Trammell Crow, InSite to Build 1 MSF Downtown Chicago Office Skyscraper

Making plans to build a behemoth spec office tower in any city in the United States right now is nothing if not bold, but Trammell Crow is doing just that.

November 1, 2010

By Barbra Murray, Contributing Editor

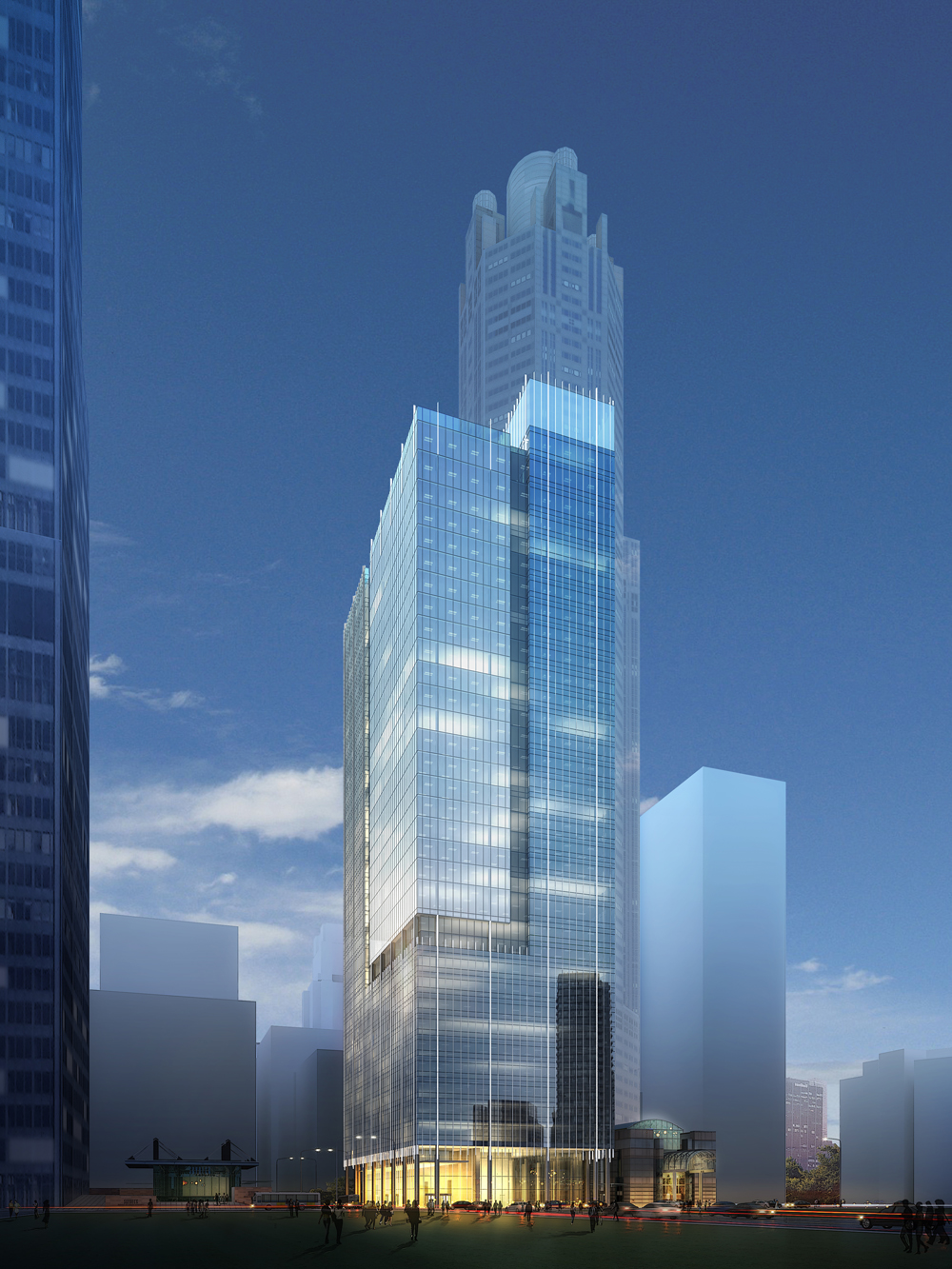

Making plans to build a behemoth spec office tower in any city in the United States right now is nothing if not bold, but Trammell Crow is doing just that. Trammell Crow, having just signed a partnership agreement with co-investor InSite Real Estate L.L.C., will erect a premier, 1 million square-foot office building at 301 South Wacker Avenue in downtown Chicago, where the vacancy rate induces everything but construction plans in the minds of most developers.

In addition to top-of-the-line office accommodations, 301 South Wacker Drive will feature parking space for over 200 vehicles, a conference centre and a fitness facility. Additionally, the property will be designed to achieve LEED Certification from the U.S. Green Building Council.

Trammell Crow and InSite did not reveal a construction start date for the project. The downtown Chicago office market will not be in the condition to absorb such a grand amount of space anytime soon. The vacancy rate for Class A properties in the CBD is a staggering 17 percent, but the figure marks the first decline in the vacancy rate since the second quarter of 2007, according to a third quarter report by commercial real estate services firm CB Richard Ellis Group Inc., of which TCC is an independently operated subsidiary.

It could be a couple of years before commencing construction at 301 South Wacker becomes a reasonable move. “As the overall national economy seems to have weathered the storm, the commercial real estate market in the CBD will likely continue to show minimal signs of improvement until companies regain their full confidence and commit to hiring full-time permanent employees,” as per the report. “Excluding a catastrophic event occurring, the time span for office employment returning to normal levels–not pre-recession highs–will, according to CBRE Econometric Advisors, take place over the next six years at an annual rate of only 1.8% per year. This likely will mean stagnation in our market indices such as quarterly absorption, vacancy rates, and rental rates for the remainder of 2010 and throughout 2011.”

You must be logged in to post a comment.