Capital Chase: Life Companies Still Lead, but Banks Return to Financing Market

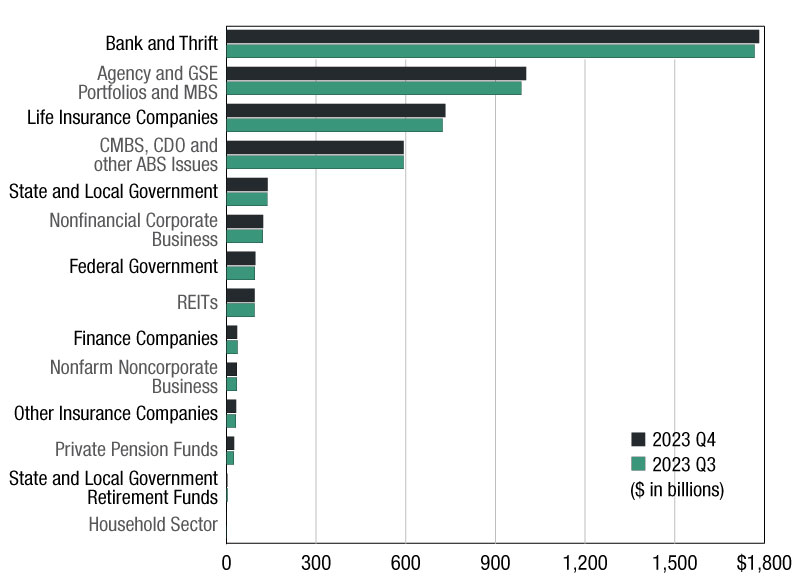

Even as capital returns to the commercial real estate market, life insurance companies continue to top the list of debt providers. Indeed, in the first quarter, life insurance companies registered an index of 212 on the Mortgage Bankers Association mortgage originations index.

By Keat Foong

Even as capital returns to the commercial real estate market, life insurance companies continue to top the list of debt providers. Indeed, in the first quarter, life insurance companies registered an index of 212 on the Mortgage Bankers Association mortgage originations index, followed by Fannie Mae/Freddie Mac (112), commercial banks (77) and conduits (26).

“Life companies have come back very strongly,” said Gerard Sansosti, executive managing director at Holliday Fenoglio Fowler L.P. “They had a lot of opportunities in the first half, driven by investment sales in the top markets. There has been a little bit of a slowdown in the second half in the core properties because the caps have become aggressive.”

Virtually all life insurance companies have returned to the debt markets. The biggest players—such as MetLife, Prudential, New York Life and Northwestern Mutual—have been the most active, followed by such second-tier firms as Nationwide and Allstate.

“The insurance companies drew the line when things got frothy the last cycle, and they did not lend much above 65 percent LTV,” observed David Twardock, president of Prudential Mortgage Capital Co. One of the reasons why insurance companies are so active through this cycle is because their level of problem loans is much lower, he said. “It is much easier to be active and comfortable in the market when there are not as many problems to deal with.”

Prudential is expecting to execute $10 billion in total on- and off-balance-sheet debt financing this year, Twardock said. This level of activity is not far below the $14.5 billion in volume achieved in 2007, Prudential’s peak financing year. In fact, it will be the third biggest year in debt financing for the company since 2003. Prudential is equally active in Fannie Mae, Freddie Mac, FHA and CMBS financing (the company just created a CMBS unit with venture capital to make as much as $1 billion in loans per year), as well as in on-balance-sheet financing, Twardock added.

Prudential is lending on virtually all product types, but more so in multi-family, retail and industrial than the office sector at this time, Twardock reported. The hotel sector is seeing some overleverage, which makes it difficult for the deals to pencil out, he noted. Prudential’s portfolio lending is made generally to Class A and B-plus properties in the top 10 to 12 markets, but its other lending programs extend to secondary and tertiary markets.

“Our balance-sheet lending is done to create assets to match liabilities in the insurance and retirement business,” explained Twardock. “The attractiveness of the asset is driven by how the risk is priced relative to alternatives. Spreads on commercial mortgages are now attractive relative to bonds, though not as much as a year ago. There is pretty good investor demand for those assets.”

The Banks Are Back

The financing market is also witnessing a surprising comeback of sorts by banks. In the first quarter, commercial banks increased their origination volume by 73 percent, second only to conduits (391 percent) and life insurance companies (126 percent), according to the MBA’s originations index. “We are seeing banks become very aggressive,” said Clay Sublett, senior vice president & CMBS manager with KeyBank Real Estate Capital. “A lot of banks have managed through their problems more rapidly than anticipated.”

Many banks, including KeyBank, had increased their liquidity tremendously, whether by choice or government direction, following the financial meltdown, and they are now seeking to deploy that substantial capacity, Sublett said. “The question is how to get a decent return on that (deposit). (Banks) have moved from liquidity concerns to earnings concerns.” Also, loans have been paid off or refinanced more rapidly than expected, reducing the ratio of loans to deposits and further releasing the reserves held by the banks.

KeyBank is hoping to complete at least $1 billion in balance-sheet financing this year, compared to the $5 billion to $6 billion in financing achieved in 2007. This volume represents a huge bounceback in financing volume from 2009 and 2010, when the on-balance-sheet financing was insignificant. In its off-balance-sheet financing department, KeyBank is on track to lend more than $2 billion this year in Fannie Mae, Freddie Mac and FHA financing. About $1 billion is projected under KeyBank’s CMBS arm, though it will likely fall far short of that level, said Sublett.

For KeyBank and many other banks, “the marching order is to ‘go find new loans,’ ” said Sublett. KeyBank is now seeking to add banking clients, as it has shrunken its balance sheet over the past three years slightly more than what it now views as desirable. Nevertheless, in making on-balance-sheet loans, the bank is avoiding financing-only relationships, Sublett pointed out, and is seeking borrowers with which it can have a complete banking relationship.

It is also making new construction loans, though only for multi-family and build-to-suits. The bank provides debt financing at the entity level by providing credit facilities to REITs. At the project level, it is seeking to finance acquisitions and repositionings more than new construction.

“We are trying to manage and control the amount of construction in part because we do not see enough lift in the overall economy to drive demand for significant ground-up activity,” said Sublett. For commercial property, Sublett sees more support for office or specialized retail properties, and if a tenant property is already signed up, “we will follow those developers where they want to go,” including to secondary markets, said Sublett.

Private equity funds are also preoccupied with seeking business in the value-added space. Ryan Krauch, principal at Mesa West Capital, said there were probably fewer than five of the funds in the market providing bridge loans before the financial crisis. However, after the crash, there were more than 100 debt funds in the value-added space. Debt funds were driven out of the market when the crisis hit, and a lot of the pension fund clients wanted advisors with track record. Mesa West has invested about two-thirds of the $2 billion fund it raised last year for bridge financing, said Krauch. The fund invests in “good locations in good markets with a high chance of success.”

Some life companies and private equity funds are also providing preferred equity or mezzanine financing, including Principal Financial and The Hartford, as well as private equity funds such as Investcorp, according to Sansosti.

Active in Equity

On the equity front, all three major types of joint venture equity capital today—traditional, non-traditional and foreign—are active, according to Spencer Levy, executive managing director of CB Richard Ellis Capital Markets. Among the traditional players, he singled out the pension fund advisory community as being particularly astir. Sansosti noted AEW, Invesco, Blackstone and iStar, in particular. “They have raised a tremendous amount of capital each and every day,” he observed.

In addition, life companies have closed at least $20 billion in commercial real estate investments so far this year, Sansosti said. REITs, large owner-operators with excess capital for joint ventures, individual pension funds and insurance companies are also seeking opportunities in the market, said Levy.

Even non-traditional players that have historically not engaged in real estate—namely, private equity funds and hedge funds—are getting in on the game. They are now actively seeking partners because they are seeing opportunities, said Levy.

Foreign investors have also been active, from public and private pension funds to the sovereign wealth funds. The recent market plunge notwithstanding, “our sense is that investors are pretty bullish on the U.S. again,” observed Dale Taysom, COO of Prudential Real Estate Investors. They are well aware, he noted, that unlike most real estate recessions in the past 40 years, this time there was no oversupply of commercial real estate. And investors’ interest in commercial real estate has been particularly driven by expectations that inflation will kick in again.

Levy noted a lot of interest coming from Canada and Asia, especially high-net-worth investors from China. The Chinese investors are showing interest in joint ventures with well-established American operators in both major and secondary markets, Levy noted. “It is encouraging because there is some spending beyond the gateway cities,” he added.

At this stage, equity is targeted to the top and bottom ends of the risk-reward spectrum, and there is still very little interest in middle-market real estate. Investors are chasing either core or core-plus deals on the one hand or value-added transactions or opportunistic new development deals on the other. “It is the barbell effect,” Sansosti observed.

While core properties are often purchased without joint venture equity, plenty of joint venture equity sources are eyeing distressed deals, including broken condos and discounted loans. “We are seeing a lot of that joint venture capital appear, especially for transactions in which the deal is underwater,” said Levy. A number of traditional private equity funds are providing capital to purchase the debt at a discount as well as to stabilize the property, Levy added.

Indeed, “during the recession, a lot of opportunistic capital had been raised in anticipation of blood in the water,” noted Sansosti. “This has not occurred to the magnitude, or as quickly as, expected.” To satisfy the funds’ yield requirements, this capital is instead being deployed into new development and note purchases, Sansosti observed.

Prudential Real Estate Investors is an example of an active joint venture player in the new development sphere. JP Morgan, ING, RREEF and The Carlyle Group are also said to be among the more prominent equity players seeking to provide joint venture equity for new developments.

Prices obtained in the core acquisition arena are becoming a bit steep for PREI’s taste in many cases, Taysom said, and the investment advisor is moving some of its equity investments into joint venture arrangements, mostly in new developments. “In the last several months, 80 percent (of our activity) has been in joint ventures,” said Taysom.

PREI is expecting to make overall equity investments of about $2 billion this year, compared to $5 billion to $6 billion annually during the peak business cycle years of 2005-07. Taysom estimates that about 60 to 65 percent of that equity will be sunken into joint ventures. “Joint ventures have been our lifeblood for a decade,” he said.

PREI is investing in joint ventures to develop apartments primarily, as well as some retail. The company has not returned to developing office or industrial, however. PREI favors joint venturing with regional developers that are local experts in their markets. The institutional advisor likes to build urban infill or combination high-and-mid-rise developments, Taysom said. It also considers investing in new construction of garden apartments in some markets, such as Texas, which is currently a leader in job growth, he added.

Two recent project examples are the 363-unit Broadstone Valley Parkway in Lewisville, Texas, with Alliance Residential Co. and the 328-unit Greystar Brightleaf in Durham, N.C., with Greystar Residential.