Improving Fundamentals Support Stable Outlook for Lodging REITs

By Griselda Bisono, Assistant Vice President & Analyst, Commercial Real Estate Finance, Moody’s Investors Service: The U.S. lodging industry remains healthy, as its fundamentals continue on a positive trajectory.

By Griselda Bisono, Assistant Vice President & Analyst, Commercial Real Estate Finance, Moody’s Investors Service

By Griselda Bisono, Assistant Vice President & Analyst, Commercial Real Estate Finance, Moody’s Investors Service

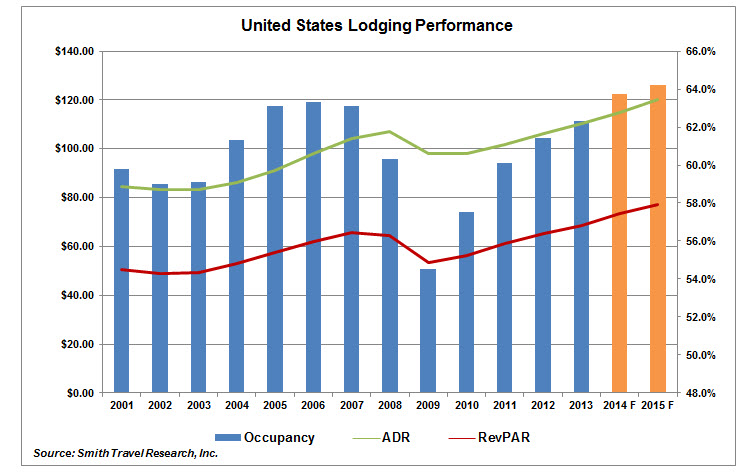

The U.S. lodging industry remains healthy, as its fundamentals continue on a positive trajectory. Occupancy, average daily rate (ADR) and revenue per available room (RevPAR) for the sector have climbed to all-time highs, long departing the bottoms they reached in 2009. According to Smith Travel Research, these measures should continue to improve throughout 2015.

Growth in both transient and group business has contributed to the improvement, with group business starting to increase more recently. Also beneficial is that development has remained limited, with expansion in the supply of existing hotel rooms at less than 1 percent versus a year ago (as of August 2014).

The lodging REITs have been pruning their portfolios over the past two to three years, becoming net sellers of real estate during this period. Most notably, Moody’s-rated REITs have been reducing their exposure to non-core hotels in airport and suburban locations, particularly in secondary and tertiary markets. In addition, the REITs have improved their asset quality overall, with most focusing on renovating older assets; in some instances, the renovations have been quite extensive and have led to rebranding.

Positively, these improvements have usually been done in a leverage neutral way. The REITs have generally used internally generated cash flow or a prudent mix of debt and equity capital. In some cases, the REITs have been able to reduce leverage and improve their overall cost of capital. REITs that have accomplished this include Host Hotels & Resorts Inc. and Felcor Lodging Trust Inc.

Positively, these improvements have usually been done in a leverage neutral way. The REITs have generally used internally generated cash flow or a prudent mix of debt and equity capital. In some cases, the REITs have been able to reduce leverage and improve their overall cost of capital. REITs that have accomplished this include Host Hotels & Resorts Inc. and Felcor Lodging Trust Inc.

The stable outlook for the lodging REITs considers the sector’s strong fundamentals as well as its newer assets, which should allow companies to push up both occupancy and rate over the next 12 months. The likelihood of fundamentals improving further, coupled with the slower growth in supply, suggests a more protracted cycle than in the past. By 2015, we expect ADR and RevPAR growth in the mid-single digits, with a more modest gain in occupancy of less than 1 percent. The biggest risk factors in the sector today are an unexpected slowdown in U.S. GDP growth, additional fiscal tightening in the U.S. or any dramatic political or monetary shifts.

You must be logged in to post a comment.