Infrastructure Upgrades Are Critical for CRE’s Future

While epic, the 2021 bill just got the ball rolling. And the industry is on the watch.

Three years ago, when the $1.2 trillion bipartisan infrastructure bill became law, $550 billion was earmarked for surface transportation and core infrastructure, including the power grid, broadband expansion and environmental resiliency.

Most CRE insiders see this spending as critical for existing property values, but also as a catalyst for the future. In this context, vital is not an understatement. As the country’s infrastructure gets left behind by the fast-paced economy, the erosion may be slow, but it touches everything.

Beside location, real estate performance is a function of the quality of infrastructure supporting it—that is, the ability of developers, investors and users to maximize the usefulness of the asset, said Korin Crawford, executive vice president in charge of public-private partnerships at Griffin Structures, a construction manager based in Irvine, Calif.

READ ALSO: Manufacturing Thrives Amid Construction Surges

But the state of U.S. infrastructure has largely remained in decline. In 2021, the American Society of Engineers reported that, for the first time in two decades, the country’s infrastructure had earned a grade higher than a D, according to an assessment it performs every 4 years.

The C- it handed out, however, was far from celebratory: Roads, transit, airports, dams and other subcategories remained stuck in the D range, while rail and ports alone climbed above a C.

“Generally speaking, infrastructure is the foundation on which society is built,” added Crawford, who is a member of the Counselors of Real Estate. “If it’s crumbling, it won’t support efficient, comfortable, safe and durable real estate.”

Plus, large infrastructure such as roadways, bridges, airports and public transit foster new development within communities, said Jeanne Kim, director of operations for JLL’s Clean Energy & Infrastructure Advisory.

“Infrastructure can impact a property’s value as well as its desirability,” she noted.

Transportation: From Hudson Yards to small TODs

As of early February, $442 billion of the funding in the infrastructure bill and other measures had been allocated to infrastructure and green energy projects. That includes some $285 billion for roads, bridges, public transit, ports and airports, as well as electric buses, electric vehicle charging and other endeavors, according to White House estimates.

Transportation projects, widely distributed geographically, are relatively small—Phoenix is getting $1 million for a transit-oriented development program, for example, and most other commitments are much less.

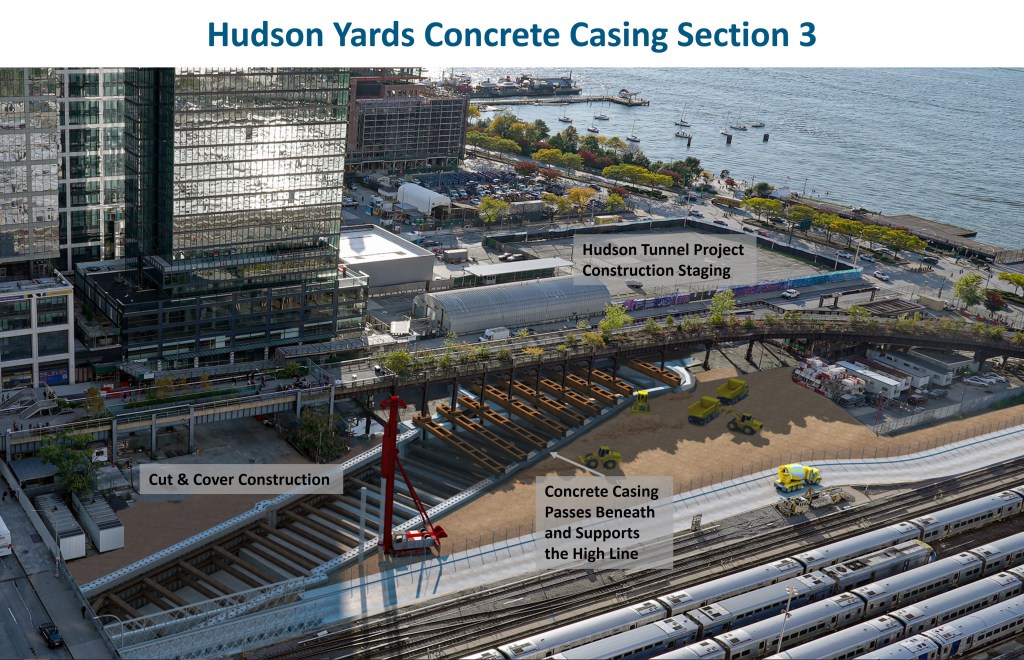

Larger allocations, however, include $292 million to help fund the final section of concrete casing in Hudson Yards in Manhattan, which will preserve future right-of-way for the new Hudson River Tunnel and facilitate the Gateway Project to deliver rail projects between Newark, N.J., and Penn Station. Bay City, Mich., is getting $73 million to replace the deck and control systems of an 85-year-old drawbridge after a too-hefty price tag sidelined the project in 2019.

That type of funding is money well spent, weighed in Ryan Severino, BGO‘s chief economist. For too long, transportation infrastructure lagged the needs of such an advanced national economy, he argued.

A good example of that, Severino continued, is congested roads that contribute to long commutes in the bigger metros, keeping workers out of the office.

“If you can make it easier for people to move around, you at least take a noteworthy barrier out of that equation,” Severino stated.

“The ability to move people and goods faster without any unnecessary or inordinate amount of disruption is a massive net positive for both CRE and the economy,” BGO’s chief economist concluded.

Catching up to change

Some Southern California communities are taking that lesson to heart. Amid resident pressure, a handful of cities enacted temporary moratoriums on new warehouses in the Inland Empire industrial hub over the last few years. That’s largely because prior to the warehouse boom, the region was largely agricultural and served by low-intensity two-lane roads, pointed out John Ellis, an executive vice president with CBRE’s Valuation and Advisory Services division in Encino, Calif..

“Warehouses generate a huge amount of truck traffic, and the distances they have to travel to the nearest freeway has become critical—the roads are inadequate to serve them,” he said. “Local residents have seen traffic times that they need to endure significantly increase, and they’re pushing back.”

In 2022, the Inland Empire city of Fontana received a $15 million federal grant enabled by the infrastructure bill to help fund major street work, including increased lane capacity and other improvements.

Down payment

On top of road and bridge projects, the infrastructure law is plowing funds into initiatives ranging from carbon reduction programs to wildlife crossings. Given its scope, it has been heralded as a spending package that ranks with the New Deal public works programs in the 1930s and interstate highway funding some 20 years later.

Still, the ASCE’s most recent report card also projected a nearly $2.6 trillion gap between what had been budgeted and the nearly $6 trillion need in infrastructure spending by the end of the decade. While the infrastructure law may have narrowed the gap, more is needed, Crawford said.

“We often view infrastructure spending as either we do everything in one fell swoop or nothing at all,” Crawford observed. “But there is a third way, which is to create momentum with a down payment but then follow up with more spending initiatives. The infrastructure law is the first domino to go down, but we need multiple dominoes behind it.”

You must be logged in to post a comment.