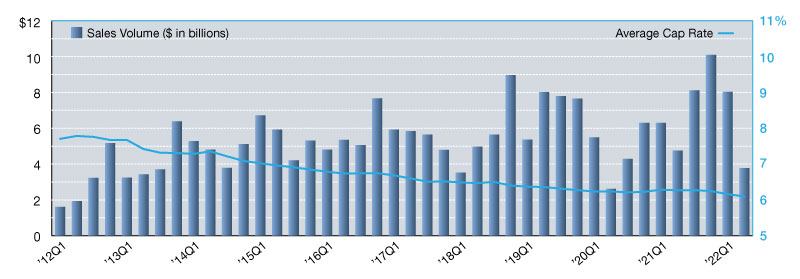

2022 Net Lease Office Sales Volume and Cap Rates

After a fast start, transactions took a big dip in the second quarter.

The single-tenant office sector had an impressive start to the year. The sector posted more than $8.0 billion in investment sales activity, securing first quarter 2022’s place as the fourth strongest quarter on record. In fact, post-pandemic activity for the office market has led to three top-five performing quarters in history. Despite the recent momentum, it couldn’t carry over into second quarter 2022, when just $3.8 billion in transactions were logged. Quarter-to-quarter, this represents a 53.1 percent drop in activity, and it’s also the lowest level of sales volume reported since the height of the pandemic. As is typical, the quarter was dotted with several higher priced transactions including the $205.5 million sale of the former Xerox facility in El Segundo, Calif., as well as AT&T’s corporate office in the Buckhead submarket of Atlanta that sold for $137 million. However, the highest profile transaction of the quarter was the four-property Meta campus in Silicon Valley that traded for nearly $707 million.

Overall transaction count was down, but most activity for the quarter involved smaller transactions, primarily under $25 million, with numerous sales falling below the $10-million-mark. While this trend isn’t necessarily unusual, especially in the single-tenant sector where many office properties are of smaller size and price point, there was a noticeable absence of larger portfolio closings that have been prevalent in recent quarters. Without these substantial transactions, overall sales activity naturally falls, but it doesn’t necessarily indicate a reduction in buyer demand for the sector. In just the first half of this year, private investors have taken market share away from REITs and institutional investors by being very active in the small deal space. If we study the historic dominant players for single-tenant office properties along the spectrum, from small freestanding facilities to massive corporate offices and campuses, the reduction in sales volume doesn’t feel so surprising.

Lanie Beck joined Stan Johnson Co. in 2013. She oversees the firm’s corporate research efforts, publishing the quarterly MarketSnapshot report, the Viewpoint series of whitepapers and a variety of other thought leadership content. Beck is also responsible for leading Stan Johnson Co.’s corporate marketing, communications and public relations strategy, including the coordination of the firm’s social media presence, industry conference and event sponsorships, as well as management of the brand.

—Posted on Aug. 25, 2022

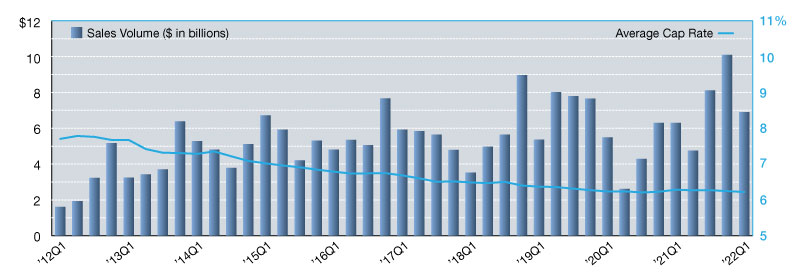

Rumors of the office market being dead are just that–rumors. It’s true there may still be some uncertainty about the future of the sector, but tenants and investors alike are largely in agreement that office space, in some form, will play a vital role in the long-term strategies of many companies. Post-pandemic, the market’s renewed confidence has been illustrated by strong investment sales activity and high-profile transactions in recent months. In fact, the single-tenant office market set two new records in 2021.

First, a new high-water mark was reached for annual sales volume with nearly $29.3 billion posted for the year. Secondly, an incredibly strong fourth quarter, where approximately $10.1 billion in sales were logged, resulted in a new quarterly record as well. Momentum has carried into early 2022, and first quarter saw sales volume reach nearly $6.9 billion. It should be noted, however, that a single asset sale in the Northeast–Google’s purchase of a Manhattan office building–contributed $1.9 billion of the quarter’s activity. Still, even without this one transaction, activity in the single-tenant office sector has seen noticeable growth in the months and quarters following the onset of the pandemic. As market conditions shift though, we’ll be watching the office sector closely to see if and how demand levels are impacted. We will also be watching cap rate movement. At an average of 6.2 percent at the close of first quarter 2022, office cap rates are the highest by sector in the net lease market, although they’ve been compressing over the last year. Within the next quarter or so, it’s highly likely that those averages will begin to climb.

Lanie Beck joined Stan Johnson Co. in 2013. She oversees the firm’s corporate research efforts, publishing the quarterly MarketSnapshot report, the Viewpoint series of whitepapers and a variety of other thought leadership content. Beck is also responsible for leading Stan Johnson Co.’s corporate marketing, communications and public relations strategy, including the coordination of the firm’s social media presence, industry conference and event sponsorships, as well as management of the brand.

—Posted on May 23, 2022

You must be logged in to post a comment.