Placer.ai Office Index—2024 Recap

Find out how visits are trending in major cities.

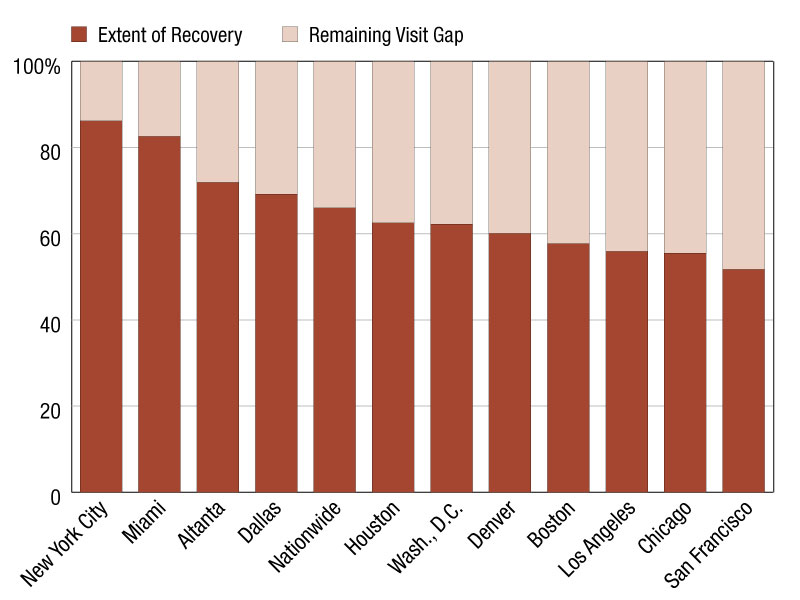

Nationwide office visits closed out December 2024 at 39.2 percent below December 2019 levels—a bigger visit gap than that seen in November (37.6 percent), but a narrower one than last December’s 42.8 percent.

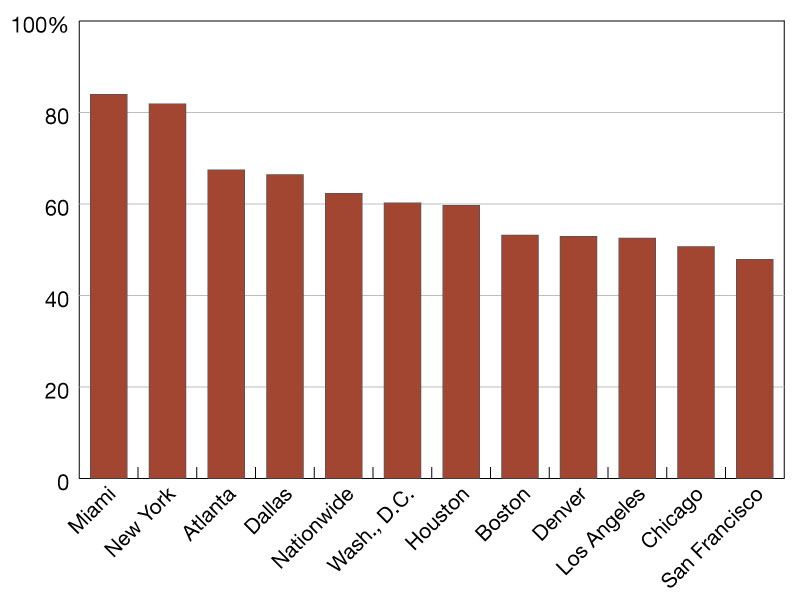

Office visits in New York and Miami hovered around 20.0% below pre-pandemic levels. Atlanta (down 34.1 percent) and Dallas (down 35.2 percent) also outpaced the national average.

San Francisco finally pulled out of last place for year-over-five-year recovery—thanks in part to recent RTO mandates from local heavyweights like Salesforce.

Return-to-office mandates are once again the talk of the town, with companies from Amazon to AT&T set to crack down on remote work in the new year—in some cases, demanding that workers show up in person five days a week.

But how did the office recovery shape up in December 2024? We dove into the data to find out.

December doldrums

December is typically a quiet month for offices, with many Americans taking time off for the holidays to enjoy vacations and family gatherings. So, it may come as no surprise that office visits in December 2024 dropped to their lowest point of the year.

Compared to December 2019, office visits in December 2024 lagged by 39.2 percent—a bigger visit gap than that seen in either November (37.8 percent) or October (34.0 percent), as employees likely embarked on extended “workations” and enjoyed greater WFH flexibility during the holiday season. Put another way, December 2024 office foot traffic clocked in at 60.8 percent of pre-pandemic (December 2019) levels.

Still, offices were busier this December than last—in December 2023, the recovery compared to December 2019 stood at just 57.2 percent.

New York, Miami, and … San Francisco?

New York and Miami once again led the regional return to office charge with year-over-five-year visit gaps of 19.6 percent and 20.9 percent, respectively—though both cities’ year-over-five-year numbers were weaker than those seen in either October or November.

Atlanta (-34.1 percent) and Dallas (-35.2 percent) also outperformed the nationwide average for year-over-five-year office foot traffic. And with Dallas-based companies like AT&T and Southwest Airlines starting to enforce stricter in-office policies in the new year, the Texas hub may experience even more accelerated recovery in the coming months. (AT&T also has a strong presence in Atlanta, which may also benefit from the company’s crackdown.)

Meanwhile, San Francisco, which has long lagged in post-pandemic office recovery, finally pulled out of last place in December 2024 with a year-over-five-year visit gap of 48.0 percent, just edging out Chicago. The impressive year-over-year office visit growth seen by the West Coast hub in recent months—likely fueled in part by Salesforce’s recent RTO mandate—appears to have finally left a tangible mark on the city’s year-over-five-year ranking.

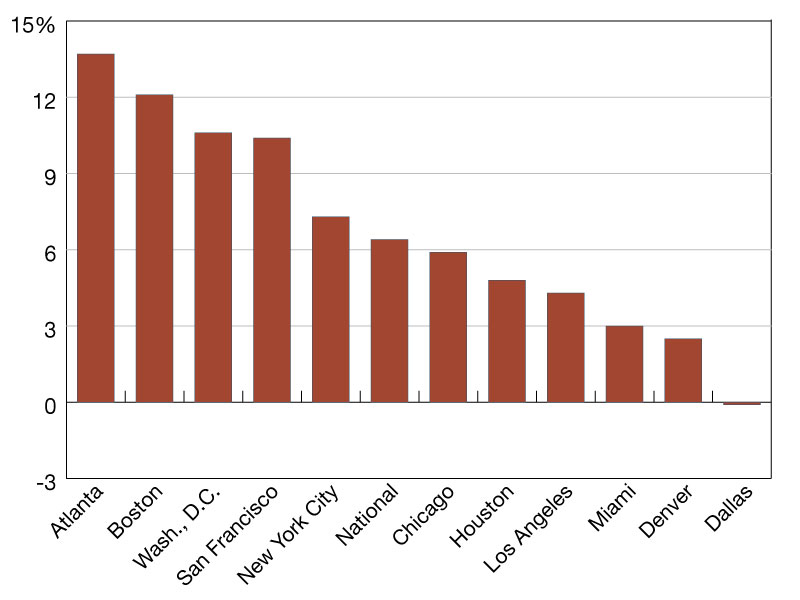

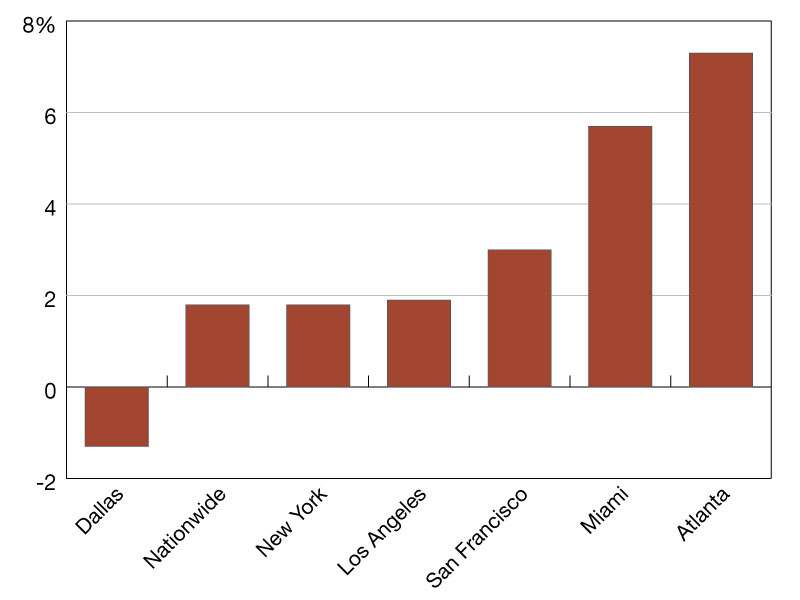

Year-over-year, visits to office buildings nationwide were up 6.4 percent in December 2024—showing that despite seasonal setbacks, office visits remain overall on an upward trajectory. Atlanta (13.7 percent) and Boston (12.1 percent) led the way for year-over-year office recovery, followed by Washington, D.C. (10.6 percent) and San Francisco (10.4 percent).

As additional RTO mandates go into effect in the new year, the office recovery needle may move once again. Will additional companies jump on the full-time in-office bandwagon—or will hybrid work models continue to dominate?

Follow placer.ai’s data-driven office index reports to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

—Posted on January 29, 2025

In November, visits to office buildings nationwide were 62.4 percent of November 2019 (pre-pandemic) levels, down from 66.7 percent in November 2023.

Miami led the regional office recovery pack with visits at 84.0 percent of November 2019 levels, followed by New York (81.9 percent).

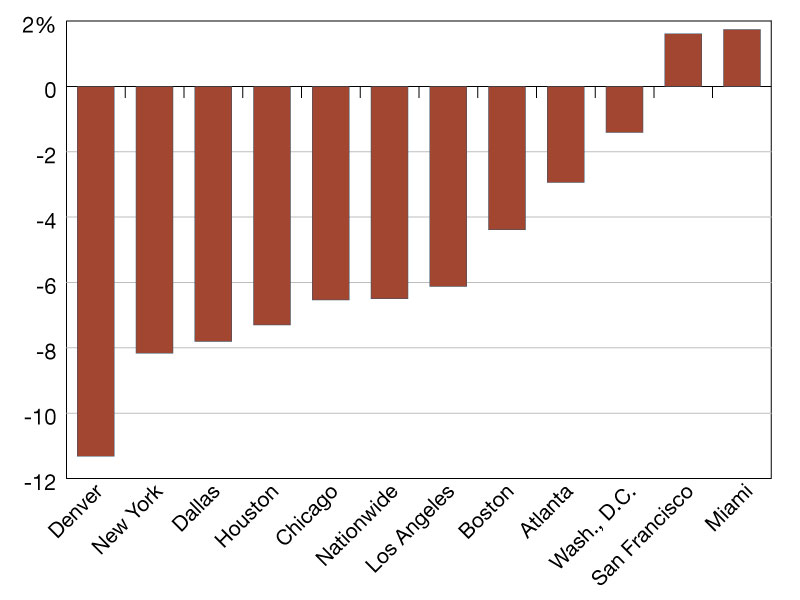

Year over year, office foot traffic dropped 6.5 percent in November 2024—likely due to record-breaking Thanksgiving travel. But some cities, including San Francisco and Miami, continued to see year-over-year visit growth.

After reaching new heights in October 2024, how did the office recovery fare in November? We dove into the data to find out.

Two steps forward, one step back…

In November 2024, visits to office buildings nationwide were 62.4 percent of what they were in November 2019, down from 66.7 percent in November 2023. This marks the most substantial drop in office foot traffic since January 2024—and a sharp decline from October 2024.

But though significant, November’s downturn is likely a reflection of this year’s record-breaking Thanksgiving travel rather than of any real office recovery slowdown. Millions of Americans took to the skies and roads to spend the holiday with loved ones. And with remote work making it easier than ever before for professionals to plug in from virtually anywhere, many likely extended their trips without taking extra days off—leading to fewer office visits in the days leading up to the holiday.

READ ALSO: When Office Meets Hospitality: A Love Story

Taking a look at regional trends, Miami continued to outshine other cities in November 2024, with visits at 84.0 percent of pre-pandemic levels—perhaps due in part to strict return-to-office policies implemented by major players within the city’s growing tech and finance sector. New York came in second with recovery at 81.9 percent, while San Francisco continued to lag behind other major cities. But with major projects like the September 2024 grand opening of the revamped Transamerica Pyramid set to revitalize the city’s Financial District, more accelerated recovery may be ahead for this West Coast hub.

Indeed, San Francisco was among November 2024’s regional leaders for year-over-year office visit growth. Nationwide, office building foot traffic was down 6.5 percent year-over-year. But in San Francisco, visits increased 1.6 percent—likely bolstered by recent RTO mandates from major local employers like Salesforce. The city’s temperate climate may also have played a role in encouraging residents to stay local for the holidays. Miami, too—a popular holiday destination in its own right—saw visits increase 1.7 percent year-over-year.

Denver, meanwhile, experienced its fourth snowiest November on record, which may have contributed to a larger portion of its workforce embracing remote work during the month—and an 11.3 percent year-over-year visit decline. And in New York, extended “workcations” by remote-capable finance employees, as well as potential disruptions in public transit and increased congestion during the holiday season, may have fueled a larger-than-average drop. Given the Big Apple’s strong overall recovery trajectory, we will likely see a rebound to more robust year-over-year growth by January, when the holiday season winds down.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

—Posted on December 26, 2024

In October, visits to office buildings nationwide were 34.0 percent below October 2019 levels—and the highest they’ve been since February 2020. New York and Miami continued to lead the office recovery pack in October, with visits in the two cities back to 86.2 percent and 82.6 percent, respectively, of pre-pandemic levels. Washington, D.C., Boston, and Atlanta saw the biggest year-over-year office foot traffic increases last month.

Amazon, Dell, Goldman Sachs, Walmart and UPS are just a few of the major employers that have been cracking down on remote work in recent months, some requiring their teams to be on-site full time.

So with summer behind us, we dove into the data to assess the impact these accumulating RTO mandates are having on the ground. Are offices continuing to fill up, or has the office recovery run its course?

Growth leaders

In October 2024, office visits nationwide were 34.0 percent below October 2019 levels. And looking at monthly fluctuations in office foot traffic over the past five years shows that the RTO remains in full swing—with last month’s visits reaching the highest point seen since February 2020.

Digging down into regional data shows that in several major hubs—including Atlanta, Dallas, Houston, Denver, Washington, D.C., Chicago and San Francisco—October 2024 was the single busiest in-office month since COVID-19. In Boston, Los Angeles, Miami and New York, October was the second-busiest month, outpaced only by July.

READ ALSO: Manhattan Office Shows Strength in a Still Lackluster Market

Still, New York and Miami continued to lead the regional office recovery pack, with October 2024 visits in the two cities up to 86.2 percent and 82.6 percent, respectively, of 2019 levels. The two hubs, joined by Atlanta and Dallas, continued to outperform the nationwide average. And Houston, which lagged behind other major business hubs during the summer in the wake of major storms, reclaimed its position just under the nationwide baseline.

In October 2024, visits to office buildings in Washington D.C. increased by 16.4 percent year-over-year, likely boosted by a RTO push meant to increase meaningful in-person work in federal agencies—though many government employees continue to telework.

In Boston, where office building occupancy is outperforming national levels, visits saw a 15.6 percent year-over-year uptick. And Atlanta, where major employers from UPS to NCR Voyix are requiring workers to show up at the office five days a week, saw visits grow 13.8 percent year-over-year.

Nationwide, office foot traffic increased 10.1 percent year-over-year—showing that the return-to-office movement is still very much a work in progress.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

—Posted on November 25, 2024

In August, office visits nationwide were 68.8 percent of August 2019 levels—slightly below the post-pandemic office visit recovery level seen in July.

Also in August, Miami, New York, Atlanta, and Dallas outperformed the nationwide baseline for year-over-five-year office recovery, while Los Angeles and San Francisco lagged behind. Year-over-year, Atlanta saw the most impressive office visit growth (7.3 percent).

A Regional Snapshot

Drilling down into the data for major urban hubs throughout the country shows a continuation of recent trends, with Miami, New York, Atlanta and Dallas outperforming the nationwide baseline. In Miami and New York, office visits were nearly 90.0 percent and 85.0 percent, respectively, of what they were pre-pandemic. And Atlanta, where employers have begun enforcing stricter in-office policies, held onto its high ranking, with visits 75.6 percent of what they were in August 2019.

Indeed, Atlanta, which has seen a surge in office leasing activity according to Bisnow, saw 7.3 percent year-over-year visit growth in August 2024, followed by Miami (5.7 percent). San Francisco—which despite lagging behind other cities compared to pre-pandemic, has been making steady annual gains—came in third with a year-over-year visit increase of 3.0 percent.

With the school year underway and summer vacations already a not-so-distant memory, office foot traffic is likely to resume its upward trajectory. Will September 2024 set a new post-pandemic RTO record?

—Posted on September 20, 2024

You must be logged in to post a comment.