Most Active REITs

This month, CPE offers an index of the Most Active REITs. While it is good to be a REIT due to tax benefits and the ability to raise capital, it is not necessarily easy. These companies are constantly looking to refresh and reposition their portfolios in accordance with market trends.

(Be sure to tune in to our podcast dissecting the current state of the REIT sector, and what firms are doing to refine and expand their holdings.)

Leaps and Bounds

By Mike Ratliff and Jack Kern

This month, CPE offers an index of the Most Active REITs. While it is good to be a REIT due to tax benefits and the ability to raise capital, it is not necessarily easy. These companies are constantly looking to refresh and reposition their portfolios in accordance with market trends. Top-tier urban markets saw prices exceed pre-recession highs, and certain firms began to look more heavily into secondary and tertiary markets.

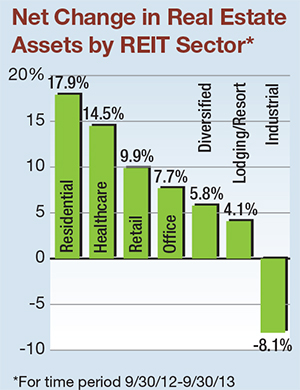

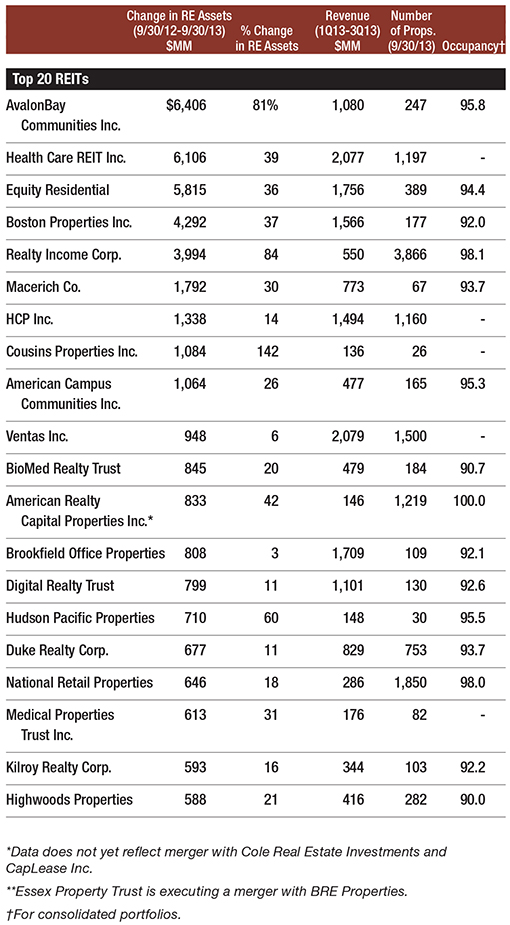

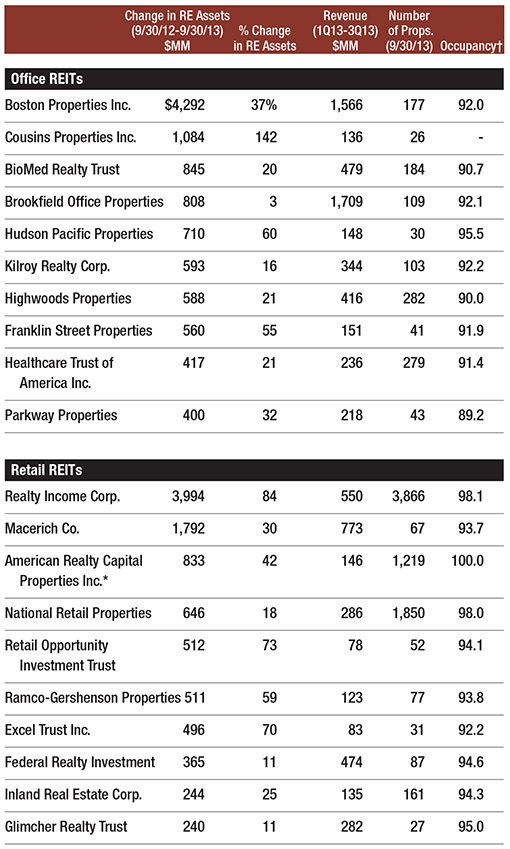

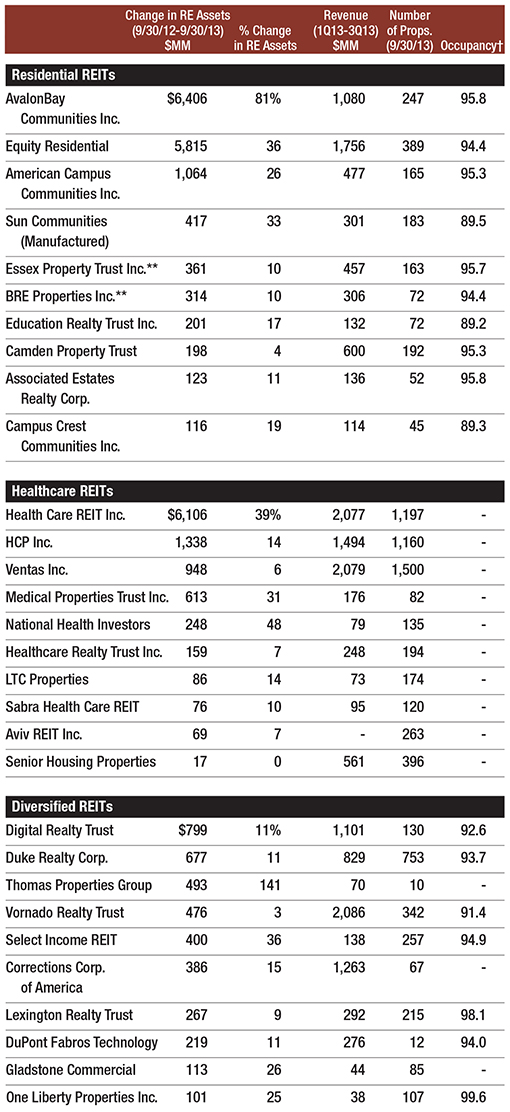

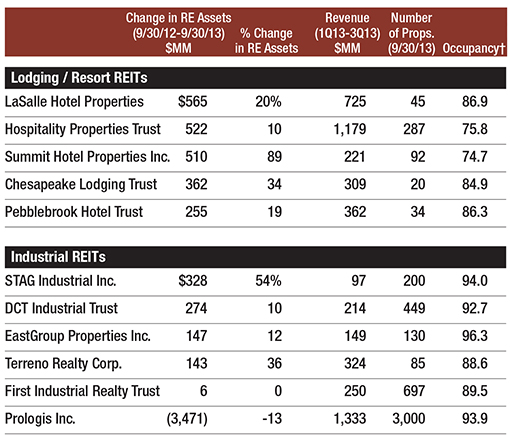

We listed the biggest players based on change in net real estate assets. For the time period of Sept. 30, 2012, through Sept. 30, 2013, the top 20 companies on this list added $39.9 billion worth of real estate to their portfolios. That figure averages out to a 26 percent increase per firm. The most active residential and healthcare REITs saw the highest positive net change in their real estate holdings, at 21.1 and 16.9 percent, respectively.

We listed the biggest players based on change in net real estate assets. For the time period of Sept. 30, 2012, through Sept. 30, 2013, the top 20 companies on this list added $39.9 billion worth of real estate to their portfolios. That figure averages out to a 26 percent increase per firm. The most active residential and healthcare REITs saw the highest positive net change in their real estate holdings, at 21.1 and 16.9 percent, respectively.

A large portion of the past year’s activity occurred early in 2013, when multi-family powerhouses AvalonBay Communities Inc. and Equity Residential made national headlines with the acquisition of Archstone. The healthcare sector was moved in part by big deals by Health Care REIT Inc. In July 2013, the company finalized the $4.3 billion acquisition of Sunrise Senior Living. The company also picked up 47 seniors housing communities from Revera Inc. This past year also marked the evolution of American Realty Capital Properties into the dominant net lease player via M&As with both Cole Real Estate Investments and CapLease Inc. The Cole acquisition is the biggest REIT deal since AMB Property Corp. bought ProLogis in 2011. With deals like these, we are very excited for what 2014 brings for the public REIT sector.

You must be logged in to post a comment.