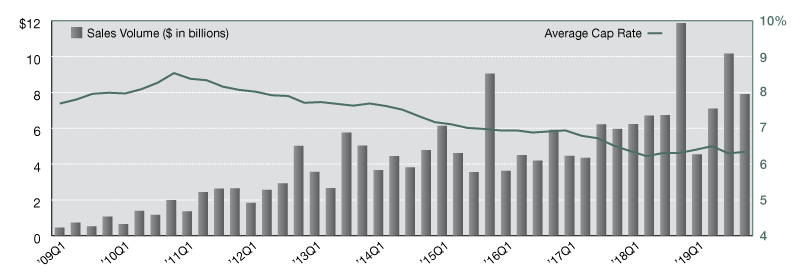

2019 Net Lease Industrial Sales Volume & Cap Rates

Single-tenant industrial sales volume versus average cap rates, updated quarterly.

Unlike the retail sector, which has seen stagnant cap rates for years, the single-tenant industrial sector tells a slightly different story. Since peaking in 2010, rates spent the majority of the last decade on a slow, steady decline, finally bottoming out during second quarter 2018 at 6.1 percent. In the year and a half since then, rates have fluctuated as they’ve started their slow climb upwards. After a little back-and-forth, average cap rates for single-tenant industrial product ended 2019 at 6.3 percent–a 21 basis point increase from the sector’s record low and 12 basis points up from this time last year. Investment sales volume remains incredibly high for the sector, with two consecutive years of approximately $32.0 billion each. And while 2019 failed to surpass 2018’s record setting volume, further revisions in the data may push us past the peak to set a new all-time record.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Mar. 26, 2020

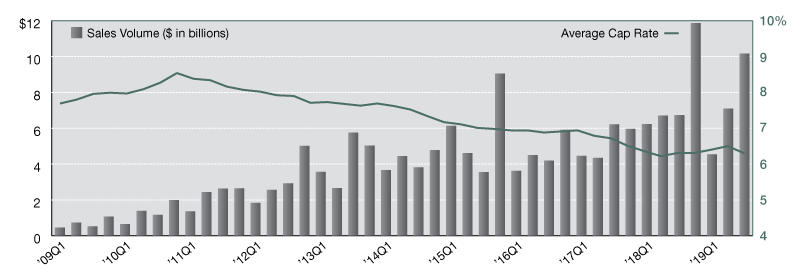

The single-tenant net lease industrial market posted transaction volume in excess of $10.1 billion during third quarter 2019, making it the second strongest quarter in the sector’s history. However, a lackluster start to the year, where only $12.1 billion was reported in the entire first half, puts the market on pace to fall short of topping 2018 sales totals. In fact, only the West and Mid-Atlantic regions are currently on track to surpass their respective sales volumes from last year. Without substantial activity from the remaining regions, however, the sector is likely to finish the year just shy of the $30-billion-mark. Still, the industrial market is looking to report back-to-back years of substantial activity, with every indication that momentum will continue into the new year. Cap rates, after bottoming out in second quarter 2018 at a low point of 6.1 percent, have inched upward over the last few quarters, reaching 6.5 percent at mid-year. Those gains were erased during third quarter though, as a 13-basis-point decline pushed the average down to 6.3 percent. The Mid-Atlantic, Midwest, and Southwest regions reported noticeable declines quarter-to-quarter, with the remaining regions continuing to report small but steady increases.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Dec. 16, 2019

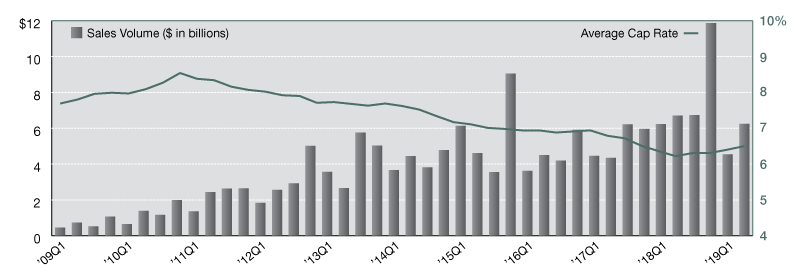

Coming off a tremendously strong 2018, the single-tenant net lease industrial sector experienced a bit of a hangover in the first half of 2019. Momentum did not carry over to the current year and sale totals appear a bit lackluster compared to the record-setting $32.0 billion reported in 2018. With $4.8 billion in sales reported during first quarter 2019, and another $6.2 billion in the last three months, the industrial sector is currently not on pace for a repeat year. However, compared to recent historical averages, investment demand is still quite strong, and it’s likely that we’ll see annual sales volume finish the year somewhere between 2015 and 2017’s reported totals. As has happened in past cycles, average cap rates across the sector have steadily marched upwards since bottoming out this time last year. Since then, cap rates have increased 33 basis points to an average of 6.5 percent, and future increases are expected now that we’re past this market cycle’s peak.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on Sep. 24, 2019

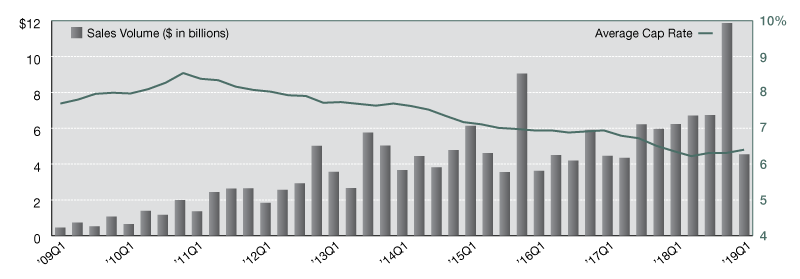

Fourth quarter 2018 saw a tremendous amount of demand in the single-tenant net lease industrial sector. Nearly $12.0 billion in sales brought the annual total to a record-breaking $31.5 billion, but the momentum was short-lived. First quarter 2019 witnessed a rather dramatic slowing of activity as the market posted below-average sales totals of only $4.5 billion, which puts the market on track to match 2016 sales levels.

Unlike the retail and office sectors, industrial cap rates have begun to rise–a full 12 basis points in first quarter 2019 to an average of 6.39 percent. But current economic conditions are incredibly favorable for investors. And as consumers put more and more pressure on retailers to deliver goods faster and more efficiently, the industrial sector will play a very important role–and that means sustained, if not increasing, demand for warehouses, distribution facilities, and manufacturing buildings.

Already-strong industrial markets like Los Angeles, Chicago, Atlanta, and Dallas will continue to be major logistics hubs. But second- and third-tier markets like Memphis, Tenn., Indianapolis, Ind., East Bay, Cincinnati, and many others will provide outstanding opportunities for investors to purchase newly constructed industrial assets with growing and established companies as they expand their footprints to better reach consumers.

Focusing on business development, industry and client-specific research, and the analysis of local and national market trends, Lanie Beck has been the Director of Research for Stan Johnson Co. since 2013.

—Posted on June 20, 2019

You must be logged in to post a comment.