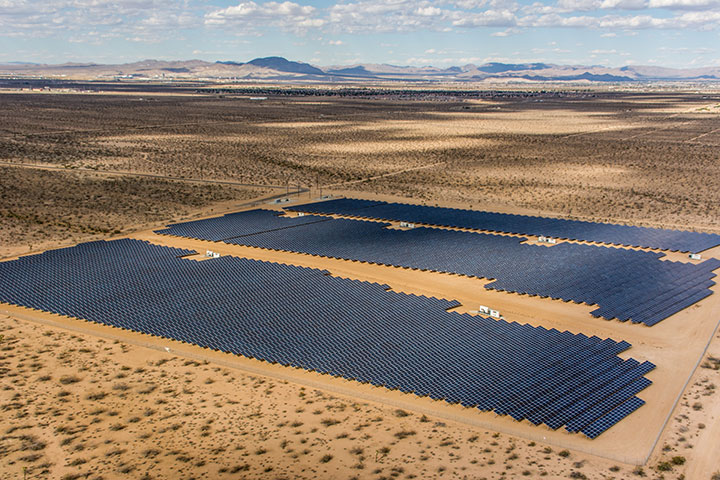

sPower Gets $434M in Financing for Its Beacon Solar Projects

The three solar facilities will generate more than 183 megawatts of renewable energy when finalized.

By Anca Gagiuc, Associate Editor

Salt Lake City—sPower announced it has closed a tax equity investment and construction/term loan totaling $434 million for three solar projects in California. CohnReznick Capital Markets Securities advised sPower on the transactions.

KeyBanc Capital Markets Inc. acted as coordinating lead arranger, while the debt facility was provided by CIT Bank, N.A., CoBank ACB, Coöperatieve Rabobank U.A., KeyBank N.A., Norddeutsche Landesbank Girozentrale (Nord/LB) and Siemens Financial Services, Inc. PNC Energy Capital and U.S. Bancorp Community Development Corp. partnered to provide tax equity.

“The team successfully came together to find creative finance and structuring solutions,” Ray Henger, sPower SVP of M&A & structured finance, said in a prepared statement. “While coordination across this many banks was a challenge, we appreciate how hard our partners worked to close the transaction.”

The funds will be used to finance three solar projects, which when fully operational, will generate 183.4 megawatts (MW) of renewable energy. All three Beacon solar projects are located in Cantil, Calif. and are currently under construction. Furthermore, all three have 25-year PPAs with Los Angeles Department of Water and Power. sPower estimated Beacon 4 (56.5MW) will achieve commercial operations by the end of the month, while Beacon 3 (63MW) is projected to come online by year’s end. Beacon 1 (63.9MW) will be completed in the first quarter of 2017.

“Leading investors are drawn to sPower’s demonstrated ability to develop consistently bankable renewable energy projects,” added sPower CFO David Shipley. “This most recent financing is critical as we work towards connecting nearly 500MW to the grid in the next 90 days.”

Image courtesy of sPower

You must be logged in to post a comment.