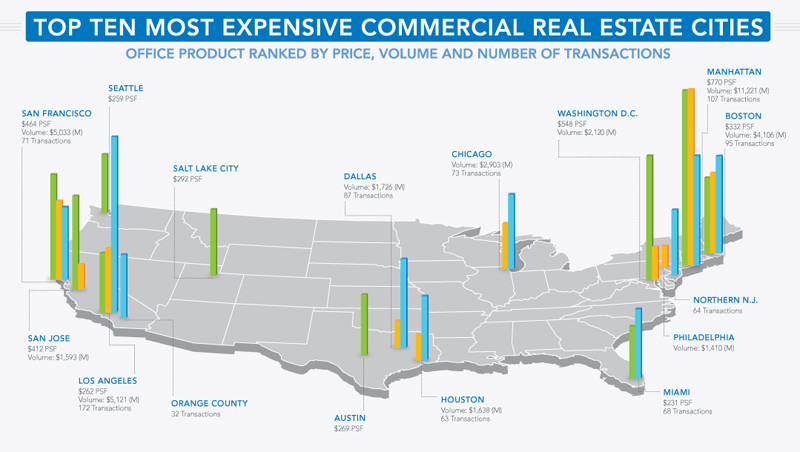

The 10 Most Expensive Commercial Real Estate Cities

Transwestern research finds that the East and West Coast cities continue to outperform the rest of the U.S. when it comes to commercial real estate investment, although investors are starting to move inland.

By Keith Loria, Contributing Editor

By Keith Loria, Contributing Editor

Transwestern research finds that the East and West Coast cities continue to outperform the rest of the U.S. when it comes to commercial real estate investment, although investors are starting to move inland.

The research ranked the top 10 most expensive commercial real estate cities for office product based on price, volume and number of transactions.

“Pro-business states are utilizing incentives for growth,” Transwestern executive managing director Steve Pumper told Commercial Property Executive. “We’ve gone through a period of time where businesses are beaten down due to what occurred in Sept. 15 of ’08, and it’s almost that certain businesses were penalized. Those states that are more pro-business, which tend to be in the Sunbelt locations — Georgia, the Carolinas, Florida, Texas, Arizona — I see those states outperforming other states because they know it’s important to have businesses growing.”

Manhattan was tops in both sales price and volume, completing 107 transactions last year, with a $770-per-square-foot average. Meanwhile, Los Angeles had the most transactions with 172, at a $262-a-square-foot average.

Not to say there weren’t some surprises on the list.

“If you’re looking at the top 10 cities on the chart, Salt Lake City is the one that jumps out at me, but I think that was skewed by a couple of transactions; it’s still a good market, but it’s probably a niche market,” Pumper said. “It’s a good alternative to the West Coast markets at a lesser price point.”

“If you’re looking at the top 10 cities on the chart, Salt Lake City is the one that jumps out at me, but I think that was skewed by a couple of transactions; it’s still a good market, but it’s probably a niche market,” Pumper said. “It’s a good alternative to the West Coast markets at a lesser price point.”

Other surprises included Denver not being on the top 10 list, even though many experts in the industry remain impressed by its performance. “It’s highly sought after and has done well both in the CBD marketplaces and suburban marketplaces,” Pumper said. “I view Denver as a strong market performer and one that in my estimation has done quite well over the last 18 to 24 months.”

Several of the cities on the list have gone from troublesome to positive, with some that were affected by the recession starting to recover. “If you look at the volume, for me it was nice to see Northern New Jersey bounce back on the office transaction side, because that had been a fairly difficult market but we’re now seeing signs of rebounding,” Pumper said. “If you look at Chicago, the CBD has done extremely well, and now you’re starting to see transactions in the suburban markets, which were arguably, along with Phoenix and Atlanta, one of the toughest major urban market situations around the country.”

Houston is also on the rise, with healthcare, the port and energy contributing to its success. According to Transwestern’s research, the Texas city is now the seventh top coastal market.

“One city that has really taken off in the last 12 months is Nashville, which is doing well because of universities and healthcare, plus their auto industry has done really well,” Pumper said.

You must be logged in to post a comment.