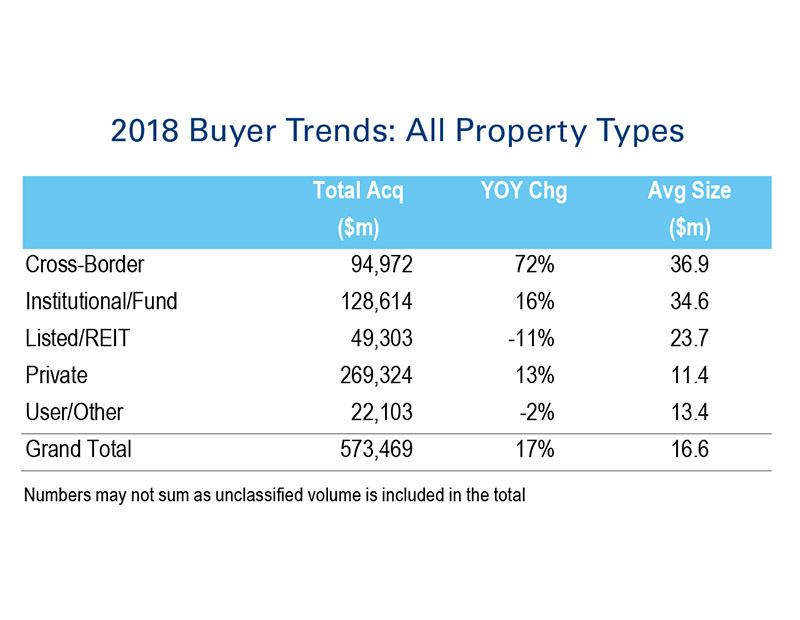

Cross-Border Spending Up 72% in 2018

While private investors again did most of the acquiring last year, foreign entities (mostly Canadian) accelerated their purchasing of U.S. commercial real estate.

Private investors continued to be the most active buyers of commercial real estate in 2018, according to Real Capital Analytics. But they lost some ground to other investor types, namely institutional and cross-border players.

Of the roughly $573 billion in acquisitions last year, private investors accounted for about 50 percent of the transactions―a 13 percent increase over 2017. Cross-border investors (mainly Canadians), meanwhile, were 17 percent of the market―a 72 percent rise. Institutional/fund buyers maintained 23 percent of the market share―despite a 16 percent increase in deal activity. REITs finished 2018 with 9 percent of acquisitions―an 11 percent drop from 2018. User/other were 4 percent of the market―down 2 percent.

©2019 Real Capital Analytics, Inc. All rights reserved. Data believed to be accurate but not guaranteed or warranted; subject to future revision.

You must be logged in to post a comment.