Taking the Measure of Benchmarking

IREM Director of Sustainability Todd Feist discusses the insights gleaned from a wide-ranging study.

Todd Feist, Director of Sustainability, Institute of Real Estate Management

Benchmarking is an energy management byword today. To size up the current state of the practice, the Institute of Real Estate Management conducted a wide-ranging study of property stakeholders. The results reveal differences among asset categories, challenges to further progress and a few surprises, says IREM Director of Sustainability Todd Feist.

What do the results of the IREM Energy Efficiency Survey tell us about the current state of benchmarking? How would you sum up the key takeaways for real estate owners, managers and other stakeholders?

Broadly speaking, the survey results show that benchmarking is an established but by no means universally adopted best practice. This is a helpful reminder that certain property and company types still need education and resources to realize the benefits of energy efficiency. From an investment real estate perspective, companies may be leaving cash on the table or missing an opportunity to make their properties more attractive to prospective tenants and residents through sustainability and resource efficiency.

Are there any surprises in the survey results?

One surprise is the mismatch between the payback periods that owners claim to accept and those that third-party managers believe their owners will accept. This isn’t in IREM’s Measure What You Manage report, but 58.2 percent of survey respondents whose companies mostly conduct third-party management services indicate that their clients require a payback period of two years or less, while only 38.8 percent of respondents whose companies own their portfolios indicate that payback requirement.

This discrepancy makes it worthwhile for an owner’s representative and a third-party property manager to have a conversation about building energy efficiency, including acceptable paybacks, to make sure that they are on the same page on goals and risk tolerance.

Other results helpfully confirm what has been assumed through anecdotal evidence. For example, the survey shows that financial institutions, REITs, and corporate real estate entities benchmark at higher levels than other types of owners or organizations. This makes sense, since those types of owners are more likely to have corporate sustainability initiatives and other top-down drivers. Larger companies also benchmark at higher rates than smaller companies. Again, this makes sense, since larger companies typically have more staff and resources.

Why did participants say they measure the energy performance of their properties? What are their goals, and what’s driving them?

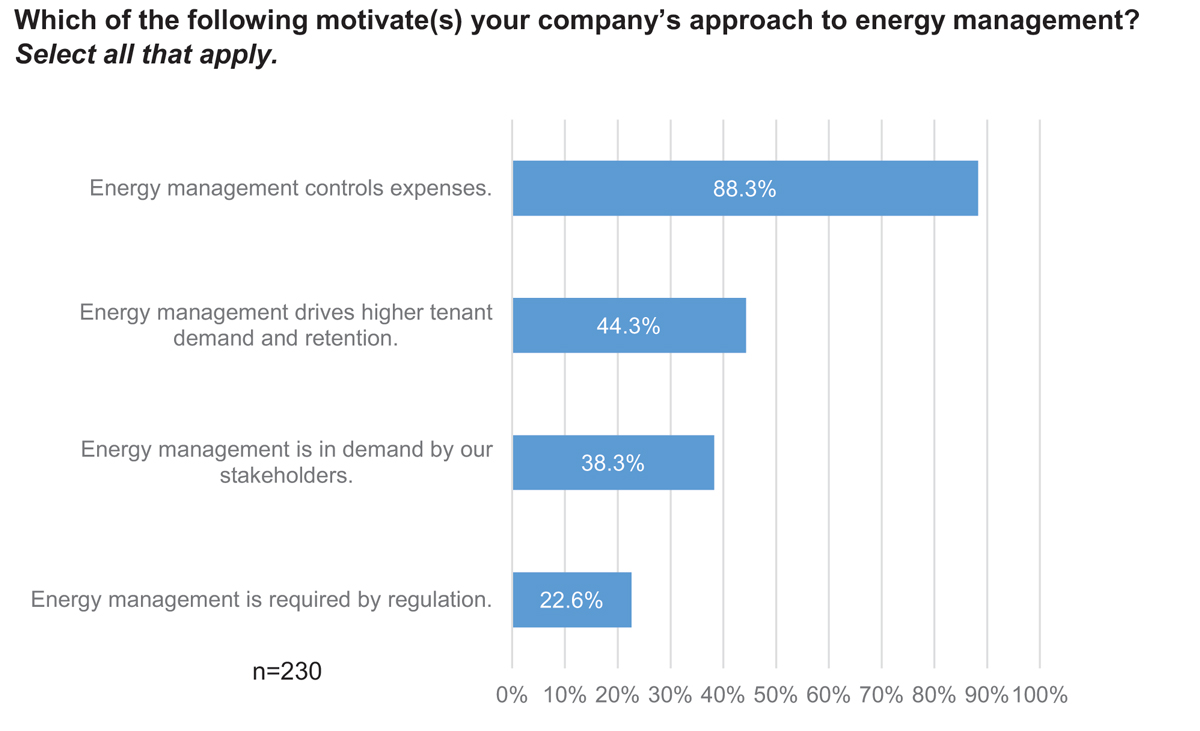

Most respondents—88.3 percent—cite cost savings benefits as their primary driver for conducting energy management activities. The second largest driver, cited by 44.3 percent of respondents, is “energy management drives higher tenant demand and retention.”

That is an encouraging finding—that tenant demand and retention ranks higher than stakeholder demand or regulations, the other choices in the survey item along with that top choice, cost savings. Tenant revenue impacts are often considered soft or intangible benefits since they are difficult to measure, but, as the survey shows, among respondents anyway, people understand and accept that energy efficiency can lead to revenue benefits in addition to cost savings.

That is an encouraging finding—that tenant demand and retention ranks higher than stakeholder demand or regulations, the other choices in the survey item along with that top choice, cost savings. Tenant revenue impacts are often considered soft or intangible benefits since they are difficult to measure, but, as the survey shows, among respondents anyway, people understand and accept that energy efficiency can lead to revenue benefits in addition to cost savings.

The Energy Efficiency Survey reveals a number of striking differences between commercial properties and multifamily properties. Would you touch on some of them?

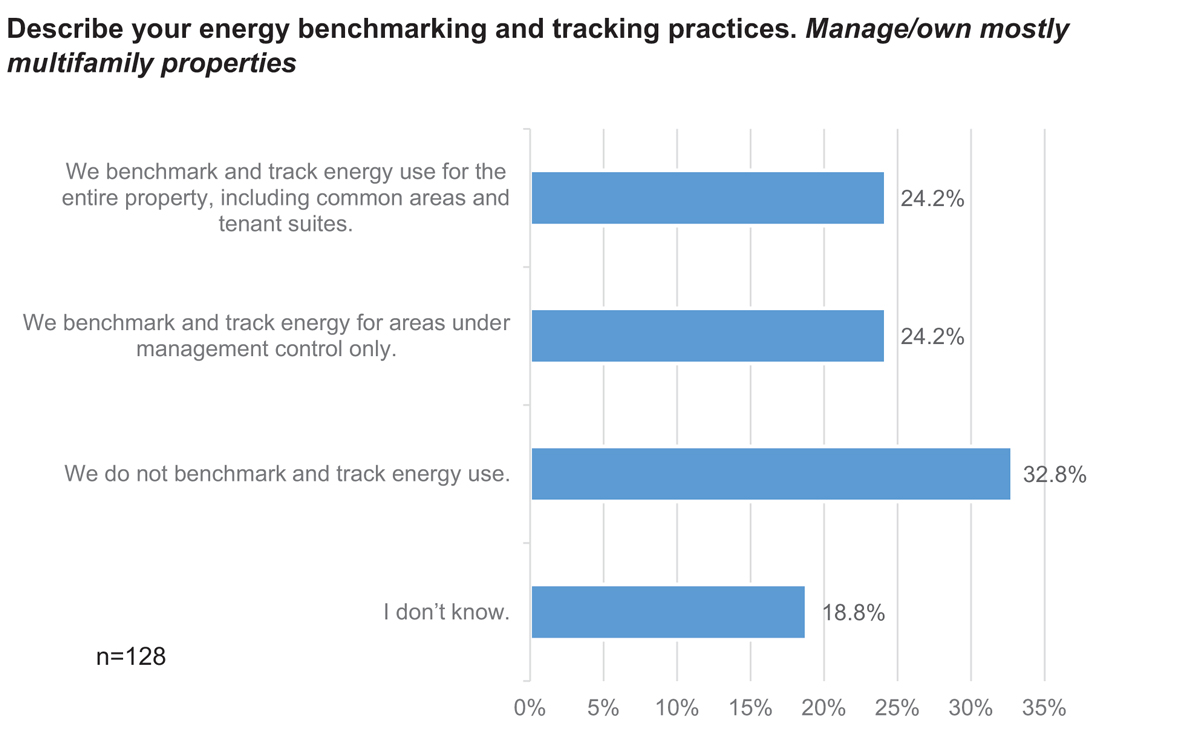

The survey finds that that the multifamily sector lags behind commercial, with 48.4 percent of multifamily respondents indicating some level of benchmarking, compared to 73.4 percent of commercial respondents.

More commercial respondents use ENERGY STAR Portfolio Manager as well, with 74.6 percent of commercial respondents who benchmark at some level using the free EPA tool, compared to 29.0 percent of multifamily respondents.

More commercial respondents use ENERGY STAR Portfolio Manager as well, with 74.6 percent of commercial respondents who benchmark at some level using the free EPA tool, compared to 29.0 percent of multifamily respondents.

Commercial respondents are also more likely to benchmark at the whole-building level. A total of 48.4 percent of commercial respondents indicate whole-building benchmarking, compared to 24.2 percent on the multifamily side.

Other survey items indicate that commercial properties are more likely to have and use advanced energy management technologies, such as private meters and software. These results are not surprising but do shine a spotlight on the differences.

Which factors primarily account for those differences—and what strategies would help boost participation, especially on the multifamily side?

ENERGY STAR Portfolio Manager has been available for commercial properties for far longer. Several of the tool’s features and benefits, including ENERGY STAR scores and access to ENERGY STAR certification, have only been available for multifamily properties for a few years. That’s one reason why multifamily lags behind commercial.

Another is access to utility data. So many multifamily communities have separately metered resident units, where residents receive and pay their own bills. A total of 82.3 percent of multifamily respondents indicate that most of the properties in their portfolios have that configuration.

On the one hand, this promotes efficiency. When people have to pay for the energy they use, they typically modify their behaviors in favor of efficiency. This metering configuration has two negative effects, though. First, owners and real estate managers are unable to benchmark whole-building energy use and are limited to tracking common areas, which is worth doing but just not as comprehensive and effective as understanding how the entire property is consuming resources.

Second, residents primarily see the cost-savings benefits of any energy efficiency measures in the units, so the owner does not have a direct financial incentive to invest in energy efficiency for the whole property or even change the normal way of operating the property.

So the industry needs wider access to whole-building utility data. The teams operating the properties need training on energy efficiency so that efficient operations are just a matter of good management. Industry leaders on both the commercial and multifamily side have already proved the concept—that resource efficiency is just good operational and financial management of a real estate asset—so we need to continue spreading that message.

What would you say are the main challenges to the further expansion of benchmarking, whether in the commercial sphere or in the multifamily sector?

One of the main challenges, cited as the top impediment to energy efficiency activities by 29.6 percent of respondents, is lack of staff expertise/training. This is largely fixable through education, and IREM has a made its contribution by providing online courses and the IREM Certified Sustainable Property certification, which is approachable enough to serve as a framework for training staff on the job.

When we’re talking about strictly benchmarking, I’d go back to the utility data access issue. Access to whole-building utility data and also access to smart meter interval data. Real estate managers and their teams need that data to start their energy efficiency programs and then take energy management to the next level.

On a related note, where do you see the best opportunities, whether for further expanding benchmarking or improving tools and techniques?

ENERGY STAR Portfolio Manager keeps getting better. You can now benchmark and track waste along with energy and water, and water scores are now available for multifamily properties.

Class B and C office buildings are ripe for energy efficiency improvements—or at least everyone assumes they are, and that’s probably true. IREM has asked respondents to identify building class for most of the properties in their portfolios in the 2018 IREM Energy Efficiency Survey, which we just conducted. We’ll be able to see what respondents who own or manage Class B and C buildings say. I’m hoping IREM can add a little more to the conversation around building energy efficiency in B and C buildings and identify impediments to energy efficiency in that group of properties.

The study makes a distinction between utility billing and tracking, on the one hand, and benchmarking on the other hand. Why is this an important difference?

I’ve found that people who have not implemented benchmarking are understandably confused about what we mean when we talk about benchmarking energy and water consumption. They often conflate utility billing and tracking services with benchmarking, or they assume that their company’s utility billing service is tracking energy and water through the utility bills. They may be, but they may also just process bills.

Or they may not provide the same metrics and opportunities available through other services and tools, such as certification through ENERGY STAR Portfolio Manager. The section in the report provided an opportunity to establish the differences in these two important but disparate functions related to utility billing.

As you look ahead to the next few years, what’s on your radar? Are there any trends related to measuring energy performance that property owners and managers should be preparing for?

The drivers could change as the effects of climate change become more tangible and widespread. There have already been reports of insurance companies refusing to provide insurance for coastal properties. It may be more than a few years, but eventually we’ll reach a tipping point where the risks can no longer be ignored.

Technologies continue to advance. For example, artificial intelligence (AI) and blockchain are already being applied to building energy management.

We should also look for benchmarking practices to continue to increase in adoption. Another way to look at multifamily “lagging” behind commercial is that multifamily is just getting started. The percentage of multifamily respondents who benchmark at some level grew slightly by about 4 percent from 2016 to 2017. That’s over one year, so it could be just a statistical blip—but IREM will be keeping an eye on benchmarking adoption rates and the rest of the energy management practices that the survey covers over the next several years, with the expectation that adoption of all building energy efficiency practices will continue to increase.

You must be logged in to post a comment.