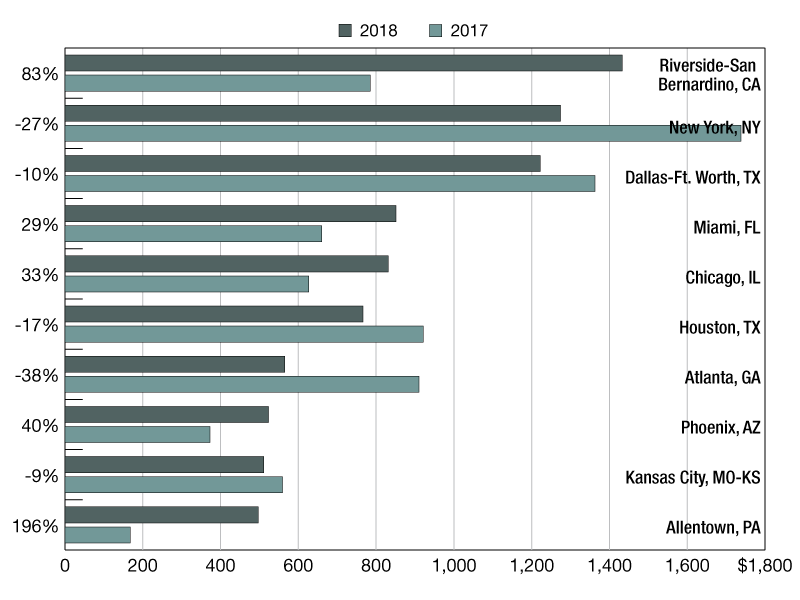

2018 Industrial Construction Starts

Year-over-year comparison of industrial building construction starts across the top 10 metros, updated twice a year.

$ in millions

Data by Robert Murray, chief economist, Dodge Data & Analytics

The top ten metropolitan areas for industrial construction starts primarily increased in 2018, with five markets displaying decreased activity compared to the same interval in 2017, Dodge Data & Analytics shows. The Allentown-Bethlehem-Easton, Pa-N.J., metro led growth, posting the largest increase (up by 196 percent), from $168 million to $497 million. Riverside-San Bernardino-Ontario, Calif., followed with an 83 percent growth, from $785 million to $1.4 billion, while the Phoenix-Mesa-Scottsdale, Ariz., metro recorded gains of 40 percent, from $373 million to $523 million year-over-year.

Industrial construction starts dropped by 38 percent or by roughly $345 million in the Atlanta-Sandy Springs-Marietta, Ga., metro area, from $910 million to $565 million. The New York-Northern New Jersey-Long Island, N.Y.-N.J.-Pa., metro also recorded declines, with construction starts falling by 27 percent, from $1.7 billion in 2017 to $1.3 billion in 2018.

—Posted on Apr. 23, 2019

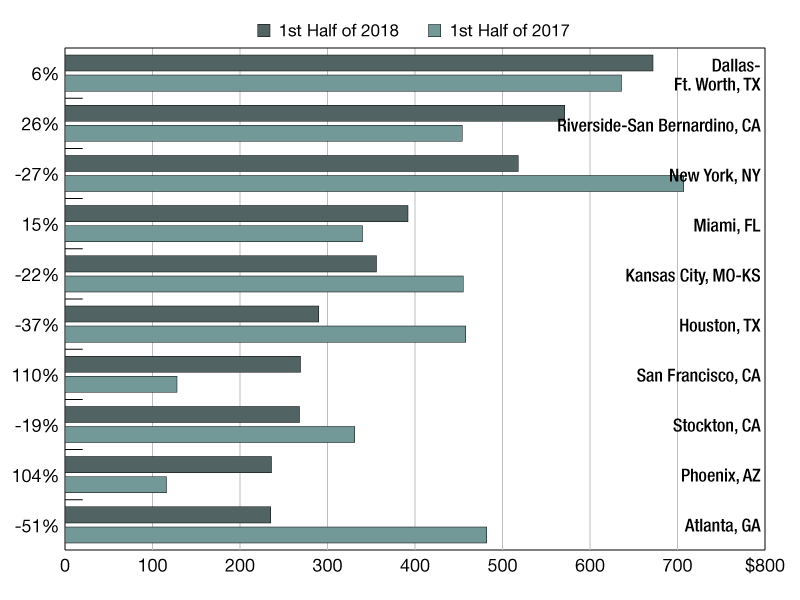

$ in millions

Data by Robert Murray, chief economist, Dodge Data & Analytics

The top ten metropolitan areas for industrial building construction starts primarily decreased in the first half of 2018, with only five markets displaying increased activity compared to the same interval in 2017. The San Francisco-Oakland-Fremont, Calif., metro led the way, posting the largest increase of 110.0 percent, from $128 million to $269 million. Phoenix-Mesa-Scottsdale, Ariz., followed closely with a 103.8 percent growth, from $116 million to $236 million year-over-year.

Industrial construction starts dipped by 51.1 percent or by roughly $247 million in the Atlanta-Sandy Springs-Marietta, Ga., metro area, from $482 million to $235 million. The Houston-Baytown-Sugar Land, Texas, metro also recorded declines, with construction starts falling by 36.6 percent, from $458 million in 2017 to $290 million in 2018. The Miami-Fort Lauderdale-Miami Beach, Fla., and Dallas-Fort Worth-Arlington, Texas, metros were among the areas recording mild increases of 15.4 percent and 5.7 percent, respectively.

—Posted on Oct. 11, 2018

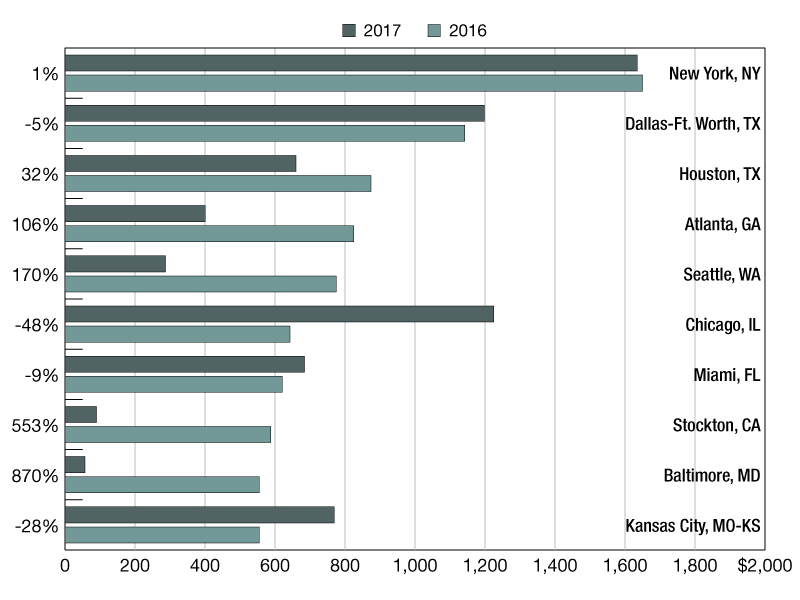

$ in millions

Data by Robert Murray, chief economist, Dodge Data & Analytics

The top ten metropolitan areas for industrial building construction starts primarily increased in 2017, with only four markets displaying decreased activity compared to 2016. The Baltimore-Towson, Md., metro led the way, posting the largest increase of 870.0 percent, from $57 million to $555 million. Stockton, Calif., followed closely with a 553.0 percent growth, from $90 million to $588 million year-over-year. Industrial construction starts dipped by 48.0 percent, or by roughly $580 million, in the Chicago-Naperville-Joliet, Ill.-Ind.-Wis., metro area, from $1.2 billion to $643 million. The Kansas City, Mo.-Kan., metro also recorded declines, with construction starts falling by 28.0 percent, from $769 million in 2016 to $555 million in 2017. The Miami-Fort Lauderdale-Miami Beach, Fla., and Dallas-Fort Worth-Arlington, Texas, metros were among the areas recording mild declines of 9.0 percent and 5.0 percent, respectively.

—Posted on May 15, 2018

You must be logged in to post a comment.