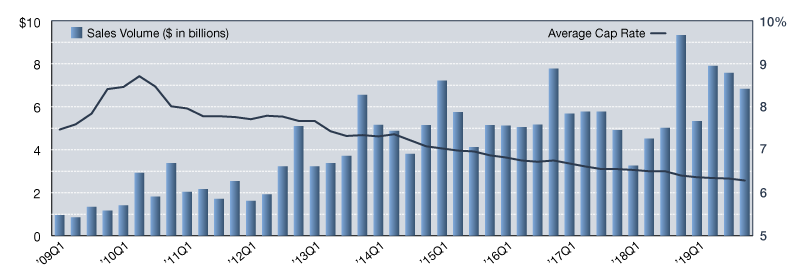

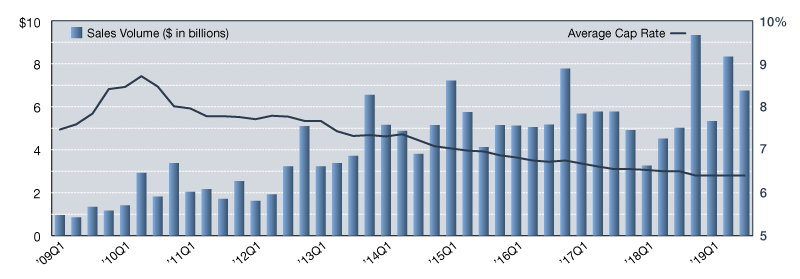

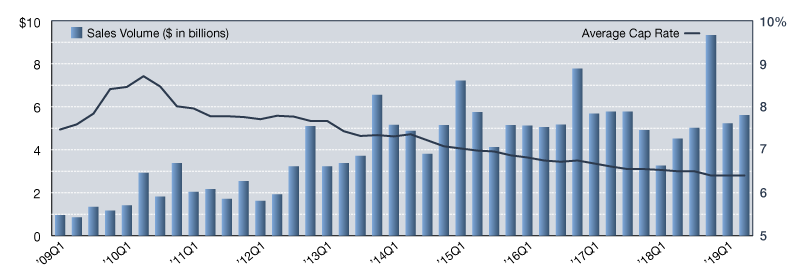

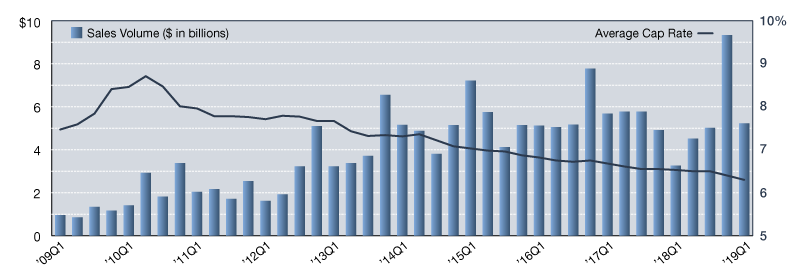

2019 Net Lease Office Sales Volume and Cap Rates

Single-tenant office sales volume versus average cap rates, updated quarterly.

After four years of strong but stagnant investment sales levels, the single-tenant net lease office sector achieved a new record high with $27.6 billion in sales during 2019. This marks a 19.4 percent increase in year-over-year activity. The West region contributed nearly half the sector’s annual gains, reaching new highs itself with $12.4 billion reported. Average cap rates in the office market, unlike in the other property sectors, have reported declines. Rates fell for five consecutive quarters and ended the year at 6.3 percent–10 basis points lower than at year-end 2018, and the lowest average on record. Have we reached the low point of this market cycle? Possibly not yet. With interest rates still incredibly low and investor appetite remaining strong, it’s likely the single-tenant net lease office sector won’t see average cap rates bottom out until mid- to late 2020.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Apr. 24, 2020

The last several quarters have seen transaction volume in the single-tenant net lease office sector fluctuate wildly, with swings from just over $3.0 billion per quarter in early 2018 to a record high of $9.0 billion in fourth quarter 2018. First quarter 2019’s hangover reported a healthy but not robust $5.3 billion in sales, which was immediately followed by an incredibly strong quarter of more than $8.3 billion. Third quarter 2019 closed with nearly $6.8 billion in sales, largely driven by activity in the West and Southwest regions, which puts the market well on pace to exceed last year’s record high totals of $23.1 billion. Cap rates remain near their all-time lows, inching up only two basis points in the last three months to end the quarter at 6.38 percent. Across the regions reporting the most activity, there has been very little upward movement in cap rates this year. If economic conditions remain favorable and investment activity stays strong as we finish the year and move into 2020, it is possible we’ll see another dip in average cap rates. For now though, mid-year’s 6.4 percent average has been the low point of this market cycle.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Jan. 16, 2020

The single-tenant net lease office sector is off to a stronger start in 2019 as compared to the first half of 2018. More than $5.6 billion in office sales were reported in the last three months, putting the sector on track to surpass $20 billion in sales this year. If momentum carries through year-end, it will be the fifth consecutive year we see the market exceed that benchmark. Regionally, West Coast markets continue to be incredibly active, and more than half of this quarter’s activity occurred in the West region. The Northeast and Southeast, while not on par with West region levels, reported comparatively strong increases quarter-to-quarter, helping to drive overall activity. Cap rate movement though remains mixed by region. We’ve seen additional compression in the West and Midwest in the past few quarters, while Northeast and Southeast averages appear to be on the rise. Overall, the inconsistencies are resulting in relatively flat quarterly movement, and the mid-year average of 6.4 percent still may not be the low point of this market cycle.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Oct. 24, 2019

The single-tenant net lease office sector has reported four consecutive years of very steady, strong demand. And the $5.2 billion in sales reported during first quarter 2019 puts the market on track to realistically meet last year’s $22.8 billion. While demand levels seen late last year weren’t expected to carry over to 2019, it is clear that investors are still very interested in non-retail product in today’s market–and they’re not afraid to pay for it either. Multiple single-asset transactions closed in first quarter with price tags greater than $100 million, with the vast majority of activity occurring in the West region. It remains to be seen if this momentum will carry over to second quarter, but it’s likely that average transaction sizes will return to more normal levels, thereby resulting in lower quarterly sales totals. Average office cap rates have yet to bottom out though. Another two-basis-point drop during first quarter put the sector’s average at 6.3 percent, and with interest rates still low, it is possible that sustained increases won’t occur until 2020.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on July 24, 2019

You must be logged in to post a comment.