2019 National Retail Absorption

Year-over-year retail market conditions compared nationally and by region, updated quarterly.

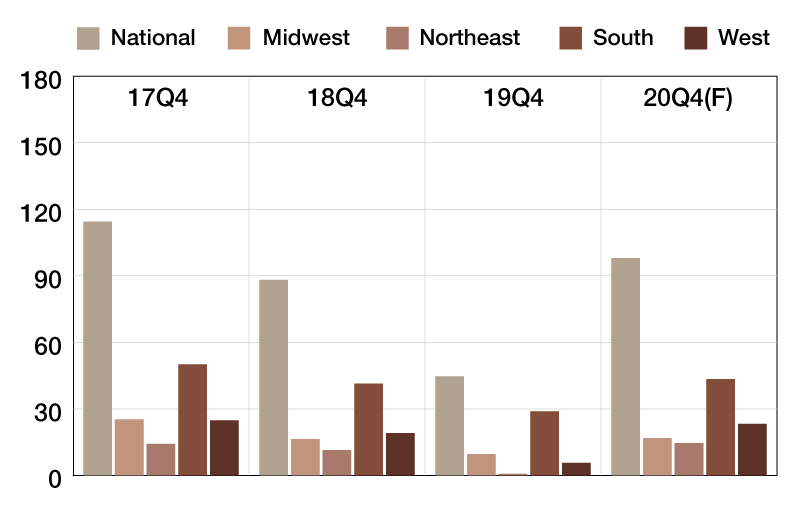

In MSF

Year-over-year, net absorption rates for retail markets dropped in the fourth quarter of 2019 by 49 percent on a national level, according to CoStar Group data. Compared to the same interval in the fourth quarter of 2017, national rates fell by 61 percent. Regionwide, the most significant decrease on a year-over-year basis came from the Northeast, where absorption decreased by 94 percent. Retail net absorption fell by 71 percent in the West, followed by the Midwest with a 42 percent dip. Absorption rates registered a 30 percent drop in the South—the smallest decrease regionwide.

Forecasts for absorption in the retail sector for the fourth quarter of 2020 indicate that rates are expected to increase in every region. Net absorption rates are projected to surge by 119 percent on a national level. The most notable increase is expected to come from the Northeast, up by a whopping 2191 percent, due to the opening of the long-awaited American Dream complex. One of the largest malls in the U.S., the 3 million square-foot center opened in October after 20 years in the making and is expected to be unveiled in stages through 2020. The West is also expected to register high absorption rates, rising by 314 percent in the fourth quarter of 2020. Absorption rates are expected to increase by 76 percent in the Midwest and by 50 percent in the South.

—Posted on March 27, 2020

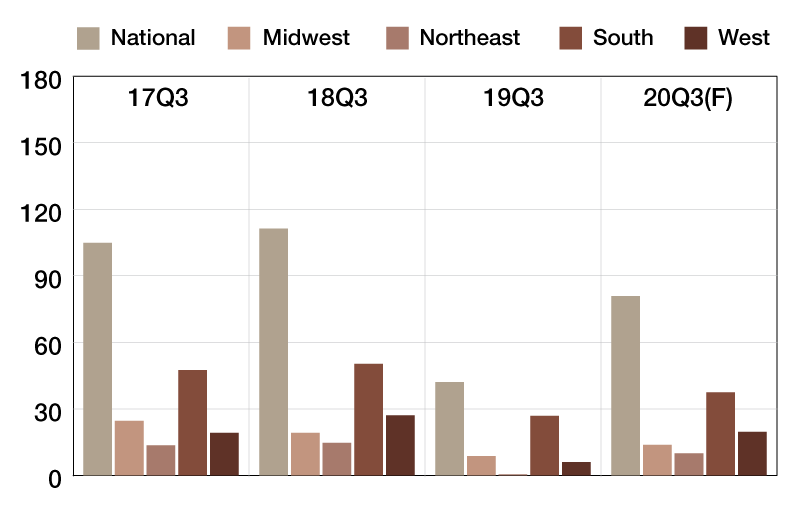

In MSF

Year-over-year, net absorption rates for retail markets decreased in the third quarter of 2019 by 62 percent on a national level, according to CoStar Group data. Compared to the same interval in the third quarter of 2017, national rates fell by 60 percent. Regionwide, the most significant decrease on a year-over-year basis came from the Northeast, where absorption dropped by 97 percent. Retail net absorption decreased by 78 percent in the West, followed by the Midwest with a 54 percent decrease. Absorption rates registered a 47 percent drop in the South. Forecasts for absorption in the retail sector for the third quarter of 2020 indicate that rates are expected to surge in every region. Net absorption rates are projected to increase by 92 percent on a national level. A whopping rise in absorption is expected to come from the Northeast (up by 1853 percent), where the long-awaited American Dream complex, one of the largest malls in the U.S., opened in October after 20 years in the making. The 3 million square-foot center will open in stages through 2020. Absorption rates are expected to increase by 229 percent in the West, followed by the Midwest (up by 58 percent) and the South (up by 29 percent) in the third quarter of 2020.

—Posted on Dec. 16, 2019

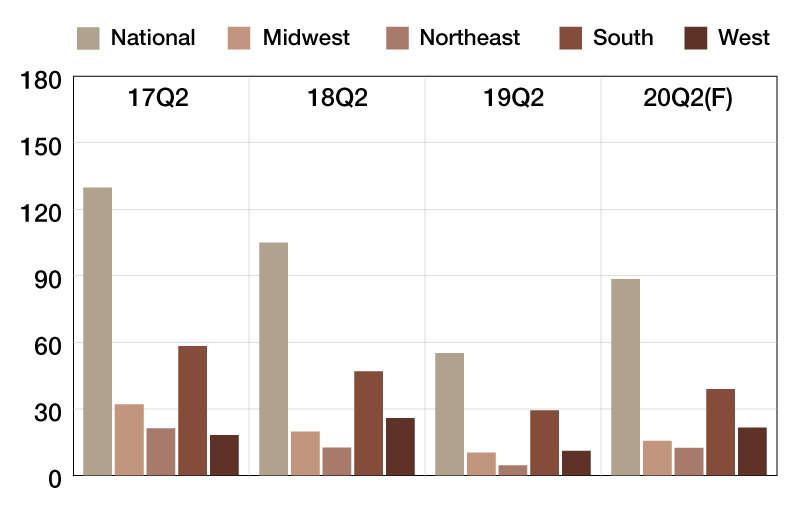

In MSF

Year-over-year, net absorption rates for retail markets fell in the second quarter of 2019 by 47.4 percent on a national level, according to CoStar Group data. Compared to the same interval in 2017, national rates dropped by 57.5 percent. Regionwide, the most considerable drop on a year-over-year basis came from the Northeast, where absorption decreased by 63.5 percent. Net absorption inched down by 57.1 percent in the West, followed by the Midwest with a 48 percent drop. Net absorption rates decreased by 37.6 percent in the South. Forecasts for the second quarter of 2020 are positive, showing that retail net absorption rates are projected to increase in every region. The most significant growth is expected to come from the Northeast (up by 173.6 percent), followed by the West (up 95 percent). Absorption rates are expected to rise by 51.5 percent in the Midwest and by 32.8 percent in the South. Net absorption rates are expected to grow by 60.4 percent on a national level.

—Posted on Sept. 30, 2019

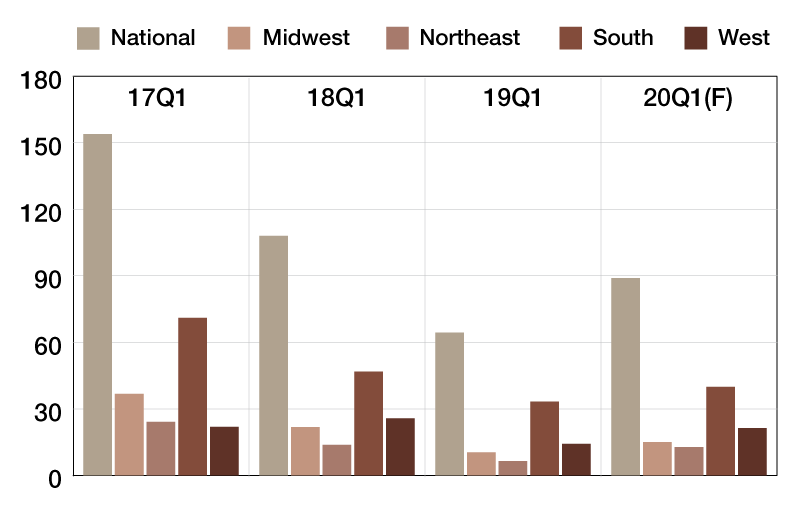

In MSF

Net absorptions fell for retail markets on a year-over-year basis in every region in the first quarter of 2019, according to CoStar Group data. The most notable change came from the Northeast, down by 52.8 percent, followed by the Midwest (down by 52.2 percent), the West (down by 44.9 percent) and the South (down by 28.9 percent). Retail net absorptions decreased by 40.4 percent on a national level. Compared to the same period in 2017, national rates dropped by more than half (down by 58.2 percent). Forecasts for the first quarter of 2020 show that retail net absorptions are projected to increase in every region. The most substantial growth—almost doubling—is expected to come from the Northeast (up by 97.1 percent), followed by the West (up 50 percent) and the Midwest (43.7 percent increase). The smallest change is expected to come from the South (up 20 percent). Net absorption rates are expected to increase by 38.2 percent on a national level.

—Posted on June 20, 2019

You must be logged in to post a comment.