Apartment Deceleration?

Despite seasonal volatility in the first quarter, commercial real estate prices across the board posted strong annual gains, demonstrating the breadth of the pricing recovery as investment activity expands across the property types. Multi-family prices have had the best recovery by far of the four major property segments. After posting the strongest results in…

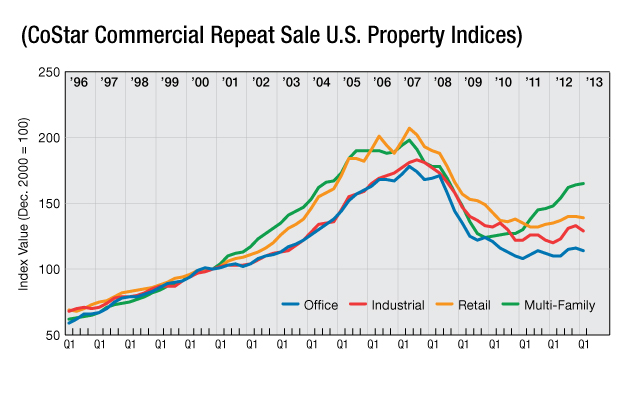

Despite seasonal volatility in the first quarter, commercial real estate prices across the board posted strong annual gains, demonstrating the breadth of the pricing recovery as investment activity expands across the property types.

Multi-family prices have had the best recovery by far of the four major property segments. After posting the strongest results in the first quarter, pricing in this segment is now up 33 percent from its trough in 2009. While the multi-family sector’s outperformance is partially driven by relatively stronger fundamentals, it is also a function of lenders, largely the GSEs, providing cheap debt financing following the downturn. However, there are signs of a deceleration in multi-family fundamentals, mainly as a result of growing supply, especially in markets where pricing has already reached its prior peak level. The multi-family index’s gains of 0.8 percent in the first quarter marked a deceleration from its quarterly average pace of 3.2 percent over the past two years.

While the recovery in the industrial sector began later than that in the other major property types, pricing has advanced by a sturdy 7.7 percent from its trough in the first quarter of last year, the second-strongest annual gain after multi-family. Big box distribution facilities located in primary logistics hubs have led recent growth; however, the emergence of large modern logistics buildings in secondary locations is increasingly allowing investors to find core deals outside of the mainstream markets.

The office index drifted up by a modest 2.8 percent from a year ago, which is reflected in the slow but steady improvement in market fundamentals during this time. Technology- and energy-driven markets, including those in Texas and the Bay Area, have led pricing gains in the overall office index.

Measured improvement in the retail sector, marked by positive aggregate rent growth in the first quarter for the first time this cycle as well as by contracting vacancies, has translated into modest price gains of 2.9 percent over the last year. Retail pricing is now 8 percent above the trough reached in early 2011, but it is still about a third below the peak of the last cycle. Core assets, such as well-leased malls and grocery-anchored centers in primary markets, have been favored by investors at this point in the cycle.

—CoStar Group Inc.

You must be logged in to post a comment.