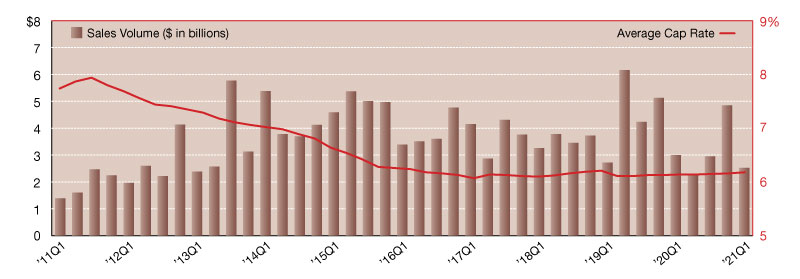

2021 Net Lease Retail Sales Volume & Cap Rates

In the retail sector alone, nearly $4.9 billion in sales was reported, far exceeding expectations for the final quarter of the year.

A rush of closings occurred in late 2020 across the single-tenant net lease market, catapulting overall fourth quarter 2020 sales volume to more than $23.5 billion.

In the retail sector alone, nearly $4.9 billion in sales was reported, far exceeding expectations for the final quarter of the year. Due to this flurry of activity, first quarter 2021 closings appeared to languish. In reality though, the market is performing with much greater consistency, and investor demand for net lease retail has been gaining momentum as we emerge from the pandemic.

Despite the seemingly slow start to the year, with only $2.5 billion in sales reported for the first quarter, buyer demand for net lease properties–especially those featuring essential retailers–has been outpacing current supply levels.

There continues to be little to no movement in retail cap rates, as the sector’s average sits at 6.2 percent. This is two basis points above year-end 2020 and only one basis point higher than this time in 2016. The market is likely in for more of the same, at least in the near term, as rates are not expected to move significantly in the coming quarters.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on May 25, 2021

You must be logged in to post a comment.