Mixed Bag for Construction Starts in 1st Half

Five of the top 10 markets posted gains, but activity was down significantly nationwide.

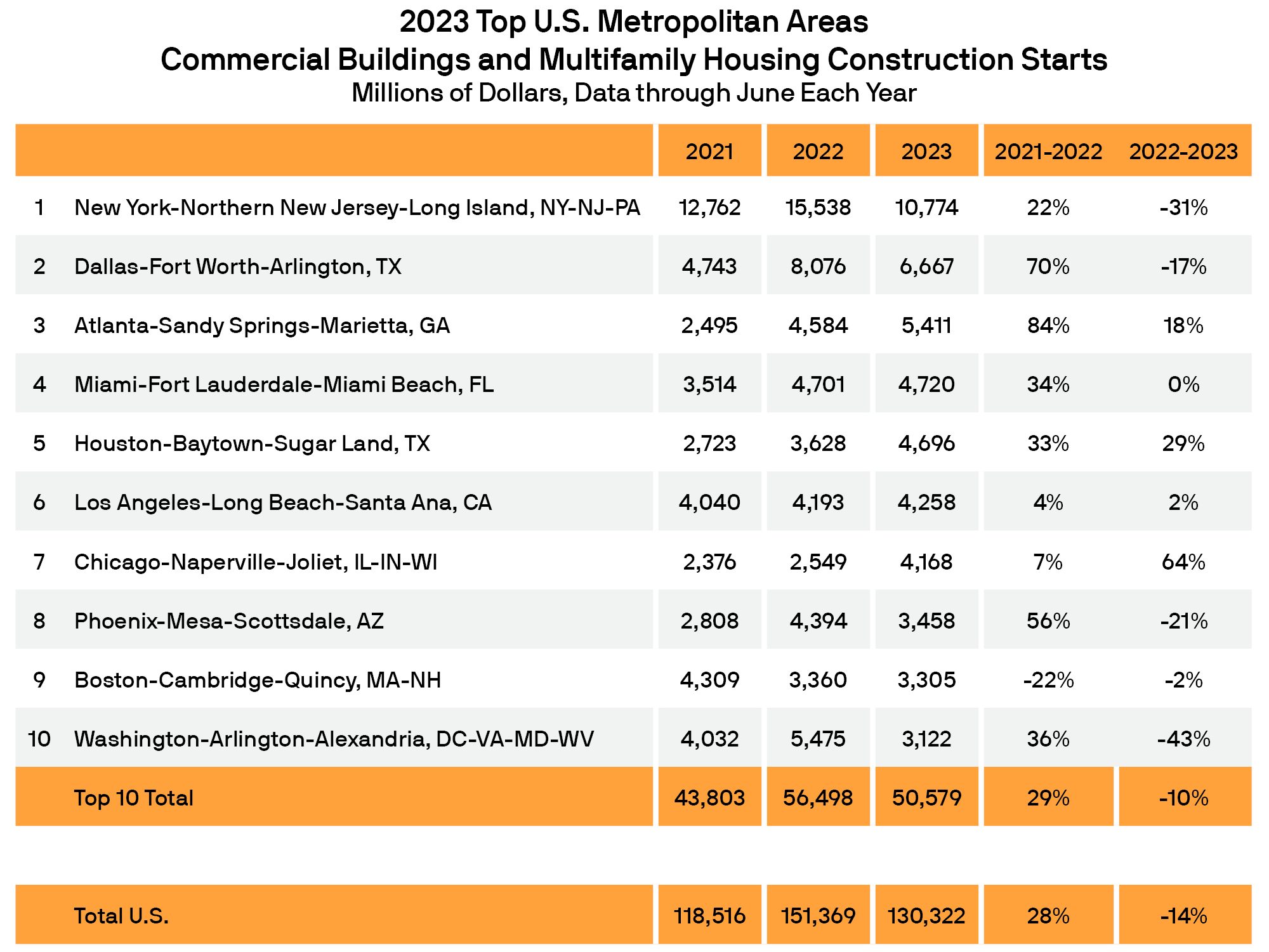

Graph of the ten largest metros for construction starts. Image and data courtesy of Dodge Construction Network

Citing tightening economic conditions, new data from Dodge Construction Network found the value of commercial and multifamily construction starts as falling nationally by 14 percent to $130 billion on a year-to-year basis through June, dropping 10 percent in the top 10 metropolitan areas across the United States.

The top 10 metro areas accounted for 39 percent of all commercial and multifamily starts in the U.S. in the first half of 2023, compared to 37 percent from January to June 2022.

The report pointed to tighter lending standards, higher interest rates, slowing demand and societal changes, including continued remote work, as impacts on commercial and multifamily construction. The report puts office buildings, stores, hotels, warehouses, commercial garages in the commercial category and also includes multifamily housing in the overall ranking. In the commercial sector, it does not tally figures for institutional projects such as educational facilities, hospitals, convention centers, casinos and transportation terminals. It also does not include manufacturing buildings, public works, electric utilities, gas plants and single-family housing.

Richard Branch, chief economist for Dodge Construction Network, said in prepared remarks that starts are expected to worsen in the second half of this year as interest rates head even higher. Yesterday, the Federal Reserve announced its 11th rate hike since March 2022. After pausing in June, the Federal Reserve raised the federal funds rate 25 basis points, to a range of between 5.25 percent and 5.5 percent. Fed chair Jerome Powell would not commit to further action in September, although economists say there could be at least one more rate hike this year.

Branch said the tighter financial conditions and significant market shifts have led to what he called precipitous declines in construction starts across many metro areas. While markets are expected to begin to recover next year, Branch said significant structural changes in the commercial real estate sector could lead to a tepid recovery with levels well below what was seen before the pandemic began in 2020.

Commercial Sees Bright Spots

The news for the commercial sector was a bit uneven; six of the top 10 metro markets saw the value of commercial construction starts increase in the first half of 2023 while four markets – including the Washington, D.C., market, which had a 42 percent decrease – saw commercial start values drop. Other markets seeing decreases in construction starts were New York (down 11 percent), Dallas (down 17 percent) and Phoenix (down 20 percent). Of the markets seeing increases, Chicago had the biggest percentage jump, up 71 percent compared to the same period in 2022. Atlanta began the year off strong with a 61 percent increase in commercial starts followed by Los Angeles (up 33 percent), Houston (up 24 percent), Boston (up 5 percent) and Miami (up 4 percent).

The report cites some of the top commercial construction projects in each of the top 10 markets. In New York, which was top market for both commercial and multifamily starts at $10.8 billion (down 31 percent), one of the largest projects starting in the first half of the year was the College Point Logistics Center in Queens. In March, a joint venture of Wildflower Ltd. and Drake Real Estate Partners received $94 million in financing from Walker & Dunlop for the development of the roughly 309,000-square foot industrial project in the College Point section of Queens. Wildflower broke ground on the $146 million development in June 2022, with completion expected in the second quarter of 2024.

READ ALSO: Construction Spending Booms Across the Board

In Dallas, Dodge reports there were gains in office and retail construction starts despite the 17 percent drop in commercial construction projects. However, the market’s biggest projects to break ground were a $154 million Aligned data center and $119 million Google data center.

Atlanta had a strong first half of 2023 with a 61 percent increase in commercial starts with all categories except retail posting gains. Data center projects were also among the largest projects to begin earlier this year including the $642 million Facebook Stanton Springs data center and another data center project estimated at $117 million.

Chicago also started the year strong with commercial starts up 71 percent. Dodge states the gain was the result of a large increase in office starts as well as upswings in hotel and retail construction. The largest commercial project to get underway was the $1 billion Prime data center campus in Elk Grove Village, Ill., that will have three buildings totaling about 750,000 square feet. The hyperscale data center will have a total capacity of 150 MW upon full build-out. A $330 million office building at 917 W. Fulton Market also began construction, according to Dodge.

Los Angeles also saw two office buildings break ground in the first half of the year as the market’s largest commercial projects to get started. One is the $490 million JMB Century City Center office building and the other is a $70 million office building at 6381 Hollywood Blvd.

In Houston, Dodge noted all the categories posted healthy growth with several industrial projects leading the way for the market’s 24 percent in commercial starts. Dodge cited the $77 million Port 99 warehouse and the $50 million FreezPak cold storage building.

You must be logged in to post a comment.