iGlobal Forum Special Report: Secondary Markets, Prime Opportunities

How do you pick a secondary market? An expert panel offered answers to that pressing question at iGlobal Forum's annual Real Estate Private Equity Summit.

By Paul Rosta, Senior Editor

How do you pick a secondary market? An expert panel offered answers to that pressing question this week at iGlobal Forum’s annual Real Estate Private Equity Summit in New York City.

From left, Jeff Adler, Matrix; Tim Wang, Clarion Partners; Dags Chen, Real Estate Advisers. Not pictured: Steve Sadler, Allegiancy.

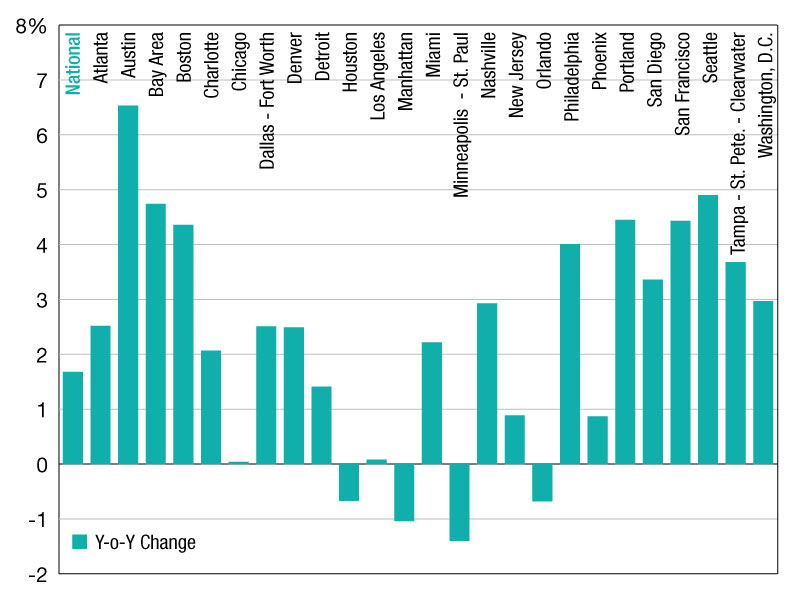

Though the views of the investors, analysts and advisers varied considerably, common threads emerged. “It’s a southern and western play,” explained Jeff Adler, the panel’s moderator and vice president at Matrix. ‘It’s mostly where jobs are being created and where there is a moderate supply” of attractive product. In addition, he noted, “You’re looking for places that have good intellectual capital,” typically in the form of technology, healthcare, energy and higher education.

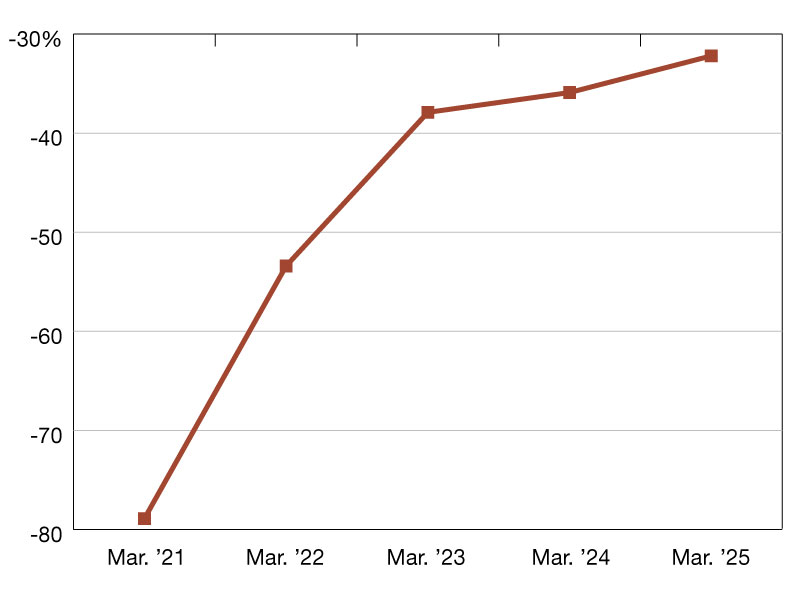

Finding those opportunities has become more of a priority in the past several years. An abundance of capital, coupled with demand for high-quality assets, is bidding up prices and pushing investors to search beyond the so-called “Sexy Six”—New York City, Boston, Washington, D.C., Chicago, San Francisco and Los Angeles. By the fourth quarter of last year, average prices for multifamily properties those markets (plus Miami) stood at least 129 percent of their 2007 peaks, led by the New York City metro region at 146 percent, according to Matrix data. By contrast, the average national price was only 114 percent of the 2007 peak.

In addressing these issues, the panelists offered some examples of their top-choice secondary markets. Tim Wang, a senior vice president with Clarion Partners, mentioned Miami, Nashville and Raleigh, N.C., as among the firm’s top secondary markets. In addition, Wang said, “We are looking for the next Seattle.” That points to Austin, Denver and Portland, all burgeoning technology hubs and Millennial magnets.

Still other attractive second-tier markets may not yet be on everyone’s radar. Wang noted that Goldman, Sachs & Co. has quietly built its second-largest North American team in Salt Lake City—1,400-plus employees and counting, according to the financial giant’s website.

Cornerstone Real Estate Advisers looks favorably on the office markets in Orlando and Atlanta, industrial properties in Pennsylvania’s I-78/I-81 corridor, retail in North Las Vegas and Wilmington, N.C., reported Dags Chen, an assistant vice president. He offered a telling indicator for the industrial sector: “If you look at historical trends, you’ll see that the port markets run at a lower availability than the historical benchmark.”

For his part, Allegiancy’s Steve Sadler dropped the names of Raleigh and Tampa. “We are certainly very focused on the big demographic trends”—job growth, education levels and age, noted the CEO of the Richmond, Va.-based asset manager.

Attractive investment opportunities can be found in these dynamic secondary markets, yet investment opportunities also come with caveats. “If you’re in a secondary or tertiary market, the exit is the question mark,” Sadler observed. As he summed up the question, “Is your market going to be out of favor the day you’re ready to sell it?”

The takeaway is that secondary markets present potential and challenges in equal measure. “You have to do your due diligence more deeply for a secondary market, but the payoff is there,” Adler noted. And Chen concurred on the importance of careful underwriting: “You’ve got to make sure you’ve done your homework.”

You must be logged in to post a comment.