in not only how we’re servicing our clients today but also in new concepts and pilot programs,” said Alec Humphries, head of solutions at C&W Services, Cushman & Wakefield’s property management subsidiary that oversees some 6.2 billion square feet of CRE space globally. “We’re going to be able to process information and produce insights that just wouldn’t normally have been feasible in the past.”

“Real estate firms will either be AI-enabled or they won’t. For those companies that are, they’ll be ahead of the game. For those that aren’t, they won’t survive.”

—Sanford Sigal, Chairman, BrightStreet

Sanford Sigal, chairman of shopping center-oriented proptech investment firm BrightStreet Ventures, likened the process of exploiting AI to trying to score in baseball. Real estate firms are still in a dash to first base, reasoned Sigal, who is also president & CEO of NewMark Merrill, an owner and operator of more than 12 million square feet of shopping centers in California, Colorado and Chicago.

“Retail generates data on thousands of customers every day that tells us where they come from, where they go and how long they stay,” added Sigal, referring to mobile data. “AI is helping analyze that data and is providing insights so that we can draw conclusions. Up to five or six years ago, we looked at two pieces of data generally: sales reports and what tenants were telling us.”

Taking action

A timely example of how Sigal could use generative AI in conjunction with the data is to optimize security in shopping centers—both in the scheduling of personnel and the placement of surveillance cameras—to deter the rise of mob-driven smash-and-grabs. That could also be extended to perform an analysis of crime and police presence around a property to inform an acquisition, he noted.

To Sigal, employing automation to make better decisions simply represents the next iteration of how technology is changing property ownership and operations. “There was a time when everybody did everything by hand, and then everyone began using Excel,” he recalled. “Real estate firms will either be AI-enabled or they won’t. For those companies that are, they’ll be ahead of the game. For those that aren’t, they won’t survive because it’s a tool that adds value.”

“Everyone will have access to public information to train their AI. But the true differentiator is proprietary data.”

—Sineesh Keshav, Chief Technology Officer, Prologis

Focus on data

Given generative AI’s relative newness, it’s best to resist the urge to quickly adopt the next “shiny object.” A more methodical approach to the implementation of advanced AI can alleviate several concerns.

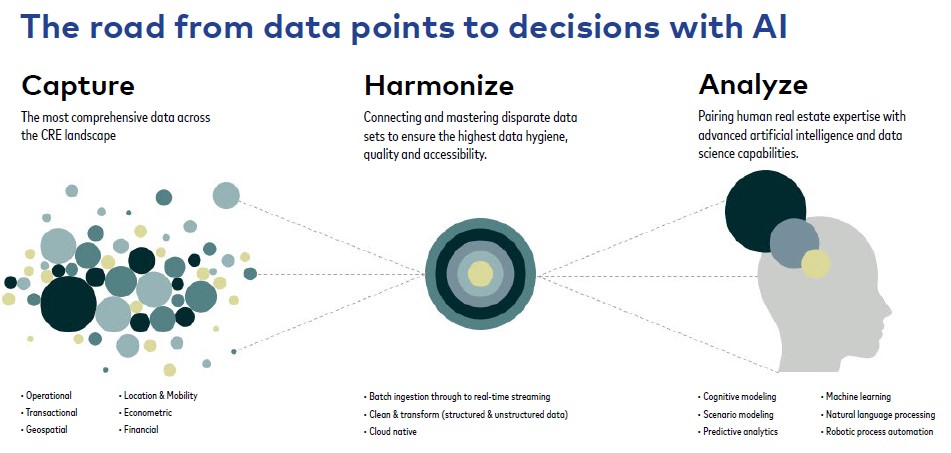

One recurrent theme among property managers and technology experts has been the importance of providing machine learning with clean data so the technology can make sense of it. It’s arguably one of the most difficult tasks, if not the most difficult, to maximizing AI usefulness today.

“AI needs data, but we need to train our AI on what the data means,” said Daniel Russo, president of JLLT Property Management Technologies, whose Prism building operations platform serves some 1,500 accounts and 5.2 billion square feet, primarily in the U.S but also in Asia-Pacific and Europe. “We need to give it real estate contexts, maintenance contexts, and contexts related to the relationships between tenants and owners. But once it knows those things, it’s really smart and can dig through massive amounts of data really quickly.”

Still, one of the biggest roadblocks to synthesizing and providing clear data to AI includes the enormous amounts of information feeding building management systems. Frequently, those systems have been digitized over time and are connected to a mass of assets. As a result, the data can produce false alerts and distract machine learning from what’s important, said Sandeep Davé, chief digital and technology officer for CBRE.

“It’s as if I’m in a room with 30 individuals and they are all talking at the same time,” he pointed out. “But I know one particular person is who I should listen to, because he or she is the most senior or knowledgeable. So it’s separating the signal from the noise, and it’s the same thing with buildings—figuring out the most important data points.”

Similarly, even aggregating data from several buildings that are in the same portfolio may be difficult because they often have different technology providers that may park data for 100 buildings in 50 separate databases, Russo added. Vendor and service codes or names in varying accounting systems typically lack uniformity in those situations, which makes it hard to bring new automation into the business, he said.

Ultimately, the amount of quality and proprietary data that managers can provide to their generative AI applications will determine how effectively their AI can perform, said Sineesh Keshav, chief technology officer for Prologis, who foresees AI applications becoming as accessible and inexpensive as personal computers over time.

“Everyone will have access to public information to train their AI,” he pointed out. “But the true differentiator is proprietary data, and certainly, we have a lot of data that we can train our models with that is walled off from others.”

How top CRE companies use AI

Generative AI is likely to provide property managers with a host of benefits as use cases become more apparent. Following are examples of how leading organizations have introduced more advanced AI features and applications into their property management strategies.

■ JLL is using generative AI in its Prism building operations platform to improve communication between management and engineering teams on one side and tenants on the other. This applies to maintenance work orders, tenant requests and even events within the building, according to Daniel Russo, president of the company’s property management technology group.

JLL also created a work efficiency prototype that can recommend the best course of action when addressing maintenance. It could be as simple as suggesting that an air conditioner be replaced vs. fixed based on its maintenance history, added Russo, whose former company, Building Engines, developed Prism and was bought by JLL three years ago.

“The early signs are that these are great use cases for AI,” he concluded. “The technology sees that you’re going to be in a certain location or have a specific work order, and it thinks for you: What else should you be doing while you’re there, or what can you do to fix a problem once and forever?”

■ Last year, CBRE’s AI-powered Smart Facilities Management Solutions hit 1 billion square feet across 20,000 client sites globally. It recently launched a generative AI product that enables employees to interact with CBRE and external data in a conversational manner to gain insight, generate content and work through problems.

In the past, CBRE harnessed traditional AI applications such as predictive models to enhance its property management functions, but each iteration of AI advancement represents a significant change in capabilities, observed Sandeep Davé, chief digital & technology officer. “What we’ve seen over the years is that as the technology matures, it seems to find certain use cases that fit like a glove.”

■ Prologis, owner of about 1.2 billion square feet of logistics space in 19 countries, has also leveraged traditional AI applications for a few good years. The company now anticipates using generative AI to analyze unstructured data such as earnings reports, investor presentations, news and even notes on interactions with tenants or would-be clients to drive customer engagement, said Chief Technology Officer Sineesh Keshav.

“That’s a model that generative AI can supercharge,” he said. “We can use it to go through a 2,000-word earnings statement in a much faster and better way to help us determine a tenant’s sentiment and what the implications are for us. What’s the likelihood that a tenant will renew? What’s the likelihood of us being able to push rents? Or maybe it’s a tenant simply looking for space, and that kind of information could help us start a conversation quicker than our competitors.”

■ C&W Services is leveraging AI in conjunction with a large online retailer to analyze machinery and equipment work order data to outline key problem areas. That can then guide technician training programs and inspection schedules and routes, revealed Alec Humphries, head of solutions for the Cushman & Wakefield property management subsidiary.

“By the end of the summer, I expect that we’ll be at a level of confidence to look at applying this to various other clients across our portfolio,” he said. “But as with any pilot project, we want to make sure we’re learning as much as we can as we look to scale it.”

■ Digital Realty, an owner and operator of data centers, recently rolled out its Apollo AI building management solution to the Asia-Pacific region, beginning with Melbourne, Australia, and Singapore.

Apollo AI finds operating anomalies that cause inefficiency without human intervention and then makes recommendations on how to resolve them. Digital Realty developed and launched the platform in Europe a few years ago, eventually rolling it out across 16 facilities. In a short time, it identified some 18 gigawatt-hours of savings—enough energy to power about 1,600 typical U.S. homes for a year.

Security and privacy

As property managers introduce new AI features into their offerings, the potential for leakage across client accounts also becomes a concern. One way to avoid the risk is to give generative AI the structure of the data, rather than the data itself, and provide it with a query so that it produces a discreet answer, Russo said. “The problem is prevalent, and there are ways to keep the data segmented, and many startups are trying to solve it,” he remarked. “That’s why you don’t see a quick rollout.”

Externally, protecting data amid a rise in cybercrimes by hackers who themselves are using AI is another concern, cautioned Keshav. “There’s a blurring of lines between digital and physical security,” he noted. “The ability to infiltrate a robot in a warehouse is just as real now as it was traditionally to breach a laptop.” And that’s an area in need of improvement, he maintained.

“We need to give AI real estate contexts, maintenance contexts, and contexts related to the relationships between tenants and owners. But once it knows those things, it’s really smart and can dig through massive amounts of data really quickly.”

—Daniel Russo, President, JLLT Property Management Technologies

Preparing for change

Beyond data and security hurdles, other challenges to generative AI implementation include training personnel to interpret AI’s conclusions and incorporate them into their daily routines, Humphries said. Too often, projects run aground simply because staff is unfamiliar with the way AI generates information.

Another challenge is internal resistance, which largely stems from news reports declaring that generative AI is going to put workers on the street. That necessitates a strong change management function within companies.

The fact that the AI landscape is rife with startups and competitors inundating the industry with products is resulting in two other, less-than-admirable trends, Keshav noted.

One is how traditional analytics companies are simply “slapping an AI label” on existing products to take advantage of the hype surrounding generative AI, he said. The other is a tendency to push AI as a “black box” technology—wherein the vendor can’t explain to its customer why the AI is reaching certain conclusions.

“Think about financial services granting a loan or even Prologis granting leases,” he said. “If you turn down a customer, you need to be able to say why. In the same way, why AI made a choice has to be visible. Otherwise, it’s going to fail to break through a certain level of adoption.”

Download the pdf “What’s Next for AI in Property Management”

You must be logged in to post a comment.