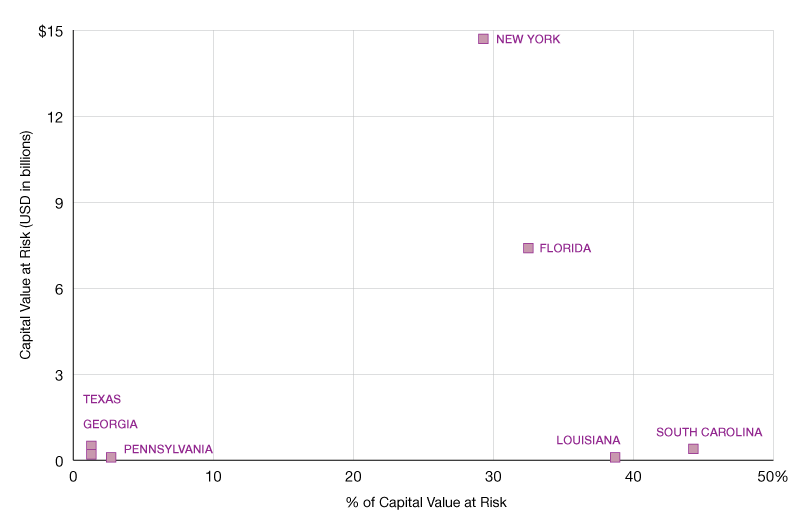

Largest Exposure by State

Climate related weather events can increase operational costs, devaluate property, and in some extreme cases, lead to asset stranding.

At risk to storm zone and surge

Climate change is becoming a reality. Extreme weather events and natural disasters are becoming more frequent and intense and as a result, costlier and climate models predict that unconstrained warming will intensify these events. Two factors which make real estate investments particularly vulnerable to a changing climate is that they are investments in physical property and are often held long-term. There is therefore growing demand to understand the potential climate related risks in real estate portfolios.

Climate related weather events can increase operational costs, devaluate property, and in some extreme cases, lead to asset stranding. A detailed understanding of exposure helps to understand the problem as exposure to physical risk should not go unnoticed.

This chart shows the exposure to storm zone and surge risk across seven US States and comes from MSCI’s recent research paper “Climate risk in private real estate portfolios: What’s the exposure?” The paper analyzed physical risks in five real estate markets in different regions (Australia, South Africa, the U.S., the U.K. and the Netherlands) to see which properties were exposed and to identify any concentrations of risk.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.