Duke’s New Look: Denny Oklak Remakes a REIT

The passage of time has transformed both the company and the industry, and Denny Oklak has done much to help Duke attain many of its significant milestones. Somehow, it seems fitting that an executive who exemplifies constancy is nimble enough to lead his company in a time of rapid change. By Paul Rosta.

Anyone who keeps a close eye on Duke Realty Corp. might have experienced déjà vu last fall. In December, the Indianapolis- based REIT wrapped up one of the year’s biggest portfolio transactions: the $1.1 billion sale of a geographically diverse portfolio of suburban office assets to an affiliate of the Blackstone Group L.P. Completed in December, that transaction was the biggest milestone yet in Duke’s strategy to transform its portfolio into majority industrial and exit many of its suburban office markets.

Six years earlier, in September 2005, Duke completed the $1 billion sale of a geographically diverse portfolio of flex industrial facilities to a joint venture of First Industrial Realty Trust Inc. and the California State Teachers Retirement System. That sale, which involved a 14.4 million-square-foot portfolio in the Midwest and Southeast, was also the centerpiece of an exit strategy as Duke moved to dispose of its flex assets. The names, property categories and market conditions changed considerably in the interim, but the two deals share striking similarities. Besides their scale and institutional players, both transactions were milestones of strategies to remake Duke’s portfolio. And both display the distinctive stamp of Denny Oklak, the 26-year company veteran who has served as CEO since 2004. As Duke marks its 40th anniversary this year, Oklak is overseeing a transformation that is on pace to reach the finish line well ahead of schedule.

When the makeover is complete, Oklak will have expanded the company’s footprint in the industrial and medical office sectors and pared down its office holdings to the most reliable markets. “He’s not been afraid to push the envelope and take the company in directions that it has not gone in before,” said Guy Metcalfe, managing director & co-head of real estate investment banking for Morgan Stanley, who has advised Oklak on numerous transactions. For future growth, Oklak is eyeing Southern California and other prime ports and logistics centers.

Duke’s shift toward the industrial sector is a major factor in Oklak’s cautiously upbeat projections for 2012. “We do think this will be another solid year (for) bulk industrial,” he said. Occupancy for the portfolio overall rose 160 basis points to end 2011 at 90.7 percent, and Oklak anticipates the slow improvement to continue. Flat growth in the suburban office portfolio was offset by an uptick in bulk industrial facilities, which increased 140 basis points to end the year at 90.5 percent.

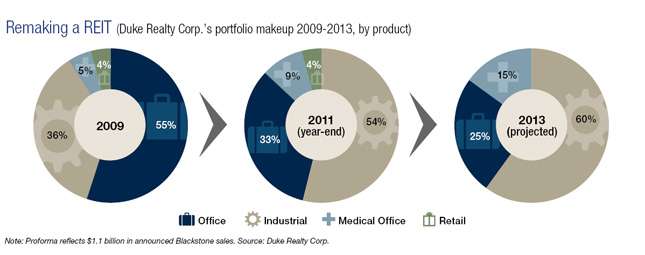

Duke’s leadership launched its latest makeover in the fall of 2009. At the time, the company’s portfolio consisted of 55 percent office, 36 percent industrial, 5 percent medical office and 4 percent retail. But the recession prompted a re-examination. Hammered by the struggling job market, portfolio-wide occupancy in Duke’s office holdings slid from its pre-recession peak of 92.5 percent at the end of 2006 to 85.3 percent by the end of last year.

“One of the things we’ve always done is look forward and ask, ‘Five or 10 years down the road, where do we want to be from a portfolio perspective?’ ” Oklak observed. The company leadership decided to increase its industrial holdings, exit the more volatile of its suburban office markets and expand its presence in medical office assets. With that in mind, in 2009, Duke announced its plan to transform its portfolio to 60 percent industrial, 25 percent office and 15 percent medical office by 2013.

Oklak is the first to acknowledge that the company is tackling a formidable task. “It’s not that easy to change an $8 billion or $9 billion portfolio—kind of like turning the iceberg,” he said. That notwithstanding, Oklak continues to push the iceberg at a steady pace. The portfolio sale to Blackstone capped a year during which Duke sold assets valued at $1.7 billion and acquired another $747 million in properties. As a result of that vigorous execution, the target is in sight ahead of the deadline. By the end of 2011, the portfolio consisted of 54 percent industrial, 33 percent suburban office, 9 percent medical office and 4 percent retail.

Besides the Blackstone deal, highlights of the portfolio makeover include the $298 million acquisition of Dugan Realty L.L.C.’s share of a jointly held industrial portfolio. Completed on July 1, 2010, that transaction gave Duke sole control of 106 properties and 20.8 million square feet of industrial space in the Midwest and Southeast, plus 62.6 acres of undeveloped land.

In the first quarter of 2011, Duke made further inroads into the South Florida market with the $450 million pickup of a 4.9 million-square-foot industrial portfolio from Premier Commercial Realty. That deal brought Duke’s holdings in high-growth Broward and Palm Beach counties to more than 7 million square feet. “These are transactions that are transformative for the company, but are not available—or not within the skill set—for other companies to execute,” said Paul Adornato, a senior research analyst specializing in REITs at BMO Capital Markets Corp.

Though the healthcare sector represented only 9 percent of Duke’s total holdings by the end of last year, the aging of the population gives the specialty potential for solid growth and reliable returns. Duke is focusing its healthcare investment and development activities on properties co-located with major medical centers. The built-in association with hospitals boosts leasing, Oklak contends. In January, the company announced medical office acquisitions in San Antonio, the Austin suburb of Cedar Park and the Chicago suburb of Burr Ridge.

The sector is also a favored category in Duke’s growing development pipeline, which Oklak estimates will reach in the neighborhood of $250 million to $350 million this year. Late last year, the company kicked off construction of a 270,000-square-foot building at the $754 million Eskenazi Health campus in Downtown Indianapolis. Formally known as the Fifth Third Faculty Office Building, the facility will be jointly owned by Duke and the Health and Hospital Corporation of Marion County. That project follows Duke’s completion last March of the $154 million Baylor Charles A. Sammons Cancer Center on the Baylor University Medical Center campus in Dallas. In November, the 459,717-square-foot facility earned LEED Gold certification.

Duke’s accelerated activity in healthcare is an outgrowth of a strategy Oklak has been pursuing for years. An early milestone was the 2007 acquisition of Bremner Healthcare Realestate and its nine-property, 784,000-square-foot portfolio. James Bremner, who founded the firm in 1996, remains on board as president of Duke’s healthcare business.

New Realities

Oklak’s steady leadership through the recession provided the foundation for Duke’s current strategy. “I’ve worked with a lot of CEOs as an investment banker, and Denny, in the most challenging times, keeps an even keel, and his demeanor remains fixed and even and positive and constructive,” commented John Case, executive vice president & chief investment officer of Escondido, Calif.-based Realty Income Corp. As a longtime Merrill Lynch investment banker, Case worked closely with Oklak for more than a decade while advising Duke on numerous major transactions, starting with the firm’s IPO.

During the latest recession, Oklak adjusted to the new realities by altering Duke’s business model. Encouraged by changes in the Tax Code, the firm had launched a merchant building business that peaked from about 2002 to 2007. When the recession virtually shut off the development pipeline, Duke exited the business. Though its pipeline is picking up again, Oklak does not foresee a return to that business anytime soon. Instead, the company will build properties for its own portfolio or in joint venture. The shutdown of the company’s building business largely accounted for reductions that trimmed Duke’s workforce by about 19 percent in 2008. In addition, salary freezes were imposed on the company’s 64 top employees, and it closed its fledgling offices in San Antonio, Seattle and Newport Beach, Calif. The board of directors added $150 million in liquidity by imposing the first year-over-year reduction in the company’s dividend since Duke’s IPO in 1993.

In addition to ordering these cost-saving measures, Oklak took steps to raise fresh capital. All told, Duke raised $2.5 billion between Oct. 1, 2007, and April 30, 2009. Adornato credits Oklak with being among the first REIT leaders to turn to Wall Street during the recession. Duke’s planned stock offering drew a skeptical response from some analysts at the time because REIT share prices had tumbled by early 2009.

Nevertheless, Oklak’s decision paid off. In April 2009, Duke raised $575 million on the sale of 75.2 million shares of common stock. “It was the right decision because it assured the market and Duke’s investors that it had sufficient capital” to complete its development pipeline, Adornato said. That summer, Duke raised another $500 million through the sale of unsecured bonds and $114 million in secured financing, and repurchased unsecured debt obligations valued at $352 million.

Duke’s approach to the capital markets during the recession showcased the acumen that Oklak has demonstrated throughout his long run there. “He knows the numbers as well as anyone,” said Adornato, citing Oklak’s ability to quickly size up the significance of complex financial statements. Oklak’s dexterity with a balance sheet dates to his early immersion in tax and accounting issues. A native Hoosier, Oklak graduated magna cum laude in accounting from Ball State University. In 1977, he joined Haskins & Sells, the venerable consulting company that was a predecessor firm of Deloitte Haskins & Sells and Deloitte & Touche. He spent nine years providing tax and accounting advisory service to a clientele that included a number of commercial real estate firms.

The Tax Reform Act of 1986 proved to be a game-changer for the REIT industry. Among its provisions were new limits on the allowable tax losses for passive investors in real estate, a step that essentially ended the use of real estate investments as tax shelters. For Duke and other private companies, the changes added new complexities. In its pre-REIT days, Duke’s holdings were controlled by individuals through multiple partnerships. The Tax Reform Act suddenly made it far more challenging to track income and losses and to determine whether certain items should be considered passive or non-passive.

Under the circumstances, Duke needed a seasoned tax specialist who was also familiar with the real estate business. In 1986, Oklak came on board as the company’s first tax manager. By 1993, he had been promoted to vice president & treasurer, helping to orchestrate the company’s IPO. He saw to it that Duke was among the first REITs to provide quarterly supplemental information beyond Securities and Exchange Commission requirements. “Duke most definitely took the lead when the REIT industry was in its infancy,” Adornato said.

Oklak served as executive vice president & chief administrative officer from 1997 to 2002. In that role, he oversaw tax, accounting, information technology, human resources and tenant services. During that period, he was an integral player in another watershed event. Tom Hefner, Duke’s then-CEO, assigned him to the fi ve-member team representing the company in negotiations for its merger with Weeks Corp. Completed in 1999, the deal expanded Duke’s footprint into eight Southeastern markets, added 31 million square feet of industrial product to its portfolio and grew the company’s value from $3.7 billion to $5.2 billion.

The high-stakes negotiations that preceded the Weeks merger highlighted Oklak’s ability to deliver the goods under pressure. “Those situations can be pretty (intense),” said Case, who had an inside view of the talks as a Duke advisor. “Denny ran point on a number of those conversations and negotiations. He had the ability to react quite well to anything that was thrown at him. Denny was always able to maintain control, keep everything going in a positive and constructive direction.”

At the turn of the decade, Duke set in motion its first succession plan as a REIT. In preparation for Hefner’s retirement, Oklak took the post of COO in April 2002 and moved up to president in January 2003. In April 2004, he officially succeeded Hefner as CEO, and stepped into the chairman’s role a year later when Hefner made his planned departure.

From the start of his tenure, Oklak was working to fine-tune Duke’s portfolio. In 2006, he oversaw the acquisition of a 2.9 million-square-foot portfolio of suburban office and light-industrial buildings from the Mark Winkler Co. That $855 million deal gave Duke a significant presence in Northern Virginia. Later that year, Duke contributed most of the Northern Virginia properties to a joint venture formed with affiliates of Eaton Vance Corp.

During Oklak’s eight years in the hot seat, he has earned a reputation as a CEO’s CEO among his peers and colleagues, not least among them the high-powered members of the Realestate Roundtable, where Oklak is an active member. “He is personable and fair, but he is also very direct and straightforward with people,” said Metcalfe. “I’ve been blessed to deal with a lot of really talented and good CEOs. I’d put Denny at the top in terms of ‘his word is his bond.’ ”

Oklak is a throwback in other respects, as well. In the past generation, it has become increasingly rare for an executive in any industry to dedicate decades to a single company. As Duke marks its 40th anniversary this year, Oklak himself is coming off a milestone he attained last year: 25 years in the real estate business, all spent with Duke. The passage of time has transformed both the company and the industry, and Oklak has done much to help Duke attain many of its significant milestones. Somehow, it seems fitting that an executive who exemplifies constancy is nimble enough to lead his company in a time of rapid change.

You must be logged in to post a comment.