Single-Asset Sales Set Record in 2018

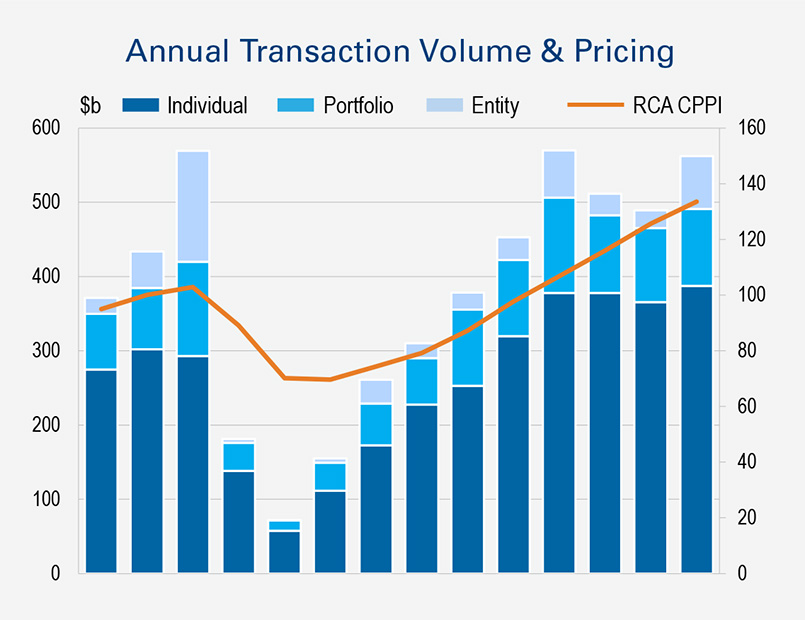

Of the total $562 billion of commercial real estate trades last year, 30 percent were portfolio- and entity-level deals―the most transacted since 2007.

Source: Real Capital Analytics

Commercial real estate sales activity was at near-record levels in 2018 and the number of transactions was up across all property types, according to data compiled by Real Capital Analytics. A record for single-asset sales was surpassed.

Total transactions of $562.1 billion, the third highest year ever, was just $8 billion shy of the record set in 2015 and 15 percent increase over 2017.

Portfolio and entity-level sales accounted for 31 percent ($71.2 billion) of the market. Not since 2007 have more portfolios or property companies traded. Single asset sales, on the other hand, did set a new bar at $387.5 billion. That is 3 percent higher than record-setting 2016.

RCA notes that the abundant volume is occurring despite record-high property prices. The RCA CPPI grew 6.2 percent last year over 2017 and 30 percent above 2007 prices.

You must be logged in to post a comment.