Employment Numbers Mask Severity of Labor Market Situation

The labor situation in the United States is more dire than it appears on the surface, writes Justin Dean of Yardi Matrix.

Click to enlarge

Despite the national unemployment rate falling to 10.3 percent and a jobs reports added 1.8 million jobs in July, the labor situation in the United States is more dire than it appears on the surface.

The official unemployment rate fails to capture the 4.5 million workers who have left the labor market since February and have yet to return. Nearly every economic statistic that has been released in recent months has shown severe swings that were previously unprecedented and unfathomable, and the drop in labor force participation is no exception. Previously, the total size of the labor force had never shrunk on a year-over-year basis more than the drop of 1.3 percent in June of 1951. That record was shattered this April when the labor force decreased 3.7 percent year-over-year.

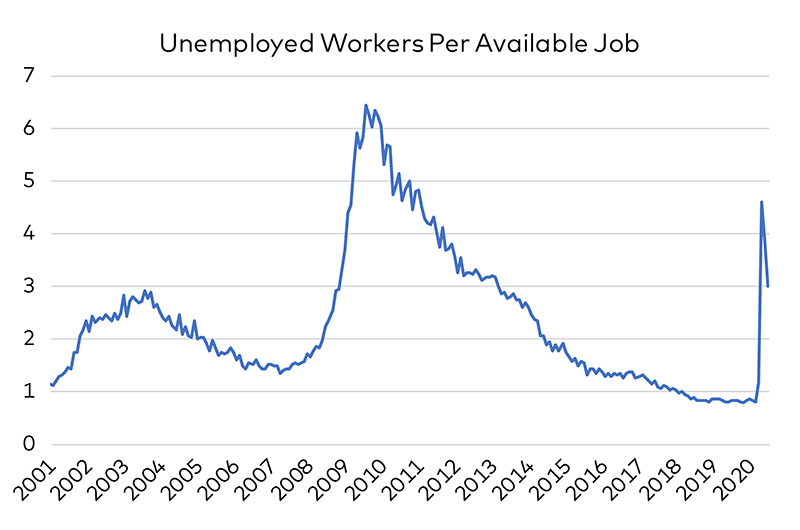

Recently some workers have started to reenter the labor force, but currently the labor force is 2.1 percent smaller than it was in July of last year. Although some have attributed the drop in labor force participation to the extended unemployment benefits disincentivizing work, the number of out-of-work Americans far outstrips the number of available jobs. Even when not including the millions of workers who have left the labor in recent months the ratio of unemployed workers to job openings spiked to 4.6 in April and sits at 3.1 in June (the most recently available data), according to the Job Opening and Labor Turnover Survey (JOLTS). If workers who have left the labor force in recent months are included, the ratio would be 3.8.

A Look at the Workforce

While the ratio of unemployed to job openings has jumped in recent months, pre-pandemic signals from the JOLTS data indicate that many of the jobs with openings do not have qualified workers to fill the positions. As the economy recovered from the previous recession the relationship between the job openings rate and unemployment rate, known as the Beveridge curve, fundamentally changes its behavior. In the early 2000s, an unemployment rate of 4-5 percent was associated with a job opening rate of 3.0-3.5 percent. However, in the 2010s the same unemployment rate came with a job opening rate of 3.5-4.5 percent. This shift in the curve suggests a substantial mismatch of the skills workers had and available jobs. Now, as millions of workers look for employment, the jobs available may not be positions that available workers can fill. With much of the job losses coming in the service sector and not nearly enough job openings to make up for the losses, the imbalance could become more pronounced.

Sector Breakdown

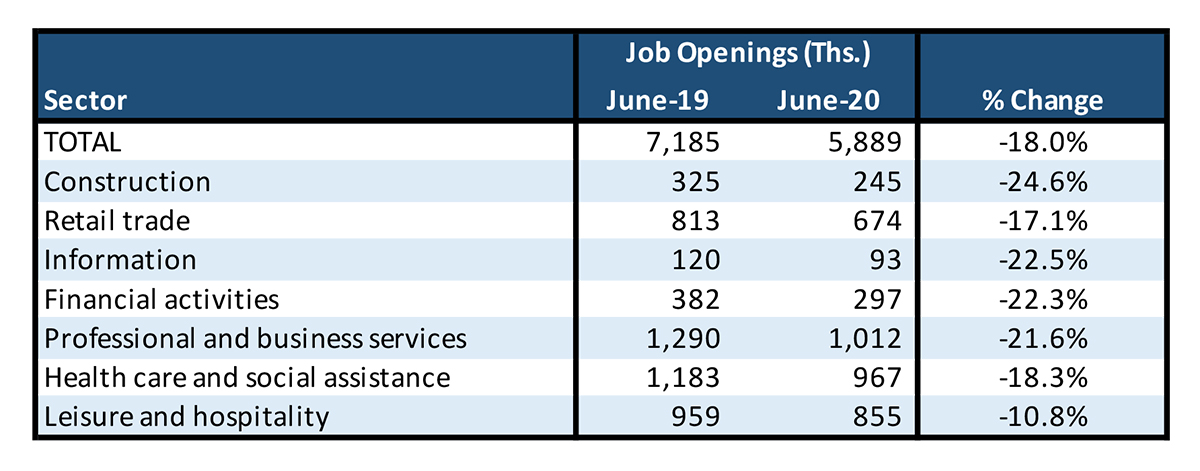

Click to enlarge

The impact of these developments will continue to send shockwaves through every sector of commercial real estate for the foreseeable future. Millions of multifamily renters will struggle to make rent payments as extended unemployment benefits have expired and legislators in Washington have failed to come to an agreement on additional aid. The office sector, already dealing with empty buildings as millions work from home has seen job openings fall substantially by more than 20 percent since last June. Retail sector employment has been stagnating for years after hitting a peak in employment in January of 2017. While retail employment had substantial monthly gains in May and June as lockdowns eased, the number of retail employees has still fallen by 914,000 (-5.8 percent) workers since February, with only 674,000 job openings currently.

The Leisure and Hospitality sector, which encompasses hotel and restaurant work, was hit hardest by the shutdowns, and has followed a similar pattern as retail but at a more pronounced magnitude. Employment in this area decreased nearly 50 percent between February and April, and despite many to work, the sector is still down 25.7 percent from its pre pandemic level with 4.3 million fewer workers. With only 855,000 job openings in the sector, it could be a long time before restaurant and hotel workers recover from the pandemic.

You must be logged in to post a comment.