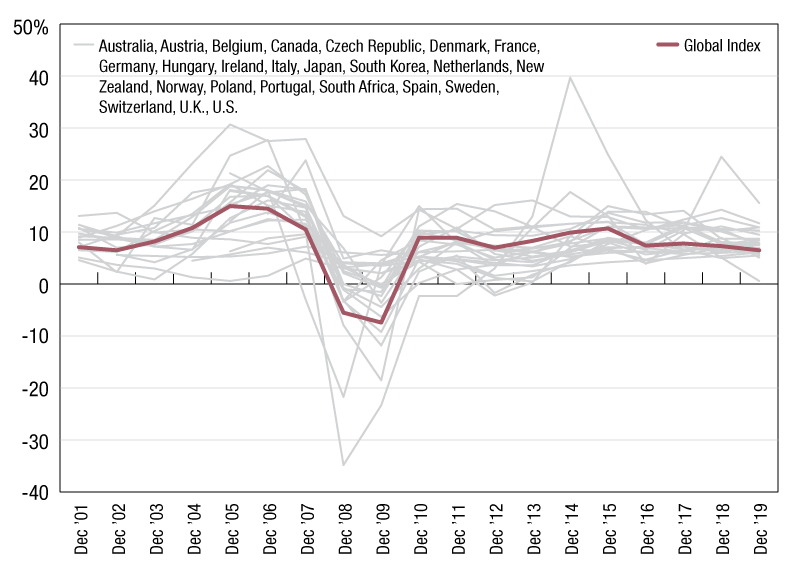

Global Index and National Market Total Returns

The index has now seen a full 10 years of positive total returns since the recovery from the financial crisis; however, COVID-19 has the potential to mark a turning point.

The MSCI Global Annual Property Index, which tracks the performance of over 58 thousand commercial real estate assets worth $1.9 trillion, has been released, revealing that the asset class achieved a 6.5 percent total return in 2019. The index has now seen a full 10 years of positive total returns since the recovery from the financial crisis, however, COVID-19 has the potential to mark a turning point for real estate. The crisis may also accelerate some of the trends we’ve seen in real estate markets while record low NOI yields may be a risk factor for real estate investors.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.