US Law Firm Leasing Surges in Q1

Volume doubled year-over-year, according to Savills' research.

Law firm leasing of office space accelerated last year and into the first quarter of 2025, according to Savills’ U.S. Law Firm Activity report. The company’s research took into account commitments of 20,000 square feet or more.

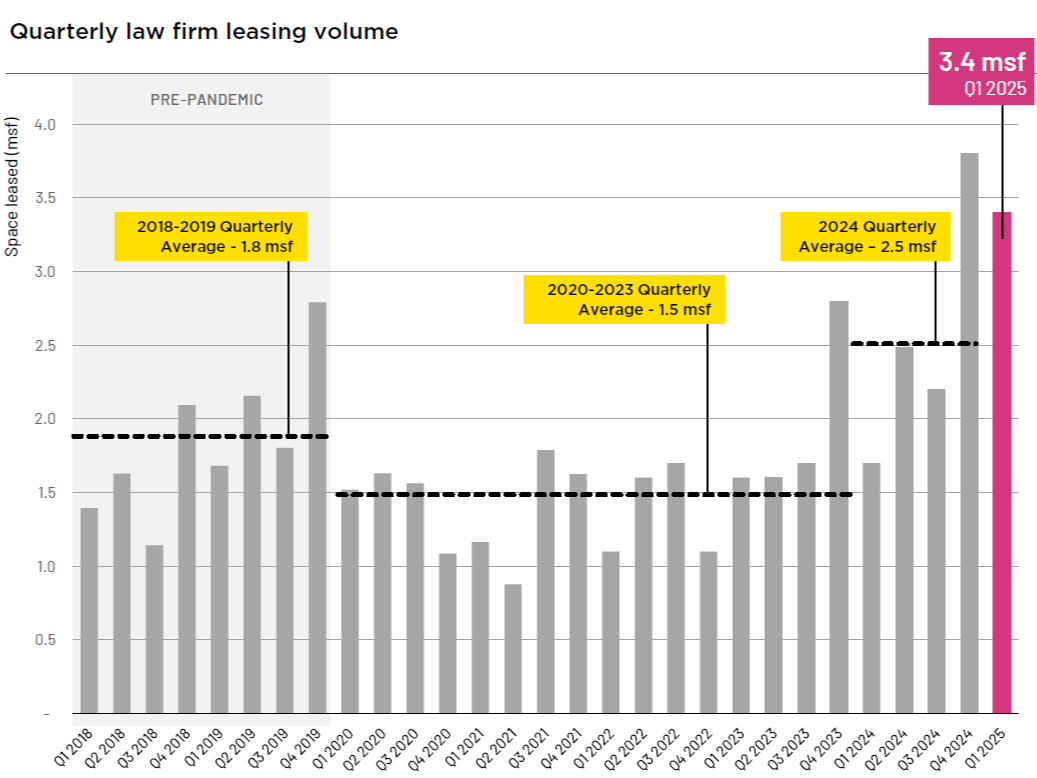

Leasing in the sector surged to 3.4 million square feet in the first quarter, double the volume of the same quarter a year earlier. The leasing momentum started last year, with average quarterly volume over the past year reaching 3 million square feet, compared to an average of 1.5 million square feet per quarter between 2020 and 2023.

During 2024, law firm leasing activity came in at 10.2 million square feet, besting the previous peak of 8.4 million square feet in 2019, amounting to a 20.5 percent jump. Thus 2024 was the most robust year for law firms in over five years, highlighting the legal sector’s revived demand for office space.

“This trend underscores the sector’s sustained return to pre-pandemic levels of activity,” the report noted.

READ ALSO: Return-to-Office Mandates Start to Clock In

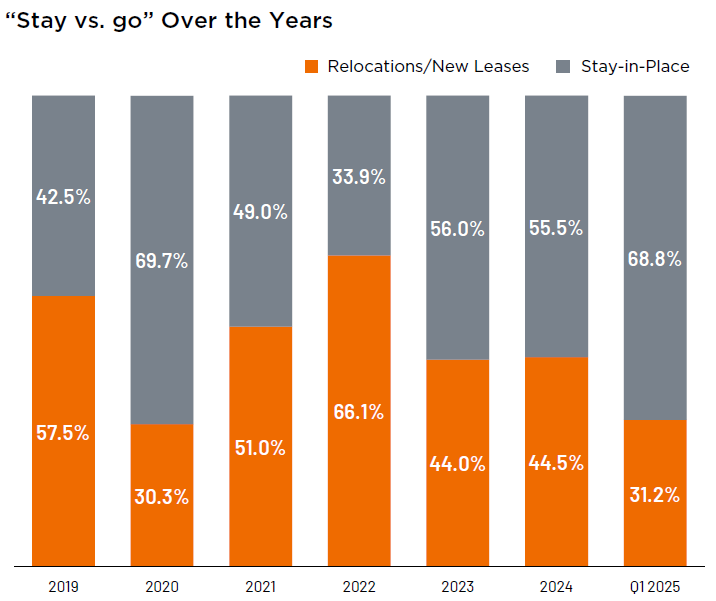

However, supply is relatively tight and construction costs are elevated, generating a surge in lease renewals among U.S. law firms. In fact, a sizable portion of last year’s leases—68.8 percent—involved renewals.

Such a strategy represents a more practical and efficient choice for many firms, the report mentioned. It is also a flip from recent years, especially 2022, when 66.1 percent of lease activity involved a relocation or new lease.

Largest Q1 law firm lease

New York City is still the hub of the industry. The market accounted for 23 percent of the total legal leasing volume and 17.5 percent of the number of lease transactions nationally in the first quarter, according to Savills data.

Indeed, the largest law firm lease of Q1 2025 was Mayer Brown’s 330,662-square-foot renewal and expansion at 1221 Avenue of the Americas in Manhattan.

Other large leases for the quarter included 271,807 square feet for Mayer Brown in Chicago—an extension; 183,000 square feet for Duane Morris in Philadelphia—a restructuring; and 131,054 square feet for Kirkland & Ellis in New York—a new lease. Other markets with leases over 100,000 square feet in Q1 included San Diego, Boston, San Francisco, Washington, D.C., and Dallas.

As construction costs climb and tenant improvement allowances aren’t keeping up, law firms are turning to longer lease terms. While concessions remain relatively strong, they rarely cover full build-out expenses, pushing firms to secure longer commitments in exchange for financial relief.

“In tighter markets where premium space is limited, firms are locking in longer terms to secure top locations, often negotiating added flexibility into their deals,” the report noted.

“In more tenant-friendly markets, firms face similar cost pressures but have more leverage to structure leases with options such as extensions, restructures or expansion clauses.”

You must be logged in to post a comment.